As I delved into the alluring world of equity options trading, I discovered a thrilling playground where potential gains danced alongside calculated risks. Like a seasoned investor, I navigated the intricate landscape, eager to harness its power to amplify my financial savvy. Join me as we embark on an enlightening journey into the realm of equity options trading in the United Kingdom, unraveling its complexities and igniting your financial aspirations.

Image: financeunlocked.com

Delving deeper into the fascinating world of equity options trading, we encounter an instrument of immense versatility. Options, financial contracts imbued with intrinsic flexibility, grant the holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This dynamic empowers investors to tailor strategies that align precisely with their risk appetite and investment objectives.

Navigating the Nuances of Equity Options

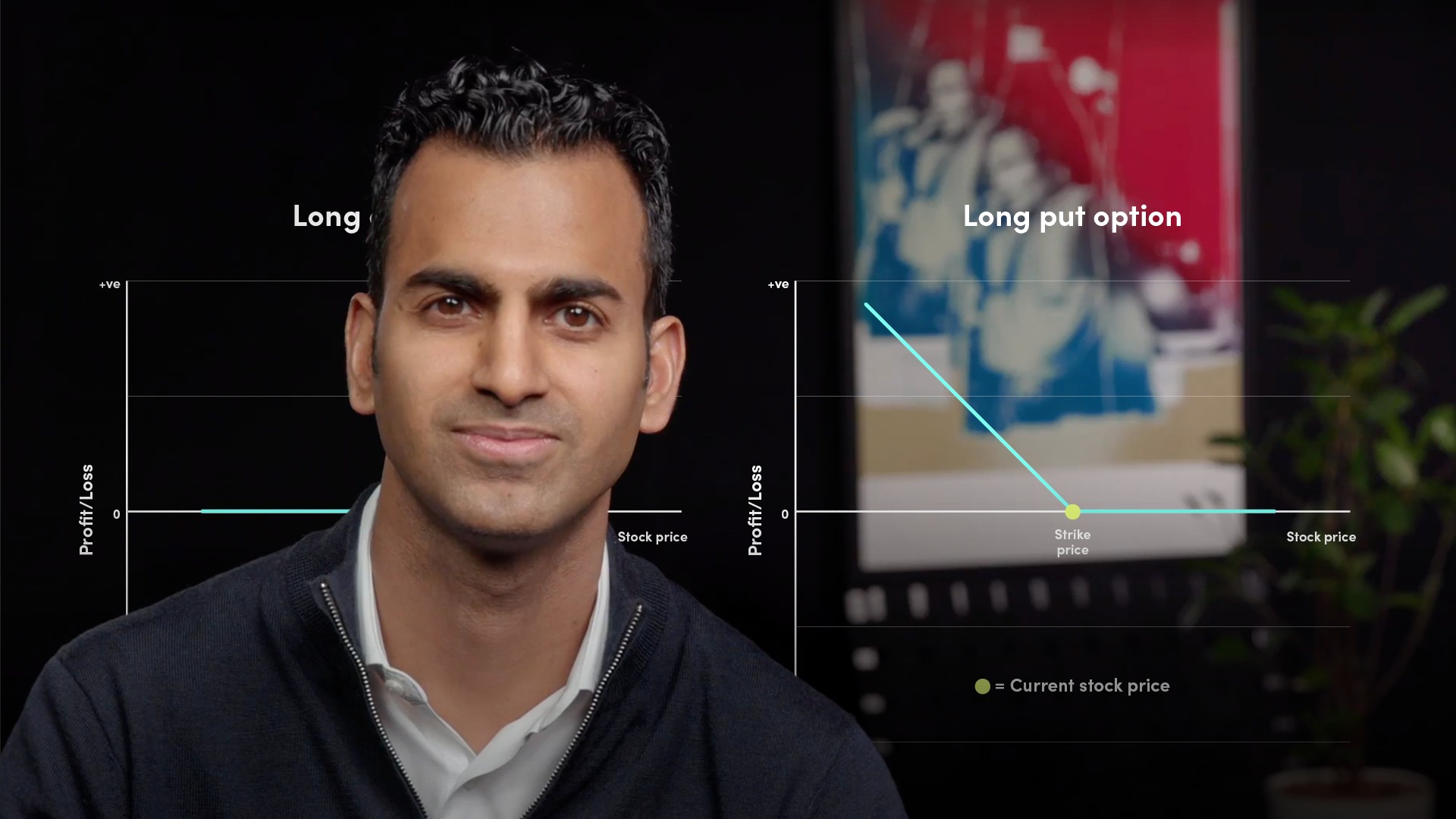

Equity options, an intriguing blend of opportunity and precision, offer a kaleidoscope of strategies. A call option confers upon its holder the right to purchase an underlying asset, effectively betting on its price ascension. Conversely, a put option grants the holder the right to sell, expressing their belief that the asset’s value will diminish. These versatile instruments empower investors to express both bullish and bearish market sentiments, positioning themselves to capitalize on price fluctuations.

Understanding the intrinsic value of an equity option is paramount. This intrinsic value, a reflection of the inherent profit potential embedded within the option contract, is meticulously calculated based on factors such as the underlying asset’s price, the option’s strike price, the time remaining until expiration, and the prevailing interest rates. A keen grasp of these dynamics is indispensable for unlocking the true power of equity options trading.

An Overview of Equity Options Trading in the UK

The United Kingdom, a global financial hub, provides a fertile ground for equity options trading. Its robust regulatory framework and vibrant capital markets foster a conducive environment for investors seeking to harness the potential of these versatile instruments. The London Stock Exchange, a cornerstone of the UK’s financial landscape, hosts a thriving options market, offering a vast array of underlying assets, including stocks, indices, and commodities.

Equity options trading in the UK flourishes within a comprehensive regulatory framework. The Financial Conduct Authority (FCA), the UK’s financial watchdog, plays a pivotal role in ensuring market integrity and investor protection. The FCA’s stringent regulations encompass all aspects of options trading, from market conduct to disclosure requirements, safeguarding the interests of both individual and institutional investors.

Exploiting Recent Trends and Developments

The realm of equity options trading is in a perpetual state of evolution, propelled by dynamic market conditions and technological advancements. Artificial intelligence and machine learning algorithms are transforming the way investors analyze options and formulate trading strategies. These sophisticated tools sift through vast amounts of data, identifying patterns and predicting market movements with unprecedented accuracy.

Furthermore, the rise of online trading platforms has democratized access to equity options trading, empowering individual investors with the tools and resources once reserved for institutional players. These platforms offer intuitive interfaces, real-time data, and advanced charting capabilities, leveling the playing field for all market participants.

Image: www.slideshare.net

Unlocking Success with Tips and Expert Advice

As you venture into the captivating world of equity options trading, I offer you a treasury of invaluable tips and expert advice to enhance your trading acumen. Knowledge is the cornerstone of success, and I urge you to invest diligently in your education, mastering the intricacies of options pricing, trading strategies, and risk management techniques.

Embrace a disciplined approach to trading, meticulously formulating a trading plan and adhering to it with unwavering dedication. This plan should encapsulate your investment objectives, risk tolerance, and clearly defined entry and exit strategies. By following a disciplined approach, you instill a sense of order and purpose into your trading endeavors, increasing your chances of consistent profitability.

Frequently Asked Questions (FAQs)

Q: What are the key differences between call and put options?

A: Call options grant the holder the right to buy, while put options confer the right to sell the underlying asset at a predetermined price.

Q: How do I calculate the intrinsic value of an equity option?

A: Intrinsic value is calculated using a formula that considers the underlying asset’s price, the option’s strike price, the time remaining until expiration, and prevailing interest rates.

Q: What regulatory body oversees equity options trading in the UK?

A: The Financial Conduct Authority (FCA) is responsible for regulating equity options trading in the UK, ensuring market integrity and investor protection.

Equity Options Trading Uk

Image: luckboxmagazine.com

Conclusion: Embarking on Your Trading Odyssey

Equity options trading in the United Kingdom presents a captivating realm of possibilities, empowering investors with the tools to amplify their financial success. By embracing the principles outlined in this comprehensive guide, you can embark on a trading odyssey that harnesses the power of options to achieve your investment aspirations. Remember, the journey of a thousand miles begins with a single step. Take that first step today and unlock the boundless potential of equity options trading.

Are you ready to embark on this transformative journey? Let us know in the comments below!