Image: www.youtube.com

Introduction

In the world of options trading, choosing the right underlying stocks can significantly impact your success. Whether you’re a seasoned trader or just starting out, understanding the characteristics of stocks that are ideal for options trading is crucial. This comprehensive guide will delve into the key factors to consider when selecting the best stocks for options trading calls, providing you with actionable insights to enhance your trading strategy.

What is Options Trading?

Options trading involves the buying and selling of options contracts, which give the holder the right but not the obligation to buy (calls) or sell (puts) an underlying stock or asset at a specified price on or before a certain date. Options trading can be a powerful tool for both hedging risk and generating profits.

Understanding the Best Stocks for Options Calls

When it comes to selecting stocks for options trading calls, there are several characteristics that you should prioritize:

● High Volatility: Volatility measures the extent to which the stock’s price fluctuates. Stocks with high volatility exhibit significant price swings, which can lead to potentially large profits for options traders.

● Liquidity: Liquidity refers to the ease with which a stock can be bought or sold. Liquid stocks have high trading volume, ensuring that you can enter or exit trades quickly without significant price slippage.

● Implied Volatility: Implied volatility is the market’s prediction of the future volatility of a stock. Stocks with high implied volatility tend to have wider price movements, which can enhance the potential returns from options trading.

● Market Cap and Industry: Larger-cap stocks and stocks belonging to sectors with strong fundamentals tend to be more stable and less prone to extreme price swings, making them suitable for options trading calls.

Image: www.pinterest.com

Identifying High-Quality Candidates

To find stocks that meet these criteria, traders can use various tools and resources:

● Option Screening Platforms: These platforms allow you to filter stocks based on volatility, liquidity, and implied volatility.

● Market Analysis and Research: Analyze historical price data, earnings reports, and industry trends to identify stocks with potential for price fluctuations.

● Broker Recommendations: Seek guidance from experienced brokers who can provide insights on stocks that may be well-suited for options trading calls.

Popular Stocks for Options Trading Calls

Some popular stocks that are commonly traded with options calls include:

● Apple (AAPL): A high-growth technology stock with high volatility and liquidity.

● Tesla (TSLA): An electric vehicle and renewable energy company with significant price swings.

● Amazon (AMZN): An e-commerce giant with a large market cap and stable financial performance.

● Microsoft (MSFT): A software and cloud computing leader with moderate volatility and high liquidity.

● Nvidia (NVDA): A semiconductor and gaming company with strong growth prospects and high implied volatility.

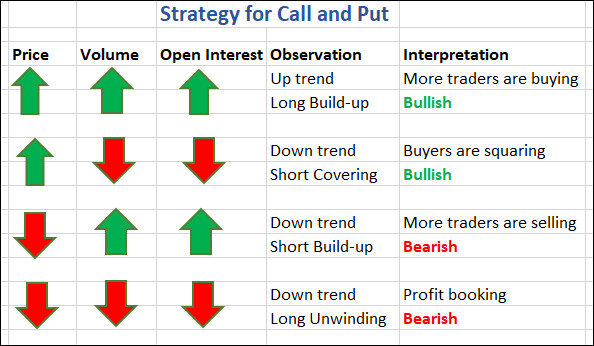

Strategies for Trading Call Options

Once you have identified suitable stocks, consider the following strategies for trading call options:

● Buy and Hold: This strategy involves purchasing call options and holding them until they expire in the money (ITM).

● Covered Calls: Sell call options on a stock that you own, allowing you to generate income while limiting your downside risk.

● Call Spreads: Create a neutral or bullish position by buying and selling call options with different strike prices and expiration dates.

● Butterfly Spreads: A combination of calls and puts that allows you to benefit from range-bound price movement.

Risk Management

Options trading involves risk, so it’s essential to manage your risk carefully:

● Define Risk Tolerance: Determine the amount of potential loss you are willing to accept.

● Diversification: Spread your trades across multiple stocks and options strategies to reduce concentration risk.

● Use Stop-Loss Orders: Set stop-loss orders to automatically close your positions if the price moves against you.

● Monitor Market Conditions: Stay updated on news and events that can impact the stocks you are trading.

Best Stocks For Options Trading Call

Image: datapeaker.com

Conclusion

Trading options calls can be a rewarding endeavor, but selecting the right stocks is paramount to success. By considering the factors discussed in this article, you can identify stocks with high volatility, liquidity, and strong fundamentals that are well-suited for options trading calls. Remember to apply sound risk management practices and continuously evaluate your strategies to maximize your profitability and minimize losses.