Introduction

If you’ve ever traded options, you know that the tax statement you receive at the end of the year can be a bit overwhelming. There are a lot of big numbers, and it can be hard to know what they all mean. In this article, we’ll break down the most important numbers on your option trading tax statement and explain what they mean.

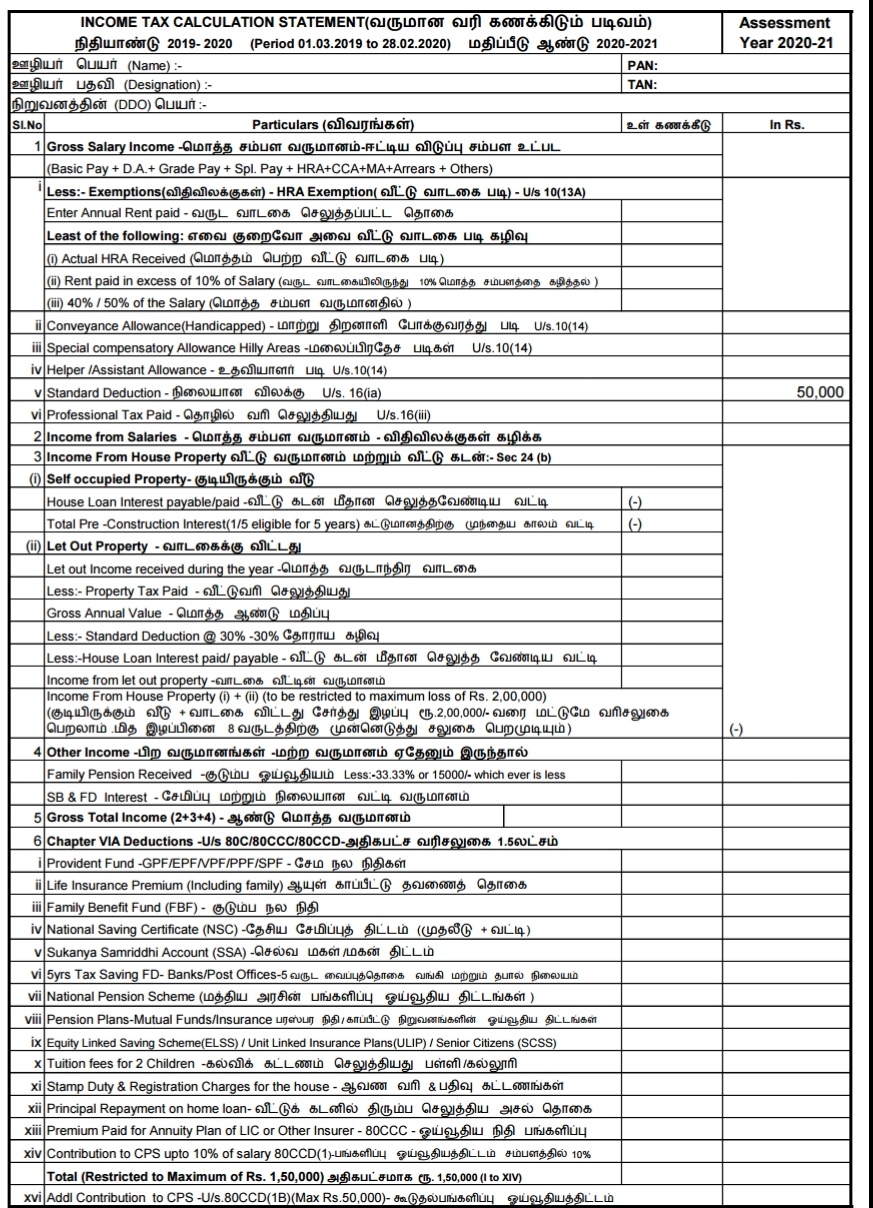

Image: jurychoice15.gitlab.io

Let’s say you received an option trading tax statement that looks something like this:

| Category | Amount |

|---|---|

| Gross proceeds from sales | $100,000 |

| Cost or other basis | (50,000) |

| Gain (loss) | $50,000 |

| Wash sales disallowed | (10,000) |

| Adjusted gain (loss) | $40,000 |

Gross Proceeds from Sales

The first number you’ll see on your option trading tax statement is the gross proceeds from sales. This is the total amount of money you received from selling options during the year. It includes both the premiums you received for selling options and the proceeds from exercising options.

Cost or Other Basis

The cost or other basis is the amount of money you paid to acquire the options you sold. This includes the premiums you paid for buying options and the cost of any underlying assets you purchased to exercise options.

Gain (Loss)

The gain (loss) is the difference between the gross proceeds from sales and the cost or other basis. This is the amount of money you made or lost on your option trades for the year.

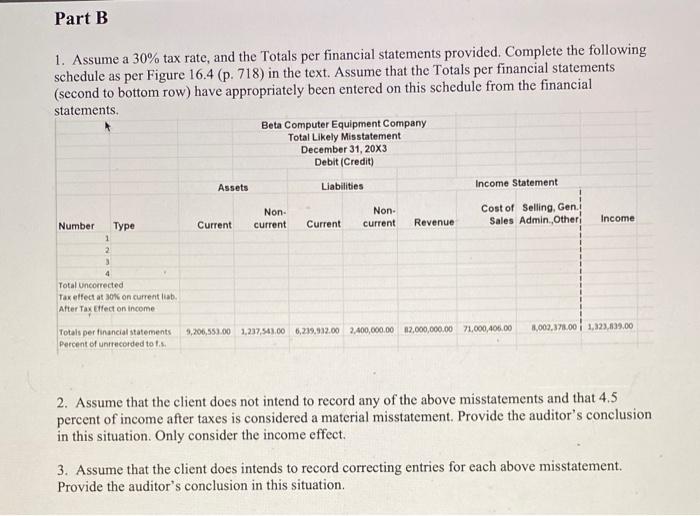

Image: www.chegg.com

Wash Sales Disallowed

A wash sale occurs when you sell an option and then buy back a substantially identical option within 30 days. Wash sales are disallowed for tax purposes, which means that you can’t deduct the loss from the sale of the first option. The amount of wash sales disallowed is shown on your tax statement.

Adjusted Gain (Loss)

The adjusted gain (loss) is the gain (loss) minus the wash sales disallowed. This is the amount of money you made or lost on your option trades for the year that is subject to taxation.

Latest Trends and Developments

The option trading market is constantly evolving, and there are always new trends and developments to be aware of. Here are a few of the latest trends:

- The rise of mobile trading: More and more people are trading options on their mobile devices. This has made it easier for people to trade options on the go, and it has also led to a more competitive market.

- The growth of complex strategies: Option traders are using increasingly complex strategies to generate profits. This has made it more difficult for individual investors to keep up with the latest trends, and it has also led to more volatility in the market.

- The increasing use of options for hedging: Options are increasingly being used by investors to hedge against risk. This has led to an increase in the demand for options, and it has also helped to stabilize the market.

Tips and Expert Advice

Here are a few tips and expert advice for option traders:

- Do your research: Don’t trade options until you understand how they work. There are a lot of resources available online and in libraries that can help you learn about options.

- Start small: Don’t trade more than you can afford to lose. The option market can be volatile, and you could lose money on your trades.

- Use a broker you trust: There are a lot of different option brokers out there, so it’s important to find one you trust. Make sure your broker is regulated and has a good reputation.

- Be patient: Option trading takes time and effort. Don’t expect to get rich quick. The best way to profit from option trading is to develop a long-term strategy and stick to it.

Explanation of Tips and Expert Advice

The most important tip for option traders is to do your research. The more you know about options, the better equipped you’ll be to make profitable trades. There are a lot of resources available online and in libraries that can help you learn about options. Once you understand how options work, you can start trading small and build your profits over time.

It’s also important to use a broker you trust. There are a lot of different option brokers out there, so it’s important to find one that is regulated and has a good reputation. A good broker will provide you with the tools and support you need to be successful.

FAQ

Q: What is an option?

A: An option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date.

Q: What are the different types of options?

A: There are two main types of options: calls and puts. A call option gives you the right to buy an underlying asset, while a put option gives you the right to sell an underlying asset.

Q: How do I trade options?

A: To trade options, you need to open an account with an option broker. Once you have an account, you can buy or sell options by placing orders through the broker’s platform.

Q: What are the risks of option trading?

A: Option trading involves a number of risks, including the risk of losing all or part of your investment. You should only trade options if you understand the risks involved.

Big Numbers On Option Trading Tax Statement

Image: www.sampletemplates.com

Conclusion

If you’re interested in learning more about option trading, there are a lot of resources available online and in libraries. You can also find a lot of helpful information on forums and social media platforms. The key to success in option trading is to do your research and develop a long-term strategy. With a little time and effort, you can start earning money from option trading.

Are you interested in learning more about option trading? Let me know in the comments below!