Unveiling the Possibilities and Risks of Options Trading in a Tax-Advantaged Account

Trading options with the potential for magnified returns may cross your mind as you explore investment opportunities within a Roth IRA. However, understanding the unique tax implications, complexities, and risks associated with options trading in this tax-advantaged account is crucial before diving in. In this article, we embark on a comprehensive exploration of the ins and outs of options trading within a Roth IRA, empowering you with the knowledge to make informed investment decisions.

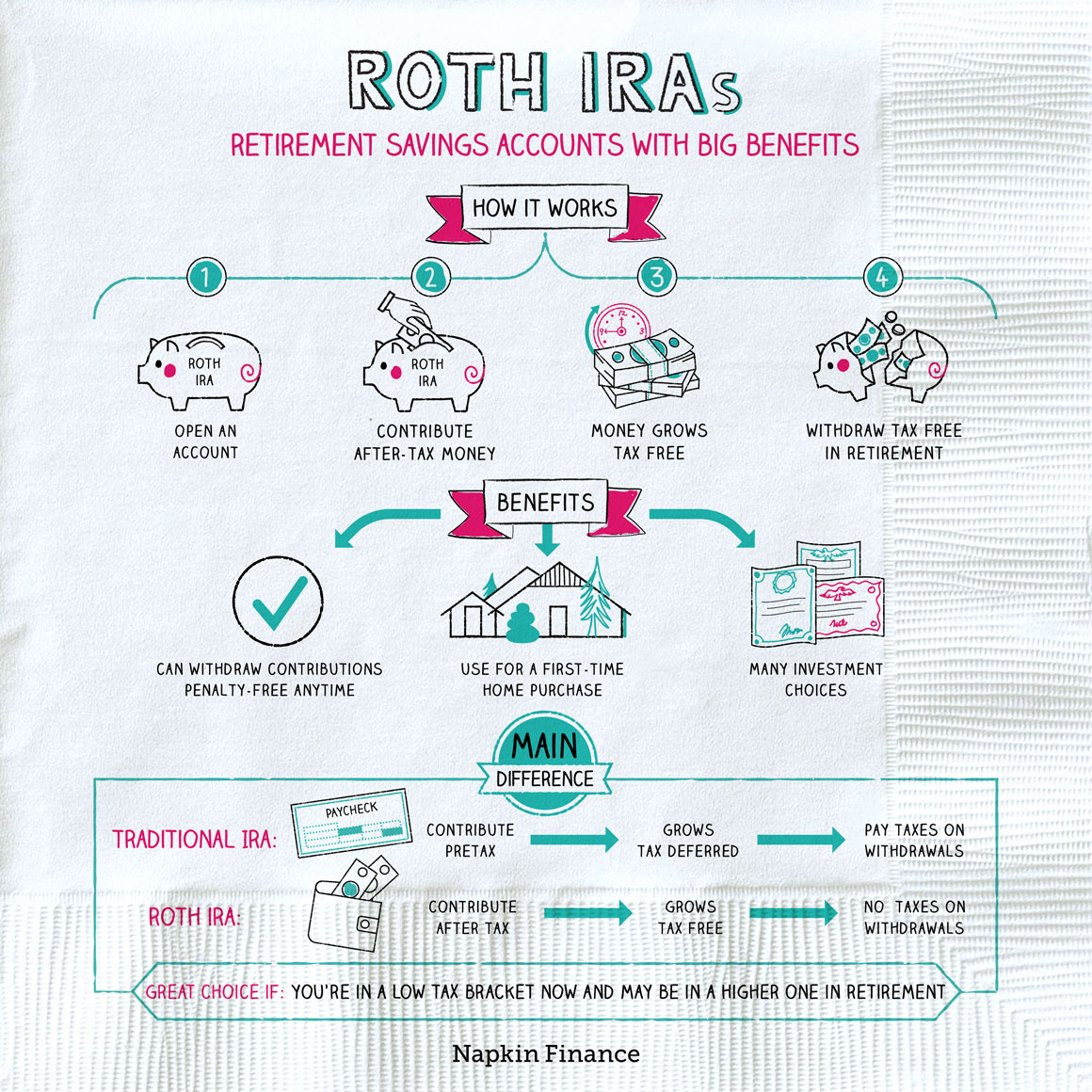

Image: napkinfinance.com

A Path of Tax Savings, Yet Complexities Await

Roth IRAs offer the allure of tax-free qualified distributions in retirement, contributing to their popularity. However, options trading within a Roth IRA introduces intricacies that demand careful consideration. Unlike stocks or bonds, options have specific tax treatments and can be subject to additional rules when held in a Roth IRA.

Decoding the Taxation of Options Premiums

When you purchase an option, you pay a premium. This premium is not tax-deductible, meaning it reduces your account balance available for investment. Suppose you buy an option and it expires worthless. In that case, the entire premium you paid is lost and will not be subject to taxation. However, if the option increases in value and you sell it for a profit, a portion of that profit may be taxed as ordinary income, depending on how long you held the option. If you hold the option for more than one year, the profit may qualify for the more favorable long-term capital gains tax rate.

Options Trading Strategies and Their Tax Treatment

Various options trading strategies exist, each with its own tax implications. For instance, if you engage in covered call writing (selling call options against an underlying stock you own), the premiums received are generally taxed as ordinary income. In contrast, if you buy and hold options for more than one year, any profit you make may qualify for the long-term capital gains tax rate. It’s essential to research and understand the tax implications of different options strategies before implementing them.

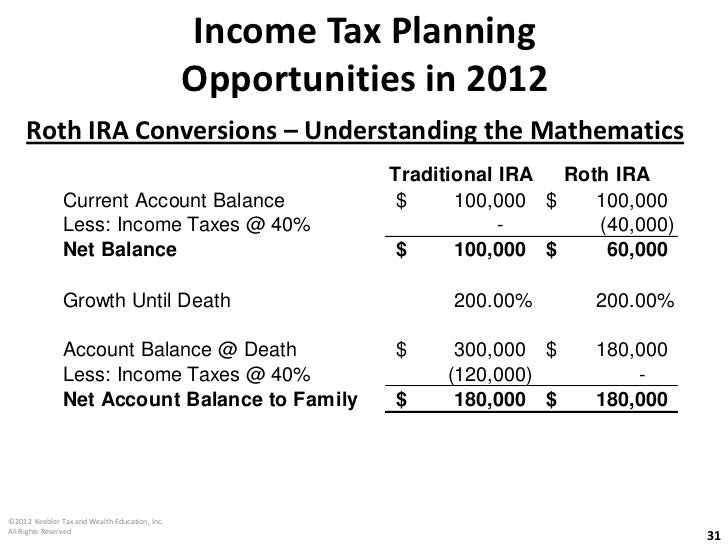

Image: www.artofit.org

Risks of Options Trading in a Roth IRA

Options trading is inherently risky, and these risks are amplified within a Roth IRA. Roth IRAs are retirement accounts with specific contribution limits and withdrawal rules. If you experience significant losses from options trading that deplete your account balance, you may not be able to fully recover before retirement age. Additionally, if you withdraw funds from your Roth IRA before age 59½, you may incur a 10% early withdrawal penalty and owe income tax on any earnings withdrawn, potentially diminishing your retirement savings.

Navigating the Challenges: Considerations for Success

If you’re determined to explore options trading within your Roth IRA, proceed with caution and consider the following strategies:

-

Start small: Begin with a modest amount of capital that you can afford to lose.

-

Educate yourself: Dedicate time to learning about options trading strategies, risk management, and tax implications.

-

Seek professional guidance: Consider consulting a financial advisor who specializes in options trading to guide you through complex decisions and strategies.

-

Monitor your portfolio: Regularly review your options positions and adjust your strategy as needed.

-

Be patient: Options trading in a Roth IRA can be a long-term investment strategy, so don’t expect instant riches.

Can I Do Options Trading In My Roth Ira

Image: odomujekadox.web.fc2.com

Conclusion

Options trading within a Roth IRA presents both potential rewards and risks that require careful consideration. Understanding the tax implications, intricacies, and potential risks is crucial before allocating any portion of your Roth IRA to this investment strategy. By thoroughly researching, seeking guidance from a qualified professional when needed, and implementing sound risk management practices, you can better navigate the complexities of options trading within your Roth IRA and potentially enhance your long-term retirement savings strategy.