Introduction

Are you a seasoned day trader looking to take your profits to the next level, or an eager beginner seeking to break into the exhilarating world of options trading? Whichever stage of your journey, selecting the ideal brokerage is paramount. In this comprehensive guide, we’ll delve into the intricate world of day trading options brokerages, empowering you with the knowledge and insights needed to make an informed decision.

Image: investgrail.com

Navigating the sea of online brokerages can be akin to sailing through a Venetian labyrinth. Factors to consider include trading fees, research tools, account minimums, and platform usability. In this article, we’ll unmask the mysteries and unveil the essential criteria for evaluating brokerage platforms, culminating in your discovery of the ultimate day trading haven.

Day Trading Options: An Overview

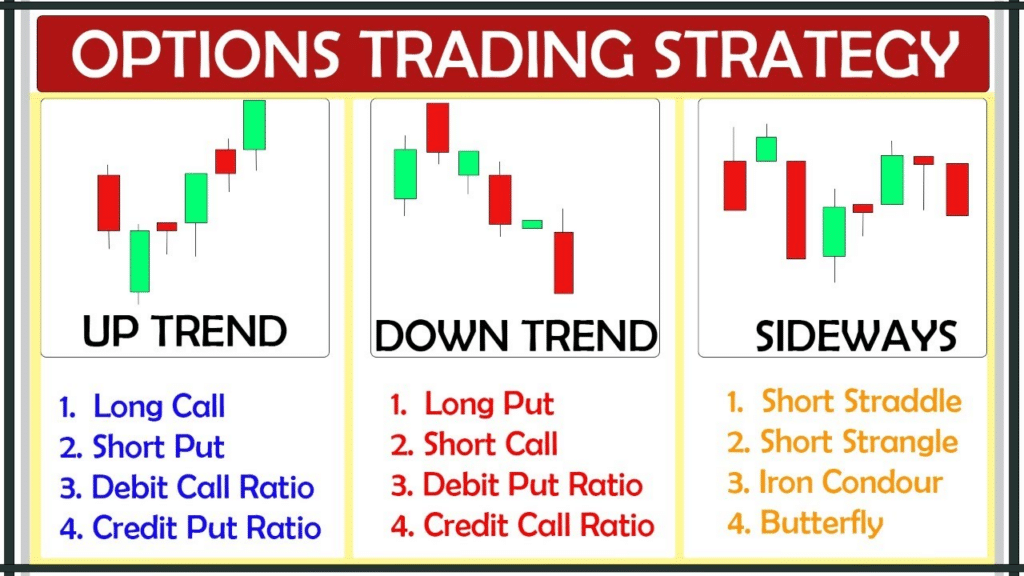

Options trading offers unique opportunities to speculate on market movements, with the potential to generate substantial returns. Day traders capitalize on price fluctuations within a single trading day, typically opening and closing positions within the same business hours to minimize risk and maximize profits.

While options trading presents ample rewards, it’s crucial to acknowledge the inherent risks involved. Thorough research, sound risk management strategies, and unwavering discipline are the pillars upon which successful day trading strategies are built. Our ultimate guide will furnish you with invaluable insights to navigate this complex landscape.

Essential Considerations for Day Trading Options Brokerage Selection

Platform Usability and Functionality

A user-friendly platform is the lifeblood of any successful day trader. Seek brokerages that offer intuitive interfaces, customizable charts, and seamless order execution. Consider the availability of features such as streaming quotes, advanced charting tools, and real-time market analysis to empower your trading decisions.

Image: www.stockbrokers.com

Fees and Commissions

Trading fees can significantly impact profitability, so scrutinize the commission structure of potential brokerages. Day traders should prioritize low per-contract fees and competitive margin rates. Additionally, research any hidden fees or charges that may erode your profits.

Research and Analysis Tools

In-depth market analysis is imperative for successful day trading. Look for brokerages that provide robust charting tools, economic calendars, and news feeds to stay abreast of market trends and identify trading opportunities.

Account Minimums and Leverage

Account minimums and leverage options vary across brokerages. Determine the minimum deposit required to open an account and the leverage ratios offered. Higher leverage can amplify both profits and losses, so use caution and consider your risk tolerance.

Customer Support and Education

Responsive and knowledgeable customer support is invaluable when navigating the fast-paced world of day trading. Ensure your chosen brokerage offers prompt assistance via multiple channels, including email, phone, and live chat. Additionally, seek brokerages that provide educational resources, webinars, and trading tutorials to enhance your knowledge and skills.

Expert Advice for Day Trading Options Brokerage Selection

Connect with experienced day traders, frequent forums and social media platforms to learn from their triumphs and tribulations. Seek recommendations for reputable brokerages that align with your trading needs and preferences.

Don’t hesitate to open demo accounts with multiple brokerages to test drive their platforms and evaluate their services firsthand. This practical approach allows you to experience the platforms’ usability, responsiveness, and overall functionality.

FAQs on Day Trading Options Brokerage Selection

- What is the best brokerage for beginner day traders?

- How much money do I need to start day trading options?

- What factors should I consider when selecting a day trading options brokerage?

- Can I day trade options with a small account?

- What is the best strategy for day trading options?

- Brokerages with low minimums, user-friendly platforms, and educational resources are recommended for beginners.

- Account minimums vary between brokerages, but it’s prudent to start with a substantial amount to accommodate market volatility and potential losses.

- Fees, platform usability, research tools, account minimums, leverage options, customer support, and educational resources are key considerations.

- Yes, some brokerages offer low account minimums, enabling traders to start with a smaller capital base.

- Successful day trading strategies vary based on individual risk tolerance and market conditions. Research, practice, and discipline are essential.

Best Brokerage For Day Trading Options

Conclusion

Choosing the ideal brokerage for day trading options is a pivotal decision that can significantly influence your trading results. In this comprehensive guide, we’ve delved into the intricate details of evaluating brokerage platforms, empowering you with the knowledge and expertise to make an informed choice.

We encourage you to engage with our community of day traders by sharing your experiences and insights below. Are you ready to embark on the exhilarating journey of day trading options? With the wealth of information and expert advice provided in this guide, you’re well-equipped to navigate the volatile market waters and emerge victorious.