In the ever-evolving financial landscape, option trading systems have emerged as a powerful tool for discerning investors seeking to optimize their trading strategies. These sophisticated systems enable traders to navigate the complexities of options markets, enhancing their ability to capitalize on market opportunities while mitigating risks. If you’re an aspiring or seasoned trader seeking to unlock the potential of option trading systems, this comprehensive guide will provide you with the essential knowledge and insights to succeed.

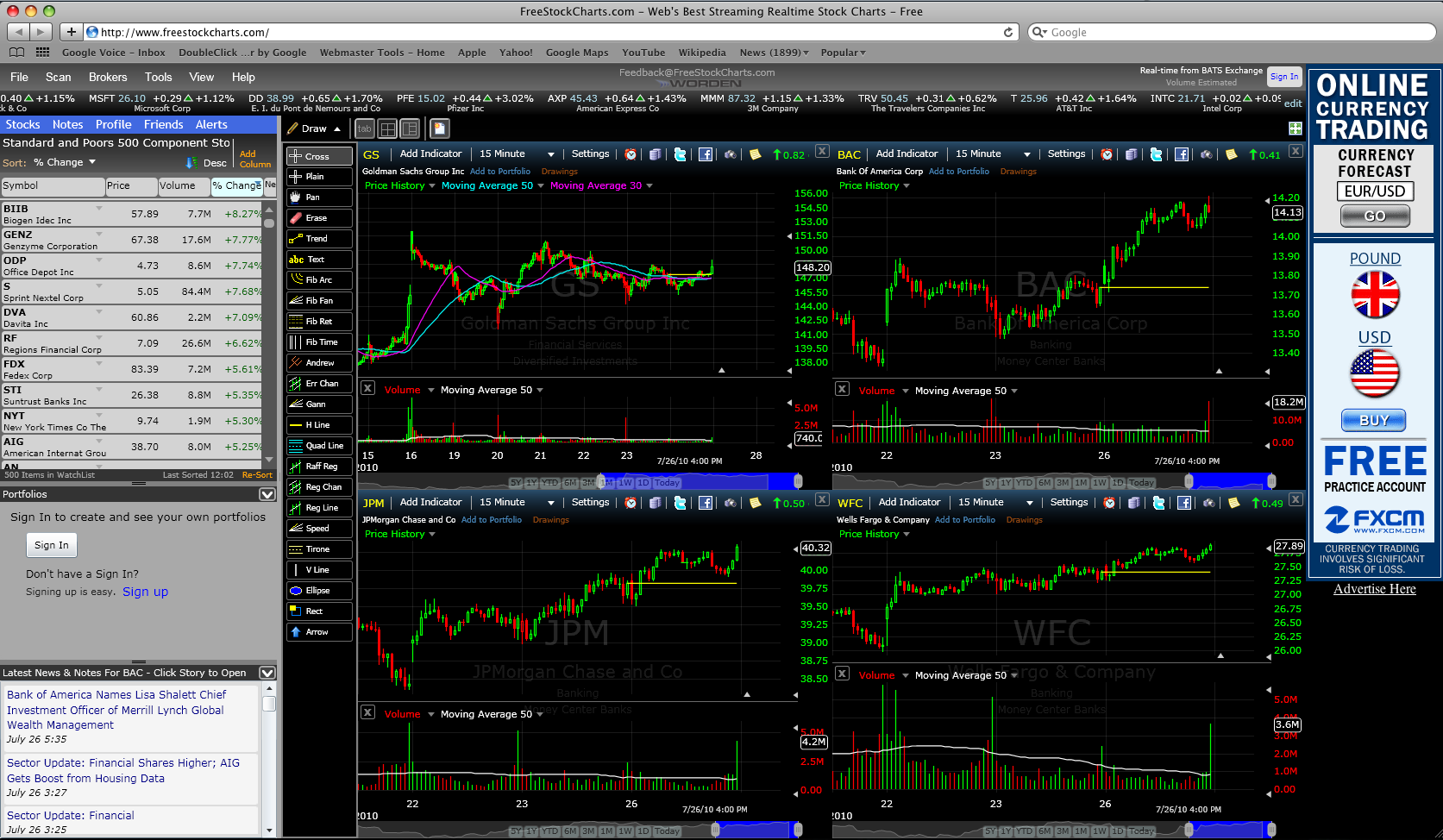

Image: profitnama.com

Understanding Option Trading Systems

An option trading system is a suite of algorithms, trading rules, and risk management techniques designed to identify and execute profitable option trades. By leveraging historical data, statistical analysis, and advanced mathematical models, these systems automate the trading process, allowing traders to make more informed and timely decisions. Option trading systems come in various forms, each tailored to specific market conditions, trading styles, and risk tolerance levels.

Benefits of Option Trading Systems

Incorporating option trading systems into your trading strategies offers a plethora of benefits, including:

- Improved Accuracy: Systems eliminate human biases and emotions, enhancing the precision of trade identification and execution.

- Enhanced Profitability: By automating the trading process, systems can capture opportunities that may be overlooked by manual traders.

- Optimized Risk Management: Predefined risk parameters ensure trades are executed within acceptable risk limits.

- Time Efficiency: Automation frees up time, allowing traders to focus on higher-level strategic planning and market analysis.

Developing an Option Trading System

Developing an effective option trading system is a multi-faceted process that requires a deep understanding of options markets and trading principles. Here’s a step-by-step guide to help you get started:

- Define Trading Strategy: Clearly outline the market conditions, trading style, and risk tolerance you’ll focus on.

- Gather Historical Data: Collect ample historical price and volume data for the assets you’ll trade.

- Algorithm Development: Create algorithms that identify trade entry and exit points based on your strategy. Test and refine algorithms using historical data.

- Risk Management Parameters: Establish clear risk thresholds for each trade and incorporate them into your system’s rules.

- Optimization and Validation: Regularly optimize your system’s parameters and validate its performance using out-of-sample data.

- Deployment and Monitoring: Implement your system in real-time trading conditions and monitor its performance continuously. Adjust parameters as needed.

Image: fintrakk.com

Develop Option Trading Systems

Image: s3.amazonaws.com

Conclusion

Developing and implementing option trading systems is a challenging yet rewarding endeavor. By mastering the principles outlined in this guide, you can create a powerful tool that enhances your trading capabilities. Remember to approach the process with a disciplined approach, embracing continuous learning and refinement. As you gain experience, you’ll unlock the full potential of option trading systems, increasing your profitability and minimizing risks in the dynamic and ever-changing financial markets.