Unlocking the World of Options Trading with a Limited Budget

Trading options can be a lucrative way to generate income and enhance your financial portfolio. However, the conventional wisdom suggests that you need a substantial amount of capital to get started. In this article, we’ll delve into the exciting realm of options trading and explore the intriguing question: can you open an options trading account with just $200? We’ll break down the basics, discuss account requirements, and provide practical strategies to maximize your trading potential with a limited budget.

Image: www.youtube.com

Understanding Options Trading: The Basics

Options are financial contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specific date. Unlike stocks where you own the underlying asset, options give you the flexibility to speculate on the future price movements of stocks, currencies, or other financial instruments without actually owning them.

When you buy an option, you pay a premium to the seller, giving you the option to exercise it at the predetermined price (known as the strike price) within a certain time frame (known as the expiration date). Depending on the type of option you purchase, you can bet on the rise (call option) or fall (put option) of the underlying asset’s price.

Can You Open an Account with $200?

The answer is a resounding yes! Many online brokerages cater to the needs of beginners and offer options trading accounts with low minimum deposit requirements. Some brokers even provide special promotions that allow you to open an account with as little as $50 or $100. However, it’s important to keep in mind that account minimums vary depending on the broker and may be subject to change.

Understanding Account Requirements and Fees

While you can open an account with a small sum, it’s essential to understand other account requirements and fees associated with options trading. These may include:

- Trading Platform Fees: Brokerages may charge a monthly fee for access to their trading platform, which provides the tools and resources you need to trade.

- Option Premiums: The cost of the option premium is determined by various factors, including the underlying asset’s price, volatility, time to expiration, and the option’s strike price.

- Margin Interest: If you trade options on margin (borrowed funds), you may be charged interest on the amount borrowed.

- Transaction Fees: Some brokers charge a fee for each trade executed.

Before opening an account, carefully review the broker’s fee structure to ensure it aligns with your trading style and budget.

Image: www.youtube.com

Strategies for Trading Options with a Small Account

Trading options with a limited budget demands a different approach to trading. Here are some strategies to optimize your success:

- Trade Micro-Contracts: Micro-contracts are smaller contracts that represent a fraction of a standard option contract. They offer a more affordable way to trade options with a smaller account size.

- Focus on High-Volume Stocks: Opt for options with high trading volume as they typically have lower premiums and higher liquidity, making it easier to enter and exit positions.

- Choose Near-Expiration Options: Options with shorter time to expiration tend to have lower premiums, which can save you money on upfront investment.

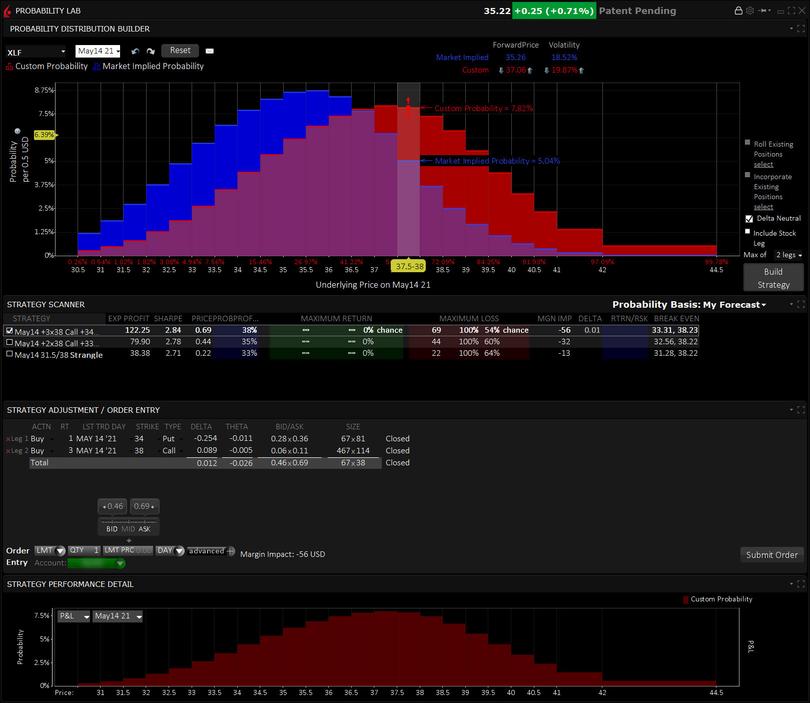

- Use Options Trading Strategies: There are various trading strategies that can enhance your profitability and risk management, such as covered calls, cash-secured puts, and bull and bear spreads.

Can You Open A Options Trading Account With 200

Image: www.interactivebrokers.com

Conclusion

Opening an options trading account with $200 is indeed possible, providing you with access to the potential rewards of this market. However, it’s crucial to understand the account requirements, associated fees, and specific strategies that cater to small accounts. By carefully selecting a broker and employing prudent trading practices, you can maximize your trading potential and embark on an exciting journey in the world of options trading.