Introduction

Options trading has long been shrouded in complexity and perceived as a risky endeavor reserved for seasoned finance professionals. However, Bill Poulos, a renowned options trader and educator, has demystified this enigmatic domain with his groundbreaking approach. In his book, “Simple Options Trading: My No-Nonsense Guide to Trading Options,” Poulos presents a stripped-down, intuitive method that empowers everyday investors to confidently navigate the options market. This comprehensive guide will explore the core principles of Poulos’s simple options trading strategy, highlighting its benefits and providing practical guidance for investors seeking to enhance their trading prowess.

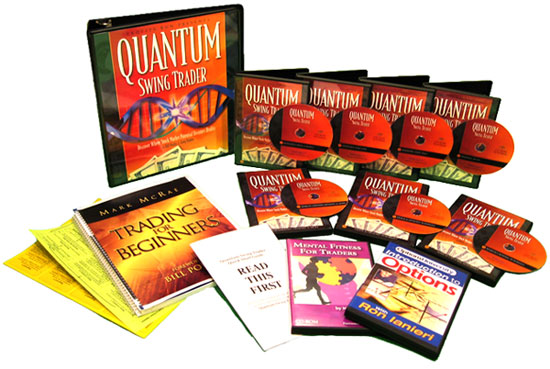

Image: www.prweb.com

The Building Blocks of Options Trading

At its core, options trading involves gaining the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price and on a specific date. This unique characteristic distinguishes options from traditional stock trading, opening up a vast array of investment strategies. Poulos’s simple options trading approach focuses on two fundamental types of options: calls and puts.

- Calls: Represent the right to buy an underlying asset at the strike price on or before the expiration date.

- Puts: Grant the right to sell an underlying asset at the strike price on or before the expiration date.

By understanding these basic concepts, investors can lay the groundwork for comprehending the complexities of the options market.

The Power of Time and Value

Time plays a crucial role in options trading, influencing the value of options contracts. Two key time-related factors are time decay and options expiration.

- Time Decay: As time progresses, the value of an option decays, gradually approaching zero as the expiration date looms. This decay is more pronounced for options with shorter durations.

- Options Expiration: Every options contract has a fixed expiration date. Once this date passes, the option becomes worthless.

Understanding these concepts enables investors to make informed decisions about the duration of their options trades.

Choosing the Right Strategy

Poulos’s simple options trading approach advocates for selecting strategies that align with market conditions and investor risk tolerance. One of the most popular strategies, commonly employed by Poulos, is known as “covered call writing.”

- Covered Call Writing: Involves selling a call option against an underlying stock that the trader already owns. This strategy generates premium income while maintaining the potential for capital appreciation.

Another effective strategy is the “buy-write.”

- Buy-Write: Combination of buying a stock and simultaneously selling a call option against it. This strategy seeks to limit potential downside while generating additional income from the option premium.

Image: esygb.com

Image: esygb.comPractical Tips for Success

- Start Small: Begin with modest trades to minimize potential losses.

- Manage Risk: Employ risk-management techniques and avoid excessive leverage.

- Understand the Basics: Master the fundamentals of options trading before executing trades.

- Seek Professional Guidance: Consider consulting a reputable options trader or financial advisor for support.

Bill Poulos Simple Options Trading

Image: brainlearns.org

Conclusion

Bill Poulos’s simple options trading strategy offers a practical roadmap for investors seeking to navigate the options market with confidence. By embracing the simplicity and time-tested principles outlined in this guide, investors can unlock the potential of options trading, generating additional income, hedging risks, and potentially enhancing their overall investment portfolio