In the realm of financial markets, the Fibonacci sequence, discovered by the Italian mathematician Leonardo Fibonacci, has emerged as a valuable tool for traders seeking to identify potential price movements. By applying Fibonacci principles to options trading, traders can gain insights into market cycles and optimize their trading strategies for enhanced returns.

Image: web-traderfx.blogspot.com

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding numbers. The sequence begins with 0 and 1, followed by 1, 2, 3, 5, 8, 13, 21, 34, and so on. Fibonacci ratios, derived from the sequence, are used to determine key levels of support and resistance in price movements.

Understanding Fibonacci Levels

Fibonacci levels are calculated using specific ratios within the sequence, such as 23.6%, 38.2%, 50%, 61.8%, and 100%. These ratios represent potential support or resistance points where price movements may encounter significant obstacles or find momentum to continue their trajectory.

For instance, a Fibonacci level of 23.6% indicates a potential support level where a price decline may pause or reverse. Conversely, a Fibonacci level of 61.8% signifies a potential resistance level where an uptrend may encounter challenges.

Fibonacci Trading for Options

Fibonacci ratios can be incorporated into options trading to identify target entry and exit points. Traders can use Fibonacci levels to:

• Establish price targets for option purchases

• Determine potential areas of profit taking

• Identify potential stop-loss levels

Latest Developments in Fibonacci Trading

Recent advancements in technology and data analysis have enhanced the application of Fibonacci principles in options trading. Fibonacci retracement indicators are now available on most trading platforms, providing traders with automated calculations of Fibonacci levels for a given security.

Social media platforms and forums also facilitate the sharing of Fibonacci-based trading strategies among traders, enabling them to learn from and collaborate with others using Fibonacci analysis.

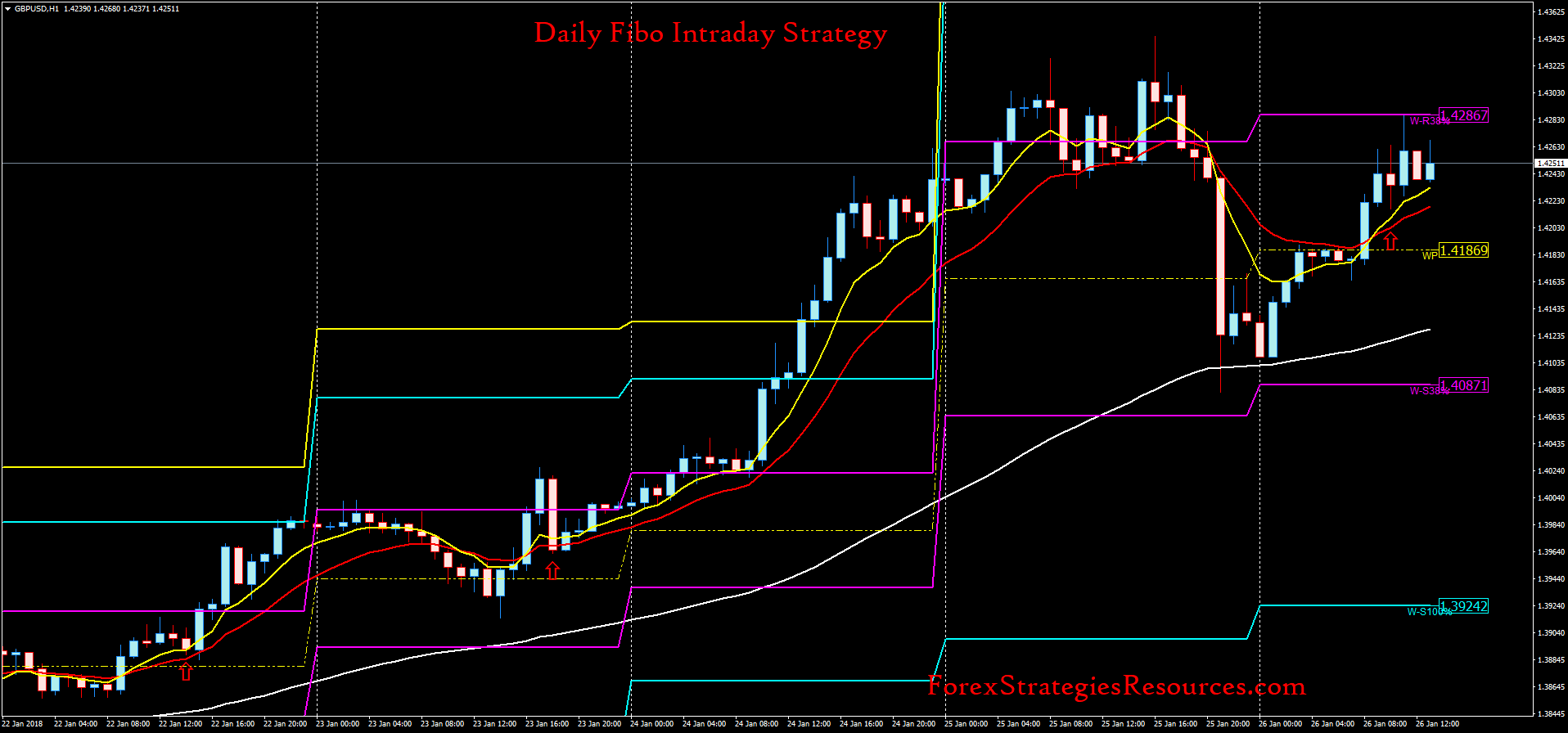

Image: www.forexstrategiesresources.com

Tips and Expert Advice for Fibonacci Trading Options

To enhance your Fibonacci trading strategies for options, consider the following tips:

• Confirm Fibonacci levels with other technical indicators

• Use Fibonacci price extensions to identify potential target levels

• Adjust Fibonacci levels based on market volatility

Expert Insights

Renowned options trader and Fibonacci enthusiast, James Stanley, emphasizes the importance of integrating Fibonacci analysis with other technical tools for comprehensive market evaluation. He suggests combining Fibonacci levels with price action readings and volume data for more reliable trading signals.

“Fibonacci can be a powerful tool, but it’s not a magic bullet,” says Stanley. “It’s essential to approach Fibonacci trading with an open mind and a data-driven approach.”

FAQ on Fibonacci Trading Options

Q: What is the best Fibonacci ratio for options trading?

A: The most widely used Fibonacci ratios for options trading are 38.2%, 50%, and 61.8%.

Q: How can I identify potential price reversal points using Fibonacci?

A: Look for price action near key Fibonacci levels, such as 23.6%, 38.2%, or 61.8%. A sharp reversal from these levels can indicate a potential price reversal point.

Q: Is Fibonacci analysis suitable for all markets?

A: Fibonacci principles can be applied to most financial markets, including stocks, Forex, and commodities.

‘ Fibo Trading Options

Conclusion

Fibonacci trading offers a powerful framework for options traders to enhance their trading strategies and capitalize on market movements. By understanding Fibonacci levels, incorporating them into trading decisions, and applying expert insights, traders can gain an advantage in navigating market fluctuations and maximizing returns.

So, are you ready to explore the world of Fibonacci trading options and elevate your trading game? Start researching, practicing, and embracing the insights provided in this article to take your options trading to the next level!