Introduction

Options trading is a complex and multifaceted financial strategy that offers both opportunities and risks to investors. Understanding the nuances of options trading is paramount to maximizing its potential, and a daily options trading report is a valuable tool in this endeavor. This report provides traders with up-to-date information on market trends, option prices, and trading volume, enabling them to make informed decisions.

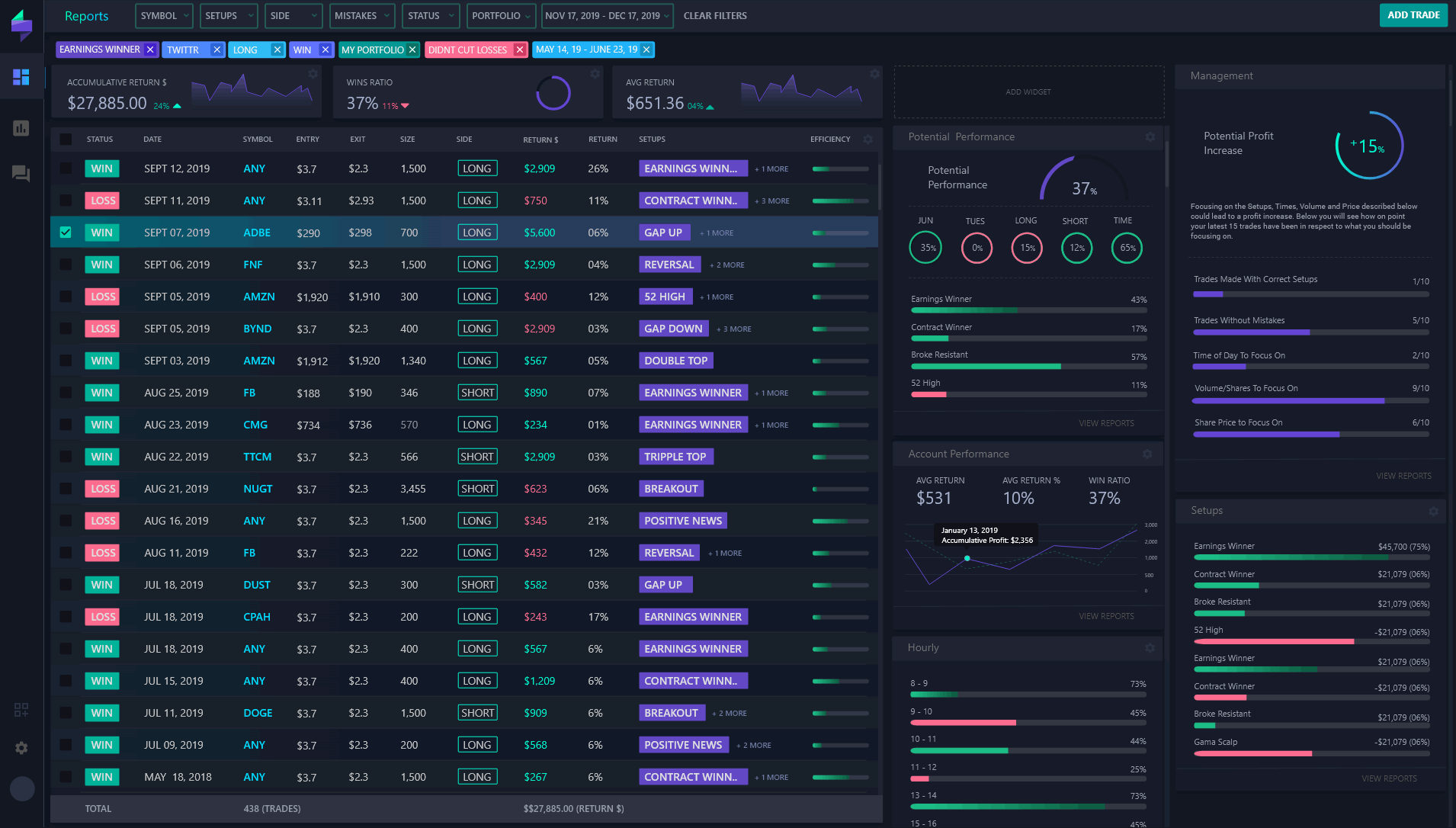

Image: scamorno.com

Daily Options Trading Report: A Summary

The daily options trading report collates essential data on option trading activity for a specific trading day. It comprises various sections presenting a holistic view of market dynamics. These sections may include:

- Market Summary: Provides a snapshot of the broader market, including indices, futures, and currency markets, to provide context for option pricing.

- Option Prices: Lists the prices of various options contracts, including calls, puts, and spreads, across different strike prices and expiration dates.

- Trading Volume: Shows the number of contracts traded for each option, indicating market activity and liquidity.

- Open Interest: Displays the total number of open option positions at the end of the day, offering insight into market sentiment.

- Implied Volatility: Calculates the implied volatility of options based on their prices, reflecting market expectations of future price movements.

- Historical Data: May include trends and historical patterns in option prices and trading volume.

- News and Commentary: Provides relevant news and expert commentary on current market events affecting options trading.

Benefits of Daily Options Trading Reports

Daily options trading reports are a valuable resource for traders of all levels, offering numerous advantages:

- Real-Time Information: Provides up-to-date data on option prices, volumes, and other market indicators, allowing traders to stay informed and make quick decisions.

- Market Analysis: Enables traders to analyze market trends, identify potential trades, and gauge overall market sentiment.

- Trade Execution: Supports traders in executing option trades by providing access to live option prices and liquidity information.

- Risk Management: Helps traders assess the risk of option strategies and adjust their positions accordingly.

- Educational Tool: Can be used as an educational resource for aspiring traders, providing insights into market dynamics and trading strategies.

How to Use a Daily Options Trading Report

To harness the power of a daily options trading report, traders should follow these steps:

- Review Market Summary: Get a broad overview of market conditions to understand how they may impact option prices.

- Assess Option Prices: Identify potential trading opportunities based on option prices and market trends.

- Monitor Trading Volume: Assess market activity and liquidity to determine the risk and potential rewards of trades.

- Identify Volatility: Implied volatility indicates market expectations of future price movements, which can influence option strategies.

- Consider Historical Data: Analyze historical trends and patterns to gain insights into option pricing and market behavior.

- Stay Informed: Pay attention to news and commentary to keep abreast of market events that may affect option trading.

Image: www.pinterest.com

Daily Options Trading Report

Image: www.youtube.com

Conclusion

Daily options trading reports are indispensable tools for anyone involved in options trading. They provide real-time insights, support data-driven decision-making, and enhance trading efficiency. By effectively utilizing daily options trading reports, traders can stay informed, make smarter trades, and navigate the volatile world of options with greater confidence.