Introduction

In the rapidly evolving financial landscape, binary options trading has emerged as a popular investment strategy, promising high returns in a short period of time. However, navigating the world of binary options trading can be complex and fraught with risks, making it crucial to understand the operations of binary options trading firms before venturing into this market.

Image: knnit.com

This comprehensive guide delves into the intricate workings of binary options trading firms, providing valuable insights into their unique trading models, risk management strategies, and regulatory frameworks. By gaining a deeper understanding of these firms, traders can make informed decisions, maximize their profit potential, and mitigate potential risks.

Chapter 1: Unveiling the Binary Options Trading Model

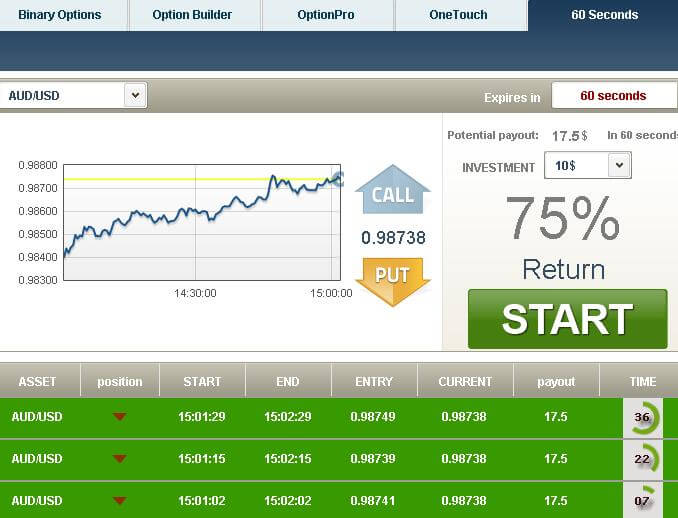

Binary options trading entails predicting the future direction of an underlying asset, such as currency pairs, indices, or commodities, within a predefined timeframe. Traders purchase contracts that offer a fixed payout if their prediction aligns with the market movement, while they lose their entire investment if their prediction proves incorrect.

Key Concepts:

- Call and Put Options: Traders can purchase call options if they anticipate an asset’s price increase or put options if they foresee a decrease.

- Expiry Time: Contracts have a specific expiration time, after which their value is determined based on the underlying asset’s price.

- Payout Ratio: The fixed payout traders receive if their prediction is correct, typically ranging from 60% to 95% of their investment.

Chapter 2: Navigating the Regulatory Landscape

The regulatory environment for binary options trading varies across jurisdictions, impacting the safety and legitimacy of firms operating in this market. Traders should be aware of the regulatory frameworks in their respective regions and only deal with firms that adhere to stringent regulations.

Image: yourincomeadvisor.com

Prominent Regulatory Bodies:

- Cyprus Securities and Exchange Commission (CySEC): Supervises binary options firms operating within the European Union.

- Australian Securities and Investments Commission (ASIC): Regulates financial services in Australia, including binary options.

- Financial Conduct Authority (FCA): Oversees financial markets in the United Kingdom, including binary options.

Chapter 3: Assessing Risk Management Strategies

Effective risk management is paramount in binary options trading, as it helps traders mitigate potential losses and preserve capital. Trading firms employ various risk management techniques to protect their clients, which traders should carefully evaluate before selecting a firm.

Common Risk Management Techniques:

- Stop-Loss Orders: Automatic orders that limit losses by closing trades when the underlying asset’s price reaches a predefined level.

- Take-Profit Orders: Automatic orders that close trades when the underlying asset’s price reaches a targeted profit level.

- Position Sizing: Managing the amount invested in each trade to limit the potential impact of losses.

Chapter 4: Evaluating Binary Options Trading Firms

Choosing a reputable binary options trading firm is crucial for success in this market. Traders should conduct thorough research and consider several key factors when evaluating firms, ensuring their safety, reliability, and profitability.

Key Evaluation Criteria:

- Regulation and Licensing: Verify that the firm holds valid licenses from recognized regulatory bodies.

- Trading Platform: Assess the user-friendliness, features, and reliability of the firm’s trading platform.

- Payout Rates: Compare the payout ratios offered by different firms to find those with competitive rates.

- Customer Support: Ensure that the firm provides accessible and responsive customer support channels.

Chapter 5: Exploring Advanced Trading Strategies

Beyond basic trading techniques, successful traders often employ advanced strategies to enhance their profit potential. These strategies require a deeper understanding of market dynamics and technical analysis.

Advanced Trading Strategies:

- Trend Following: Identifying and trading with established trends in the underlying asset’s price.

- Technical Analysis: Utilizing technical indicators and chart patterns to predict future price movements.

- Hedging: Using opposite positions in two correlated assets to reduce overall risk.

Chapter 6: Understanding Risks Associated with Binary Options Trading

While binary options trading offers the potential for high returns, it also carries inherent risks that traders must be aware of before venturing into this market. Thoroughly understanding these risks is crucial for informed decision-making.

Common Risks:

- High Risk of Loss: Trades can result in the loss of the entire invested capital.

- Time Decay: Contract value diminishes as expiration time approaches, regardless of the underlying asset’s price movement.

- Fraudulent Firms: Unregulated firms may engage in unethical practices, such as manipulating prices or refusing withdrawals.

Binary Options Trading Firm

Image: www.amtradingtips.com

Conclusion

Binary options trading firms play a significant role in facilitating this unique financial instrument. By understanding their operations, risk management strategies, and regulatory frameworks, traders can make informed choices and navigate the complexities of this market. However, it is essential to emphasize that binary options trading carries substantial risks, and traders should proceed with caution, carefully considering their risk tolerance and financial situation before entering this market.