Imagine yourself, standing confidently on the edge of a dynamic market, armed with a tool that could potentially magnify your returns while mitigating risks. This, dear reader, is the promise of options trading, and today, we journey into its intriguing world, specifically exploring the unique opportunities offered by Vanguard, a titan of the investment industry.

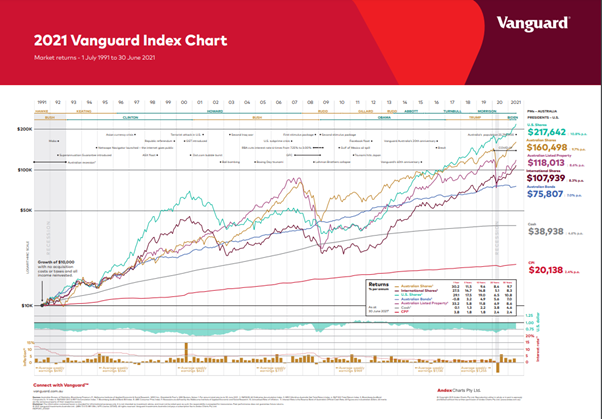

Image: www.vanguard.com.au

Options trading, often perceived as a complex and daunting realm, holds vast potential for those willing to learn and understand its intricacies. From harnessing the power of leverage to crafting strategies that outmaneuver market volatility, options can be a valuable addition to your investment toolkit. But choosing the right platform is crucial, and this is where Vanguard, known for its transparent approach and focus on long-term investing, enters the picture. This article aims to demystify the concept of options trading, focusing on the unique benefits that Vanguard offers to investors, both novice and experienced.

Unveiling the World of Options: A Deeper Dive

At its core, an option is a contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Imagine it as a “ticket” that gives you the power to potentially profit from the future price movements of an asset like stocks, ETFs, or even indices.

Options are categorized into two primary types: calls and puts. A call option gives you the right to buy an asset at a specific price (the strike price), while a put option gives you the right to sell an asset at a specific price. The beauty of options lies in their flexibility; you can tailor your strategy to match your individual investment goals, risk tolerance, and market outlook.

The Vanguard Difference: A Beacon of Trust and Transparency

While the allure of options trading is captivating, choosing the right platform is paramount. Vanguard, known for its commitment to investor education and its long-term perspective, offers a unique and compelling environment for options traders.

1. A Deep Well of Educational Resources: Vanguard believes in empowering investors with knowledge. They provide a wealth of resources, including articles, videos, and interactive tools designed to educate you on the fundamentals of options trading. These resources, often free and readily accessible, equip you with the confidence to navigate the complexities of options trading, making informed decisions based on a solid foundation of understanding.

2. A User-Friendly Platform: Vanguard’s platform is designed with user experience in mind, balancing simplicity with comprehensive functionality. It allows you to easily review quotes, track your trades, and access real-time market data, all within a streamlined interface.

3. Low Fees and Transparent Pricing: Vanguard is known for its low expense ratios and transparent pricing, ensuring that your hard-earned money isn’t eroded by hidden fees. This commitment to fairness empowers you to maximize your potential returns while minimizing unnecessary costs.

4. Focus on Long-Term Investing: While options trading can be short-term in nature, Vanguard’s core philosophy emphasizes long-term investment strategies. This approach encourages a disciplined and responsible approach to options trading, prioritizing calculated decisions based on long-term market trends rather than impulsive short-term gains.

Strategic Approaches to Options Trading with Vanguard

Now that we’ve explored the unique benefits of options trading with Vanguard, let’s dive into common strategies:

1. Covered Calls: Imagine owning 100 shares of a company you believe in. If you’re confident the stock won’t surge significantly, a covered call allows you to sell a call option, earning premium income while potentially selling the shares at a set price.

2. Cash-Secured Puts: Are you bearish on a particular stock? A cash-secured put allows you to collect premium income while potentially buying shares at a discounted price if the stock price declines.

3. Covered Puts: This strategy involves selling a put option for a premium while simultaneously short-selling the underlying asset. It’s a strategy for traders who anticipate the price of an asset to increase.

4. Long Straddles: This strategy involves buying a call and a put option with the same strike price and expiration date. It’s a high-risk, high-reward strategy that profits from significant price volatility in either direction.

Image: fxlearnpro.com

Expert Insights and Actionable Tips

Options trading, although potentially rewarding, requires a strategic, calculated approach. Here are key insights from experienced traders:

1. Start Small and Learn Gradually: Don’t jump into complex strategies before understanding the basics. Start with simple trades and progressively gain experience.

2. Manage Your Risk: Options carry inherent risk, and it’s essential to implement risk management strategies such as stop-loss orders and diversification.

3. Stay Updated: Market conditions fluctuate, and informed decisions require regular monitoring of market data and news.

4. Consider the Time Value of Options: The value of an option decays over time. Therefore, timing is crucial when choosing options strategies.

5. Seek Guidance from Professionals: If you’re unsure about certain options strategies, don’t hesitate to seek guidance from financial advisors or experienced traders.

Vanguard Option Trading

Final Thoughts: Embracing the Power of Options with Vanguard

Options trading, when approached thoughtfully and with the right tools, can be a valuable addition to your investment strategy. Vanguard, with its commitment to transparency, education, and long-term investing, offers a solid foundation for your options trading journey.

Remember to start with foundational knowledge, gradually explore different strategies, and prioritize risk management. This journey of learning and applying knowledge can unlock the potential of options trading, empowering you to navigate the market with greater confidence and potentially achieve your financial goals.