Have you ever wondered about the inner workings of the stock market and how investors navigate its complexities? Allow me to shed some light on the thrilling realm of options trading, where investors venture into the world of “Puts” and “Calls,” and discover their profound impact on market positioning.

Image: corporatefinanceinstitute.com

The Essence of Options Trading

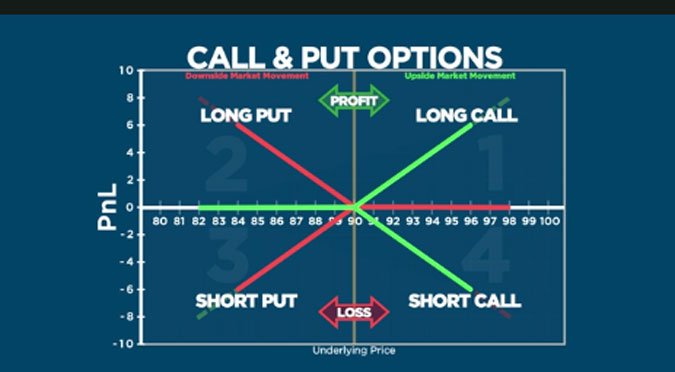

Options trading empowers investors with the right, but not the obligation, to buy (in the case of Calls) or sell (in the case of Puts) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility allows traders to strategize their market maneuvers, hedging risks, or pursuing profit opportunities.

CALL Options: A Bullish Outlook

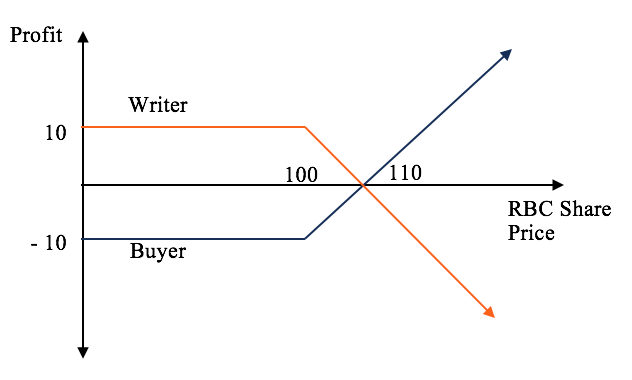

CALL options are favored by investors who anticipate an upward trend in the underlying asset’s price. By purchasing a CALL option, the trader has the right to buy that asset at the strike price, even if the prevailing market price has moved higher. The potential profit from CALL options arises when the asset’s value exceeds the strike price, allowing the trader to exercise their right to buy at a favorable price and resell at a higher market value.

PUT Options: A Bearish Stance

On the opposite side of the spectrum, PUT options are employed when investors foresee a decline in the underlying asset’s price. By acquiring a PUT option, the trader secures the right to sell an asset at the strike price, regardless of its subsequent market devaluation. PUT options become profitable when the asset’s value plunges below the strike price, enabling the holder to sell at the agreed-upon price and gain from the market downturn.

Image: ucivexe.web.fc2.com

Navigating the Options Market

The dynamics of options trading extend far beyond a mere overview of Puts and Calls. Seasoned investors employ a myriad of complex strategies, leveraging their understanding of price fluctuations, market volatility, and time decay to maximize their returns. Volatility, in particular, plays a pivotal role, as it influences the premium paid for option contracts. Higher volatility implies greater potential gains but also amplified risks.

Additionally, time decay works against the value of options as they approach their expiration date. This is because the closer an option gets to expiration, the less time remains for the underlying asset to reach (or surpass) the strike price. Consequently, the premium associated with options erodes over time, emphasizing the need for skilled decision-making and precise timing.

Expert Insights and Practical Tips

To navigate the complexities of options trading, it is prudent to seek guidance from seasoned experts. Their insights and practical tips can help you refine your strategies and mitigate potential pitfalls:

- Create a Solid Trading Plan: Define your investment objectives, risk tolerance, and exit strategies before venturing into options trading.

- Master Risk Management: Implement effective risk management techniques, such as diversification, hedging, and position sizing, to safeguard your capital.

- Enhance Understanding: Continuously educate yourself on options trading dynamics, market trends, and trading strategies to stay competitive.

- Seek Professional Support: Consider consulting experienced trading advisors or brokers to complement your knowledge and gain valuable insights.

Remember, successful options trading demands patience, discipline, and emotional fortitude. By adhering to these expert recommendations, you can enhance your trading strategies and approach the market with greater confidence.

Difference Between Puts And Calls Options Trading

Image: pediaa.com

Frequently Asked Questions (FAQs)

Q: What is the difference between Calls and Puts in options trading?

A: Calls grant the right to buy an underlying asset, while Puts convey the right to sell.

Q: Which option should I choose if I expect a stock price to increase?

A: You should opt for a Call option if you anticipate a price increase.

Q: How does volatility affect options trading?

A: Increased volatility augments potential profits but also magnifies risks associated with options contracts.

Did this article pique your interest and inspire you to delve deeper into the world of Puts and Calls?