For seasoned investors seeking profitable opportunities in the volatile options market, “Turtle Trading Options” emerges as a compelling strategy with a time-tested track record of success. Inspired by the legendary Turtle Traders who famously dominated financial markets in the 1980s, this approach empowers traders with a robust framework for navigating even the most turbulent market conditions.

Image: www.asktraders.com

Driven by a set of clearly defined rules and disciplined market observations, Turtle Trading Options offers a structured approach to options trading. This methodology enables traders to identify high-probability trades with favorable risk-to-reward ratios, increasing their chances of consistent profitability.

Defining the Turtles’ Approach to Options

Rule-Based Methodology

At the core of Turtle Trading Options lies a meticulous set of rules that guide trading decisions. These rules, derived from extensive historical market data analysis, provide traders with a clear roadmap for evaluating market trends, identifying potential trading opportunities, and managing their investments.

Focus on Trend Following

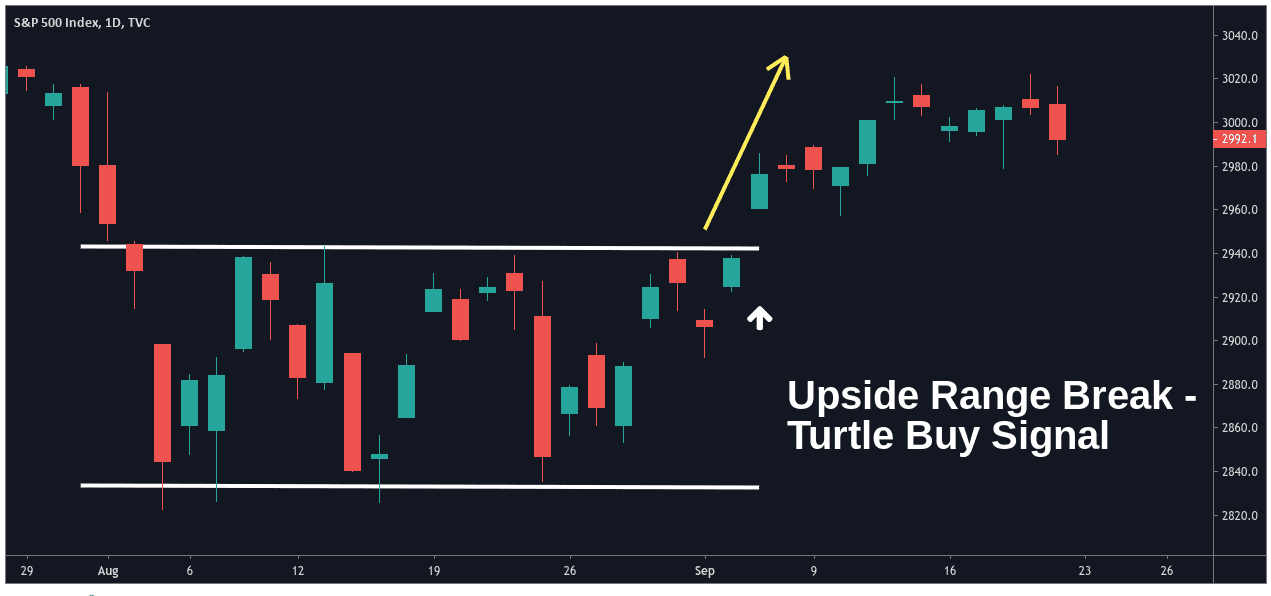

Turtle Traders believe that recognizing and capitalizing on prevailing market trends is critical to achieving success in the options market. They use a combination of technical indicators and trend analysis techniques to identify and trade in the direction of the underlying asset’s price movements.

Image: tradingtuitions.com

Risk and Position Management

Turtle Trading Options emphasizes the importance of managing risk and maintaining disciplined position sizing. Traders are taught to determine the optimal strike prices, option types, and position sizes for each trade, ensuring a well-rounded approach to capital management.

Trading Psychology

Just as crucial as technical analysis and risk management is the mindset and emotional control that Turtle Traders cultivate. They recognize the psychological challenges associated with trading and emphasize the need for emotional detachment, discipline, and a risk-tolerant mindset.

The Evolution of Turtle Trading Options

Since its inception, Turtle Trading Options has undergone several refinements and adaptations to keep pace with the evolving options market. New technical indicators, advanced charting techniques, and improved order execution systems have been incorporated into the Turtle Trading framework.

Additionally, many modern Turtle Traders have expanded their focus beyond the traditional S&P 500 index to include various asset classes, such as currencies, commodities, and emerging markets. This diversification allows them to capture trading opportunities across a broader range of financial instruments.

Tips and Expert Advice for Turtle Traders

Balancing Discipline and Adaptability

While Turtle Trading Options is rooted in a set of defined rules, successful traders recognize the importance of adapting to changing market conditions. They continuously refine their rules based on their observations and experience, while maintaining the core principles of the strategy.

Patience and Discipline

Turtle Trading Options is not a get-rich-quick scheme. It requires patience, discipline, and a willingness to stick to the rules even during periods of market volatility. By maintaining focus on the long-term goals and avoiding emotional decision-making, traders can increase their chances of achieving consistent profitability.

Frequently Asked Questions About Turtle Trading Options

- Q: Is Turtle Trading Options a suitable strategy for all traders?

- A: While the principles of Turtle Trading Options can be applied by any trader, it is best suited for those with a disciplined demeanor, a tolerance for risk, and a willingness to commit the necessary time and effort.

- Q: How much capital is required to start Turtle Trading Options?

- A: While the exact capital requirement varies based on the broker and trading plan, it is generally recommended to have sufficient capital to withstand drawdowns and to allow for multiple trades.

- Q: Can Turtle Trading Options be used to trade in any market?

- A: The principles of Turtle Trading Options can be applied to any liquid market with tradable options, including stocks, indices, currencies, and commodities.

- Q: What are the key challenges of Turtle Trading Options?

- A: The main challenges include identifying and trading in the direction of prevailing market trends, managing risk and emotions, and maintaining the discipline to follow the rules of the strategy.

- Q: Are there any resources available to learn Turtle Trading Options?

- A: Yes, numerous books, online courses, and workshops are available that provide comprehensive training on the Turtle Trading Options methodology.

Turtle Trading Options

Conclusion

Turtle Trading Options remains a powerful and effective strategy for options traders seeking consistent profitability in the ever-changing financial markets. By following its time-tested rules and adopting the recommended tips and advice, traders can enhance their chances of success in this challenging yet rewarding field.

Are you interested in learning more about Turtle Trading Options and how you can apply it to your own trading journey? If so, I encourage you to explore the wealth of information and resources available. Connect with experienced Turtle Traders, join trading forums, and immerse yourself in the world of options trading to gain the knowledge and confidence necessary to navigate the markets like a pro.