Image: trading.alamalami.com

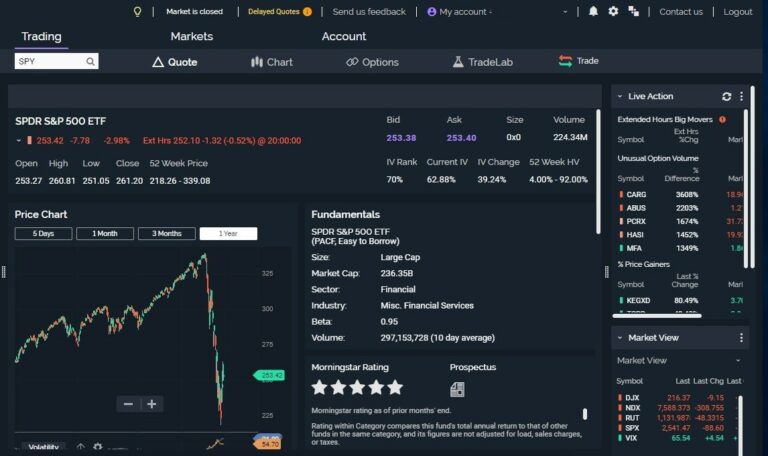

In today’s fast-paced financial landscape, the enigmatic world of options trading can seem alluring yet formidable. However, fear not, for a breakthrough has emerged: the advent of demo options trading platforms. These platforms offer an unparalleled opportunity for traders of all levels to navigate the complexities of options trading without risking a dime.

Imagine yourself as a budding artist standing before a canvas. The demo options trading platform is your easel, and the virtual funds provided within are your vibrant paints. You have the freedom to experiment, dabble in different strategies, and refine your technique without the fear of costly blunders. As you explore the myriad options, you’ll discover the exhilarating rush of simulated trading while honing your skills.

Delving into the Nuances of Options Trading

Options trading is a sophisticated financial instrument that grants you the option, but not the obligation, to buy or sell an asset at a predetermined price, known as the strike price. This flexibility provides traders with the ability to tailor their positions to their risk appetite and profit objectives.

However, the intricacies of options trading can be daunting. From understanding the Greeks (parameters that measure option risk and sensitivity) to navigating expiration dates, there’s a wealth of knowledge to absorb. Fortunately, demo options trading platforms serve as virtual classrooms where you can learn at your own pace, without the pressure of real-time market movements.

Embracing the Benefits of Virtual Trading

The possibilities are boundless with demo options trading platforms. Here are just a few of the profound benefits they offer:

-

Risk-free exploration: Immerse yourself in the world of options trading without jeopardizing your capital.

-

Unlimited experimentation: Test different strategies and techniques to identify what resonates best with your trading style.

-

Precision learning: Pause, rewind, and analyze your virtual trades to pinpoint areas for improvement and build a robust trading foundation.

-

Confidence-building exercise: As you witness yourself navigating the market successfully, your confidence in real-world trading will soar.

Harnessing Expert Insights and Actionable Tips

To maximize the value of your demo options trading experience, seek guidance from seasoned traders. Many platforms offer insights, webinars, and educational materials from reputable experts. Absorb their wisdom and implement their proven strategies into your virtual trades.

Here are some actionable tips to enhance your demo trading endeavors:

-

Set realistic expectations: Remember that simulated trading is a learning tool, not a substitute for real-time market experience.

-

Emulate real-life conditions: Approach your virtual trades as if they were actual investments, considering risk management and proper entry and exit points.

-

Document your trades: Keep a journal or spreadsheet to track your strategies, performance, and lessons learned. This invaluable record will serve as a roadmap for your future trading endeavors.

Embarking on Your Options Trading Journey

The world of options trading is an exhilarating realm, and the availability of demo options trading platforms has made it more accessible than ever before. Embrace the opportunity to learn, experiment, and refine your skills. With the right platform and unwavering determination, you’ll be well-equipped to step into the real market with confidence and reap the rewards of this captivating financial instrument.

Image: brokerchooser.com

Demo Options Trading Platform App

Image: badinvestmentsadvice.com