In the ever-evolving realm of financial markets, options trading stands as a formidable force, offering traders the potential to magnify their profits while managing risk. Grasping the intricacies of options trading is paramount for unlocking this potential, particularly when it comes to understanding the average profit one can expect.

Image: www.tradingview.com

Before delving into the average profit, it’s imperative to understand the fundamentals of options trading. Options, in essence, are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price and time. This flexibility makes options trading a versatile tool for both risk management and profit generation. However, as with any investment, understanding the potential risks and rewards is essential.

Factors Influencing Options Profitability

The average profit from options trading is influenced by a multitude of factors, each playing a pivotal role in the outcome. These include:

Underlying Asset:

The underlying asset, whether a stock or an index, has a profound impact on the profitability of an options trade. Its price fluctuations, volatility, and overall market conditions can significantly influence the value of the option contract.

Option Type:

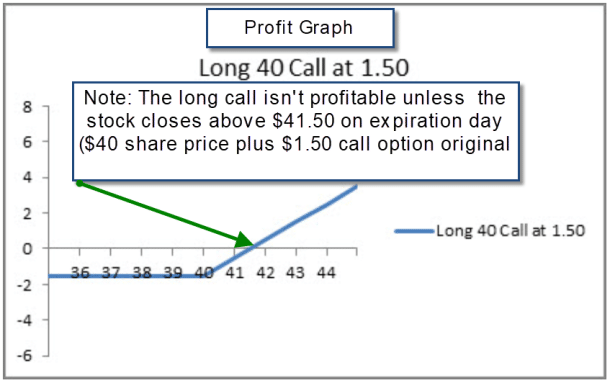

The type of option, whether call or put, determines the potential profit strategy. Call options benefit from rising asset prices, while put options thrive in falling markets.

Image: www.smbtraining.com

Strike Price:

The strike price, which represents the predetermined price at which the buyer can exercise the option, is crucial in determining the profit potential. At-the-money options (where the strike price equals the current asset price) offer balanced risk and reward, while in-the-money (strike price below the asset price) and out-of-the-money (strike price above the asset price) options provide varying degrees of risk and potential payoff.

Expiration Date:

The expiration date defines the finite period during which the option can be exercised. Time decay, which is the gradual loss of an option’s value as it nears expiration, affects the profit potential, especially for short-term options.

Volatility:

Market volatility, which measures the magnitude of price fluctuations, plays a crucial role in options pricing. Higher volatility increases the potential for substantial profits but also amplifies the risk.

Average Profit Range

The average profit from options trading can vary significantly depending on the factors discussed above. For instance, in relatively stable markets with moderate volatility, a profit range of 5-10% might be considered average. On the other hand, during periods of high volatility, savvy traders may achieve returns exceeding 20% or even more.

It’s important to note that these profit ranges are just averages, and individual traders may experience results that are either higher or lower. Managing expectations is crucial, as the inherent nature of options trading involves both the potential for significant gains and the risk of potential losses. Remember, past performance is not indicative of future success.

Strategies for Optimizing Profit

While understanding the average profit range is essential, traders seeking to enhance their profitability should adopt well-defined strategies to maximize their chances of success. These include:

1. Risk Management:

Devising a comprehensive risk management strategy is paramount. Define clear entry and exit points, set stop-loss and take-profit levels, and consider implementing hedging techniques to mitigate potential downside.

2. Market Analysis:

Thorough market analysis is the cornerstone of successful options trading. Identify long-term trends, assess volatility, and monitor key economic indicators to make informed decisions.

3. Options Pricing Models:

Leverage options pricing models, such as the Black-Scholes model, to estimate the fair value of options contracts and identify potential trading opportunities.

4. Simulation and Backtesting:

Utilize historical data to simulate trades and backtest strategies. This can provide valuable insights into potential profit outcomes under different market conditions.

5. Continuous Education:

The financial markets are constantly evolving, making continuous education essential for staying abreast of the latest trends and strategies. Attend seminars, read industry publications, and engage in online courses to enhance your understanding.

Average Profit From Options Trading

https://youtube.com/watch?v=IkGV8x5uz_A

Conclusion

While determining the exact average profit from options trading is a complex endeavor due to the multitude of factors involved, understanding the influential elements and adopting sound strategies can significantly improve the chances of profitability. Options trading presents traders with a unique opportunity for both risk management and profit generation. By embracing a proactive approach that combines risk management, market analysis, and continuous learning, traders can unlock the potential of this versatile financial instrument.

Remember, the path to success in options trading lies not solely in pursuing the average profit but in cultivating the knowledge, skills, and mindset necessary to navigate the complexities of financial markets. As you embark on this journey, may this article serve as a valuable guide, empowering you to make informed decisions and maximize your potential for success in the ever-evolving world of options trading.