Embarking on an Enlightening Journey into the Realm of Energy Option Trading

Energy option trading, an intricate but potentially lucrative investment strategy, has captivated the attention of discerning investors seeking to navigate the ever-changing energy landscape. It offers a gateway to reaping the benefits of energy price fluctuations while managing risk, allowing traders to strategically position themselves for potential returns.

Image: www.somish.com

In the dynamic world of energy markets, geopolitical events, economic shifts, and environmental concerns can trigger significant price swings. Energy option trading empowers traders with a flexible instrument to mitigate risk, speculate on future prices, and enhance overall portfolio resilience.

Comprehending Energy Option Trading: A Journey into the Basics

An energy option contract grants the holder the right, but not the obligation, to buy (call option) or sell (put option) a specific quantity of an underlying energy commodity at a predetermined price (strike price) on or before a specified date (expiration date).

By purchasing an option, a trader gains the potential to profit from favorable price movements without the obligation to complete the transaction. This limited risk exposure distinguishes options from futures contracts, where traders are bound to buy or sell the underlying asset at the contract price.

Navigating the Labyrinth of Energy Options: An Overview of Key Features

-

Option Type: Call options provide the right to purchase, while put options confer the right to sell.

-

Strike Price: This is the predetermined price at which the trader can buy or sell the underlying commodity.

-

Expiration Date: The specified date by which the option must be exercised or expires.

-

Underlying Commodity: The specific energy asset, such as crude oil, natural gas, or electricity, that the option is based upon.

-

Option Premium: The price paid upfront to acquire the option contract, representing the cost of the right to buy or sell the underlying commodity.

-

In-the-Money: When the underlying commodity’s price is favorable for exercising the option, resulting in immediate profit potential.

-

At-the-Money: When the underlying commodity’s price is equal to the strike price, indicating no immediate profit or loss.

-

Out-of-the-Money: When the underlying commodity’s price is unfavorable for exercising the option, resulting in no profit potential unless prices shift.

Unlocking the Nuances of Energy Option Trading: Strategies and Techniques

-

Hedging: Utilizing options to reduce risk exposure, ensuring downside protection against adverse price movements.

-

Speculation: Employing options with the aim of profiting from anticipated price fluctuations, leveraging market insights and risk tolerance.

-

Income Generation: Selling (writing) options to generate premium income, capturing time value decay and market volatility.

-

Combination Strategies: Combining multiple option contracts with varying strike prices and expiration dates to create tailored strategies that align with specific market conditions and risk profiles.

-

Technical Analysis: Applying technical indicators and chart patterns to identify potential trading opportunities, incorporating historical price data and market trends.

-

Fundamental Analysis: Considering economic conditions, supply and demand dynamics, and geopolitical events that influence underlying energy commodity prices.

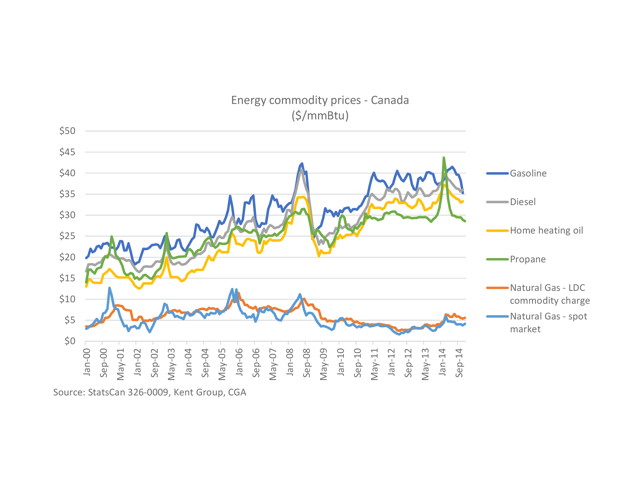

Image: abizaly.web.fc2.com

The Art of Energy Option Trading: Tips and Expert Advice for Success

-

Thorough Research: Diligently study energy markets, economic trends, and geopolitical factors to make informed trading decisions.

-

Risk Management: Establish a robust risk management framework, setting clear limits and employing risk-mitigating strategies.

-

Understanding Volatility: Comprehend the impact of volatility on option pricing and incorporate volatility measures into trading strategies.

-

Trading Discipline: Adhere to a well-defined trading plan, avoiding emotional decision-making and maintaining discipline in volatile markets.

-

Simulated Trading: Utilize paper trading or trading simulators to practice strategies and gain experience without incurring real-world risks.

-

Experienced Mentorship: Seek guidance from experienced traders or educational resources to enhance knowledge and refine trading approaches.

FAQs on Energy Option Trading: Unraveling Common Queries

Q: What is the difference between a call and a put option?

A: A call option grants the right to buy, while a put option confers the right to sell the underlying commodity.

Q: What factors influence energy option prices?

A: Supply and demand dynamics, economic conditions, geopolitical events, and market volatility are key influencers.

Q: How much does it cost to trade energy options?

A: The cost of an option contract is its premium, which can vary depending on market conditions and the specific contract parameters.

Q: Can I make significant profits from energy option trading?

A: While potential returns exist, energy option trading carries inherent risk, and profits are not guaranteed.

Q: What is the best strategy for trading energy options?

A: The optimal strategy depends on individual risk tolerance, market conditions, and trading goals, requiring tailored approaches.

Energy Option Trading

Image: www.dtn.com

Conclusion: Embracing the Dynamic Landscape of Energy Option Trading

Energy option trading presents a compelling opportunity for investors to navigate the intricacies of energy markets, manage risk, and enhance returns. By understanding the fundamental concepts, employing effective strategies, and adhering to sound risk management practices, traders can harness the power of energy option trading to achieve their financial objectives. Whether pursuing hedging, speculation, income generation, or a combination of strategies, a comprehensive approach and continuous learning are essential for success in this dynamic and rewarding field.

We invite you to explore the captivating world of energy option trading further. Engage in research, connect with experienced traders, and embrace the complexities of this market to unlock its full potential. Are you ready to embark on this thrilling journey of risk management and enhanced returns?