You may remember BlackBerry as the pioneer of mobile communication in the early 2000s, but did you know that its options trading presents unique opportunities for savvy investors?

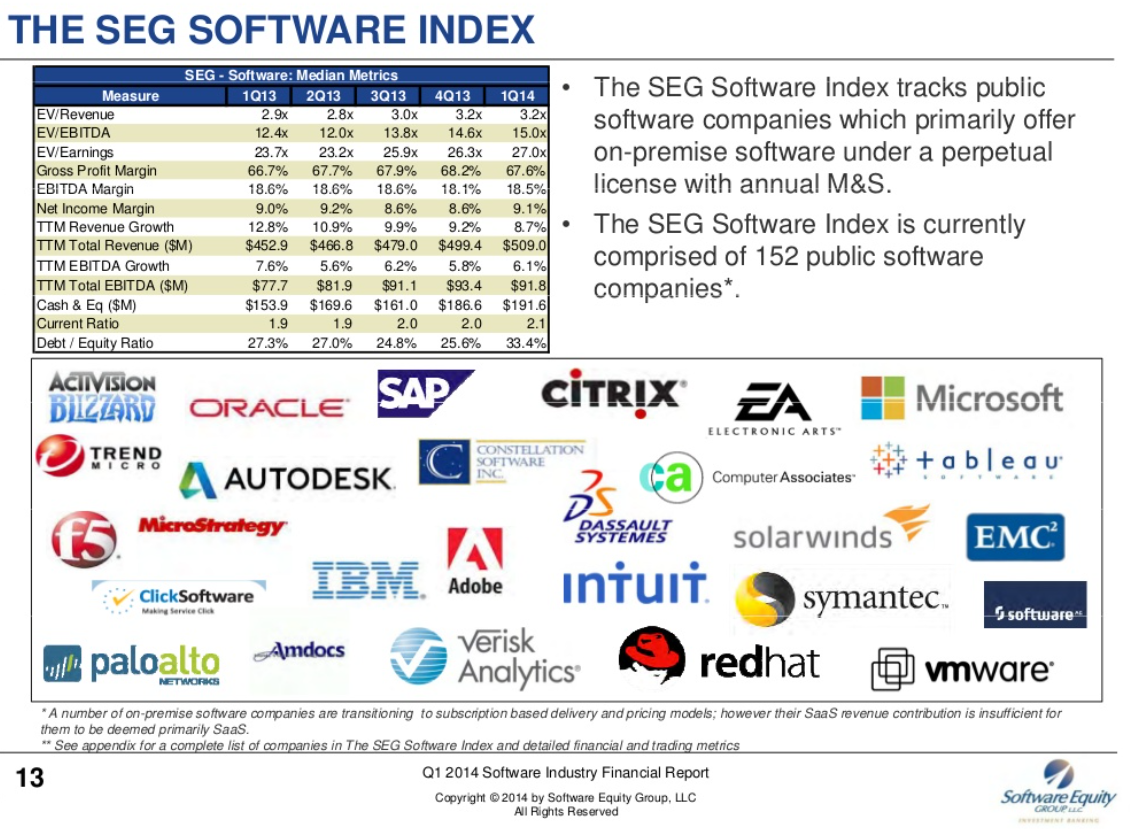

Image: www.slideshare.net

Options trading, the practice of buying or selling contracts that give you the right to buy or sell an underlying asset at a predetermined price by a certain date, can be a powerful tool for profiting from market fluctuations. In this article, we’ll delve into BlackBerry options trading, explaining its intricacies and providing expert tips to help you navigate this dynamic market.

Understanding BlackBerry Options Trading

What are Blackberry Options?

BlackBerry options, like options for other assets, are contracts that give the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) a specified number of BlackBerry shares at a predetermined price (known as the strike price) on or before a certain date (the expiration date).

Types of BlackBerry Options

There are two main types of BlackBerry options:

- Call Options: Give the holder the right to buy BlackBerry shares at the strike price.

- Put Options: Give the holder the right to sell BlackBerry shares at the strike price.

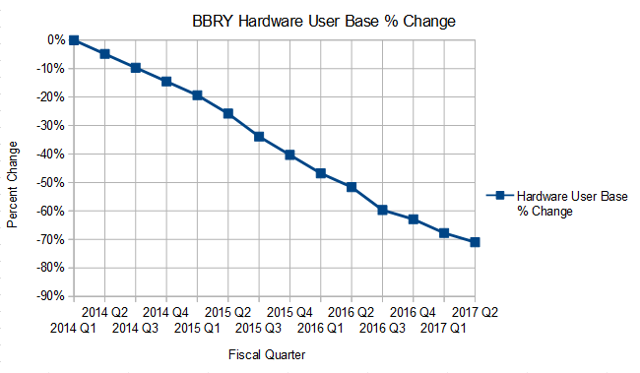

Image: seekingalpha.com

Factors Influencing BlackBerry Option Prices

The price of BlackBerry options is influenced by several factors, including:

- BlackBerry’s stock price

- The time to expiration

- The volatility of BlackBerry’s stock price

- Interest rates

- Supply and demand for BlackBerry options

Strategies for BlackBerry Options Trading

Traders use various strategies in BlackBerry options trading, including:

- Long Calls: Buying call options when you expect BlackBerry’s stock price to rise.

- Short Calls: Selling call options when you expect BlackBerry’s stock price to fall.

- Long Puts: Buying put options when you expect BlackBerry’s stock price to fall.

- Short Puts: Selling put options when you expect BlackBerry’s stock price to rise.

Tips and Expert Advice for BlackBerry Options Trading

Here are some tips to help you succeed in BlackBerry options trading:

- Understand the risks involved and trade within your risk tolerance.

- Do your research on BlackBerry and its market prospects.

- Start with small positions and gradually increase your stake as you gain experience.

- Use options strategies that align with your investment goals.

- Consider using technical analysis to identify trading opportunities.

Frequently Asked Questions (FAQs) on BlackBerry Options Trading

Q: What is the minimum investment amount for BlackBerry options trading?

A: The minimum investment amount can vary depending on the brokerage firm you use, but it is typically around $100.

Q: What are the typical expiration dates for BlackBerry options?

A: BlackBerry options typically expire on the third Friday of each month.

Q: How can I learn more about BlackBerry options trading?

A: You can learn more by reading books, attending webinars, or consulting with a financial advisor who specializes in options trading.

Blackberry Options Trading

Image: seekingalpha.com

Conclusion

BlackBerry options trading offers numerous opportunities for both experienced and novice investors. By understanding the basics, staying informed about market trends, and implementing sound trading strategies, you can maximize your returns in this dynamic market. Remember, always trade responsibly and within your risk tolerance.

Are you interested in exploring the world of BlackBerry options trading? If so, take the next step by researching further, practicing with virtual trading platforms, and consulting with a reputable broker.