Harnessing the power of currency options trading can unlock a world of opportunities for savvy investors in Canada. Options, financial instruments that grant the buyer the right but not the obligation to buy or sell an underlying asset at a predetermined price on or before a specific date, open doors to both potential gains and calculated risks. In the realm of currency markets, options trading empowers investors to navigate the ever-shifting tides of exchange rates, amplify their profits, and mitigate potential losses.

Image: www.ig.com

Delving into the Basics of Currency Options

Currency options confer upon their holders a wealth of flexibility and versatility. Call options grant the buyer the right to purchase a specific amount of currency at a specified price by a designated date, offering the opportunity to capitalize on an anticipated rise in the currency’s value. Conversely, put options accord the buyer the right to sell a stipulated amount of currency at a predetermined price before a predefined date, providing a safety net against potential currency value declines.

Understanding the intricacies of option pricing is paramount for successful trading endeavors. Intrinsic value, the inherent worth of an option, arises from the potential gain or loss resulting from exercising the option at its current market price. Time value, the premium paid for the option’s temporal flexibility, diminishes over time until the option expires worthless.

Trading Currency Options in the Canadian Market

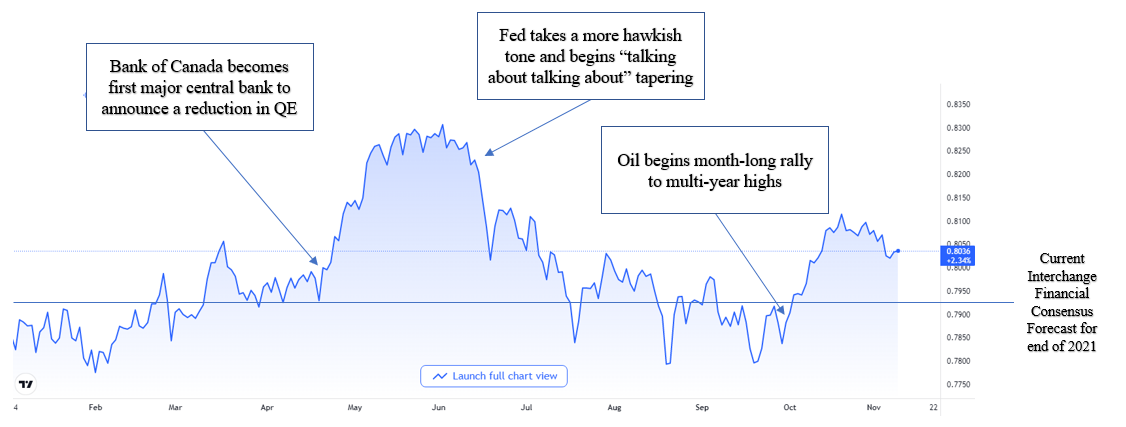

Navigating the currency options market in Canada necessitates an awareness of its distinctive characteristics. The Canadian dollar (CAD), a commodity-linked currency, exhibits a close correlation to the price of oil, Canada’s primary export. This symbiotic relationship introduces a degree of predictability to CAD’s movements, offering astute investors opportunities to harness global economic trends.

Moreover, Canadian currency options are traded on the Montréal Exchange (MX), a highly regulated and sophisticated trading platform. Traders can access a diverse spectrum of currency pairs, including CADUSD (Canadian dollar versus US dollar), CADJPY (Canadian dollar versus Japanese yen), and CADCHF (Canadian dollar versus Swiss franc).

Strategies for Currency Options Trading Success

Strategic execution lies at the heart of successful currency options trading. Trend following, a method that capitalizes on ongoing trends, involves buying call options during uptrends and put options during downtrends. Range trading, suitable for relatively stable markets, centers on buying options near support levels and selling options near resistance levels. Breakout trading, a strategy that seeks to profit from significant price fluctuations, involves entering long positions when a currency pair breaches above resistance or short positions when it falls below support.

Hedging, a technique employed to mitigate risk, entails using options to offset potential losses. For instance, a company anticipating a large foreign currency payment can purchase a put option to protect against an unfavorable exchange rate movement.

Image: www.jlcatj.gob.mx

The Benefits of Currency Options Trading

Currency options trading offers an array of enticing benefits. Leverage, the ability to control a substantial amount of currency with a relatively small investment, amplifies profit potential. Flexibility, stemming from options’ inherent versatility, allows traders to tailor their strategies to specific market conditions and risk tolerances.

Reduced risk, achieved through hedging mechanisms, safeguards against adverse currency fluctuations. Income generation, made possible by option premiums, provides an alternative revenue stream.

Currency Options Trading Canada

Image: jeraldpibriggs.gq

Conclusion

For discerning investors seeking to delve into the captivating realm of currency options trading, Canada offers a fertile ground. Equipped with an understanding of the fundamental principles, a strategic approach, and a comprehensive grasp of the Canadian market, investors can harness the power of currency options to potentially enhance their portfolios. Remember, embarking on any investment endeavor demands meticulous research, prudent risk management, and a disciplined adherence to one’s trading plan.