In the fast-paced world of finance, timing is everything. And nowhere is that more true than in the realm of option trading.

Image: www.projectfinance.com

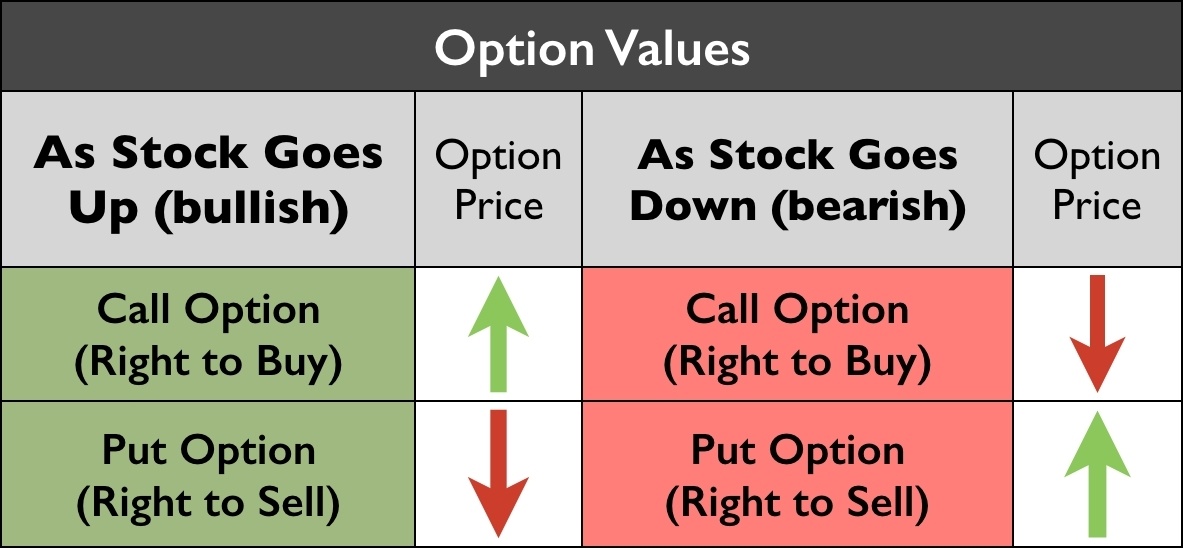

Options, which give traders the right to buy or sell an underlying asset at a certain price within a set timeframe, have become increasingly popular as a way to hedge risk and potentially generate significant returns. But with great opportunity comes great responsibility – and knowing when option trading closes is crucial for making informed decisions and managing risk effectively.

So, When Exactly Does Option Trading Close?

In the United States, the primary exchange for option trading is the Cboe Options Exchange (CBOE). The CBOE operates regular trading hours from 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday. However, certain option classes may have extended trading hours, allowing traders to enter or exit positions beyond the regular session.

For instance, CBOE-listed SPX options, which track the performance of the S&P 500 index, trade from 9:15 AM to 4:15 PM ET. Additionally, some exchanges offer after-hours trading sessions, enabling traders to execute trades outside of regular market hours.

Markets Beyond US Borders

It’s important to note that option trading hours can vary across different exchanges and jurisdictions. For example, the London Stock Exchange (LSE) hosts option trading from 8:00 AM to 4:30 PM Greenwich Mean Time (GMT). The Tokyo Stock Exchange (TSE) offers option trading from 9:00 AM to 3:00 PM Japan Standard Time (JST).

Understanding the specific trading hours for the exchanges where you intend to trade is essential for planning your trading strategy and managing risk. Failure to do so could lead to missed opportunities or unexpected losses.

The Impact of Market Closures

The closing time of option trading has several implications for traders:

- Order Execution: Orders placed after trading hours will not be executed until the following trading day.

- Volatility: Trading volume tends to decrease towards the end of the trading session, which can result in increased volatility and wider bid-ask spreads.

- Time Decay: Options lose intrinsic value over time, a process known as time decay. The closer an option gets to expiration, the faster its time decay accelerates.

Traders need to consider these factors when managing their positions as the trading session draws to a close.

Image: tradesmartu.com

The Importance of Post-Trading Activity

While trading may cease at the end of regular hours, post-trading activity can still impact option prices and positions. News, economic data releases, and other market events that occur after trading hours can cause significant price movements when the market opens the following day.

Staying informed about post-trading events and their potential implications is critical for traders looking to make informed decisions.

When Does Option Trading Close

Navigating Option Trading Time Frames

In summary, knowing when option trading closes is crucial for successful option trading. Exchanges have specific trading hours that vary depending on their location and the option class. Traders need to understand these hours to ensure timely order execution and manage risk effectively.

Traders must also account for the impact of market closures, including decreased trading volume, increased volatility, and accelerated time decay. Additionally, paying attention to post-trading activity and its potential impact on option values can help traders make informed decisions and stay ahead of market movements.

By understanding the nuances of option trading hours, traders can navigate the financial markets more confidently, make sound decisions, and maximize their trading potential.