Introduction

In the vibrant arena of financial markets, advanced trading strategies like 13 30 ave option trading have emerged as game-changers, unlocking the potential for substantial returns. For those seeking to amplify their investment prowess, mastering the intricacies of 13 30 ave option trading is key. This exclusive trading approach combines the power of stock investments with the leverage of options contracts, creating a robust and dynamic investment strategy that savvy traders leverage to enhance their financial portfolios.

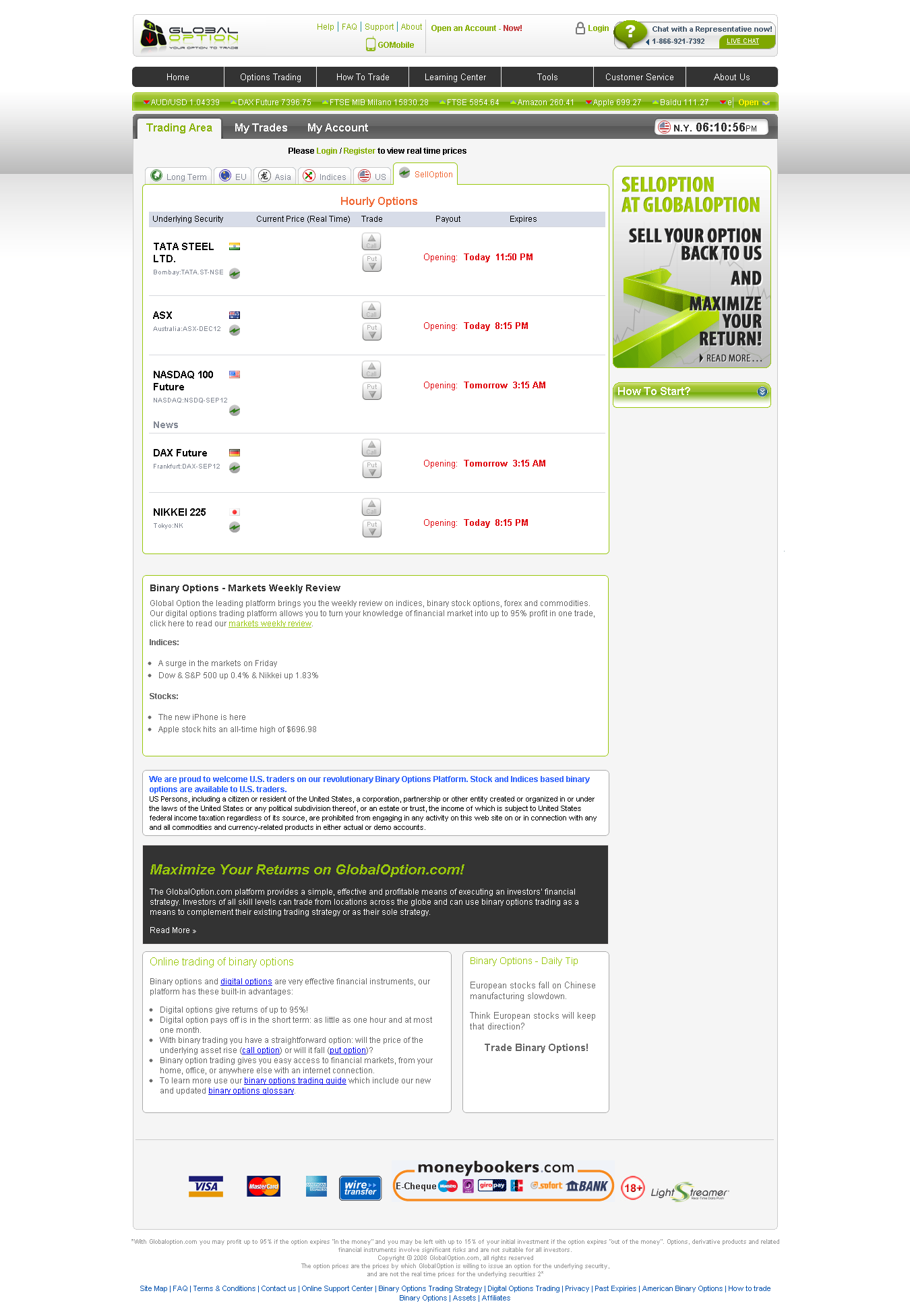

Image: www.binarytrading.com

As we delve into the captivating world of 13 30 ave option trading, we will illuminate its historical roots, explore its fundamental principles, and equip you with the insights necessary to implement this strategy effectively. By providing concrete examples, analyzing market trends, and sharing expert knowledge, this meticulously crafted guide will serve as your trusted companion as you embark on your journey towards becoming a proficient 13 30 ave option trader.

Unveiling the Essence of 13 30 Ave Option Trading

13 30 ave option trading, also known as the Andrew’s Pitchfork Indicator, is a sophisticated technical analysis tool employed by experienced traders to identify potential price movements and trading opportunities. This indicator comprises a trio of parallel trendlines: the median line, upper trendline, and lower trendline. These lines are meticulously drawn by utilizing three pivotal price points: the most recent high, the most recent low, and a third price point that establishes the pitchfork’s width.

The median line denotes the equilibrium between supply and demand, forming a crucial support and resistance level. The upper and lower trendlines, on the other hand, create boundaries within which price action tends to fluctuate. Traders may employ these trendlines to anticipate potential price reversals, breakouts, and continuation trends.

Navigating the Nuances of 13 30 Ave Option Trading

While the concept of 13 30 ave option trading may appear intricate, its implementation is surprisingly accessible. Options contracts are financial instruments that bestow upon the holder the privilege, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. By incorporating options contracts into their 13 30 ave trading strategy, traders gain flexibility and leverage, enhancing their potential for substantial returns.

Traders may adopt various approaches when engaging in 13 30 ave option trading, each tailored to their unique risk tolerance and investment objectives: buying a call option to wager on a stock’s appreciation, selling a put option to benefit from a stock’s decline, or implementing more complex strategies like the Iron Condor to profit from a stock’s range-bound movement. The possibilities are nearly limitless, offering traders the freedom to craft strategies that align with their individual goals.

Real-World Applications of 13 30 Ave Option Trading

To fully appreciate the utility of 13 30 ave option trading, let’s delve into a practical example. Consider a scenario where a trader anticipates a bullish trend in the tech giant Google (GOOGL). To capitalize on this forecast, the trader could purchase a call option for GOOGL, granting them the right to buy the stock at a predetermined price, say $100, before the option’s expiration date.

If Google’s share price rallies to $110 before expiration, the trader can exercise their call option and acquire the shares for $100, reaping a handsome profit of $10 per share. Alternatively, if the stock’s price falls below the strike price, the call option loses its value, and the trader forfeits their initial investment, providing a practical illustration of 13 30 ave option trading in action.

Image: optionsinvesting.co.uk

Evolving Trends and Innovations in 13 30 Ave Option Trading

The world of 13 30 ave option trading is constantly evolving, with the advent of technological advancements transforming the way traders analyze and execute trades. The emergence of cutting-edge trading platforms and sophisticated charting tools has paved the way for more refined analysis and more efficient order execution.

Moreover, the proliferation of educational resources and trading forums has empowered traders to augment their knowledge base and connect with like-minded individuals. These advancements continue to propel 13 30 ave option trading forward, enhancing its accessibility and effectiveness.

13 30 Ave Option Trading

Conclusion: Embracing the Power of 13 30 Ave Option Trading

As we reach the culmination of our exploration into the multifaceted world of 13 30 ave option trading, it is evident that this innovative approach can serve as a potent tool for traders seeking to unlock the full potential of their investments. By mastering the art of 13 30 ave option trading, you gain the ability to navigate market fluctuations with greater precision, seize profitable opportunities, and harness the power of leverage and flexibility.

Embrace the transformative potential of 13 30 ave option trading. Dedicate yourself to continuous learning, refining your strategies, and harnessing the latest market insights. The path towards maximizing your returns and becoming a successful 13 30 ave option trader lies before you – embark on it with conviction and excellence, and the rewards will be yours to reap.