In the bustling marketplace of finance, where traders seek to outmaneuver each other, options trading stands as an art of its own. Among the many instruments at their disposal, put options offer a unique opportunity to profit from bearish market sentiments. But navigating the complexities of put options can be likened to threading a labyrinth, and only those with a keen understanding of their dynamics can emerge victorious.

Image: tradewithmarketmoves.com

Embarking on this journey, I realized the need for a comprehensive guide that unravels the intricacies of put options. This article aims to serve as a beacon of knowledge for seasoned traders, providing them with a roadmap to explore the nuances of this financial instrument.

Trading the Nuances of Put Options

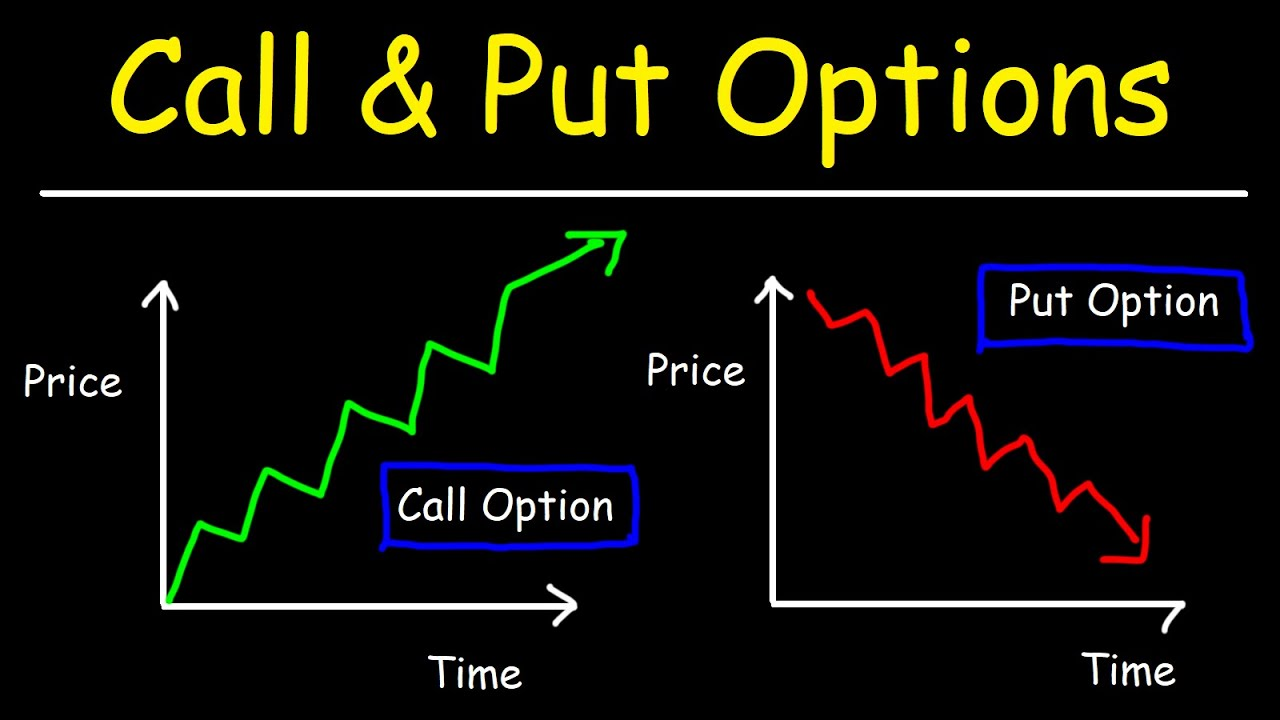

A put option grants the buyer the right, but not the obligation, to sell an underlying asset at a predetermined price, known as the strike price, on or before a specified expiration date. By purchasing a put option, the buyer is essentially betting that the underlying asset’s price will fall below the strike price by the expiration date.

Unlike call options, which confer the right to buy an asset, put options provide a cushion against potential financial losses. When market conditions turn unfavorable, the value of put options generally increases, offering protection against declining asset prices. This makes put options an invaluable tool in the arsenal of savvy traders who seek to safeguard their portfolios.

Anatomy of a Put Option

Understanding the anatomy of a put option is paramount to successful trading. Key elements to consider include:

- Underlying asset: The security or commodity that the put option is based on (e.g., stocks, bonds, indices)

- Strike price: The price at which the buyer can sell the underlying asset

- Expiration date: The date on which the put option expires and becomes worthless

- Premium: The price paid by the buyer to acquire the put option

Decoding the Dynamics of Put Options

The interplay of time and price fluctuations greatly influences the value of put options. As the expiration date approaches, the time value of the put option decays, reducing its price. Concurrently, the intrinsic value of the put option, which represents the difference between the strike price and the current market price of the underlying asset, can increase or decrease depending on market conditions.

Profiting from put options requires a deep understanding of these dynamics and an ability to predict market movements accurately. Successful traders often employ strategies such as hedging to offset potential losses and maximizing profits when the market takes a downturn.

Image: www.warriortrading.com

Expert Insights and Practical Tips

Seasoned traders impart invaluable insights into navigating the complexities of put options. Here are a few time-tested tips to guide your trading decisions:

- Consider the market outlook: Assess economic conditions, industry trends, and geopolitical events to gauge the likelihood of a price decline in the underlying asset.

- Set realistic strike prices: Choose strike prices that are within a plausible range of market fluctuations, balancing risk and potential reward.

- Monitor intrinsic value: Keep a close eye on the intrinsic value of the put option, as it provides insights into the potential profit or loss.

- Use leverage prudently: Leverage can amplify gains but also magnify losses. Use it cautiously and only when you fully comprehend the risks involved.

Frequently Asked Questions on Put Options

To further enhance your understanding, here are answers to some common questions regarding put options:

- Q: What are the benefits of using put options?

A: Put options offer protection against falling market prices, provide leverage, and can be used to hedge against risk. - Q: What are the risks associated with put options?

A: The primary risk is the loss of the premium paid for the put option if the market moves favorably. - Q: How do I determine the right strike price for a put option?

A: Consider the volatility of the underlying asset, the time to expiration, and your risk tolerance.

Trading A Put Option

Conclusion

Trading put options can be an effective way to capitalize on bearish market conditions and protect against losses. However, it is crucial to approach this endeavor with a thorough understanding of the financial instruments involved and a keen awareness of market dynamics.

By embracing the insights and tips outlined in this article, you can develop a refined strategy for trading put options. Are you ready to delve into the intricate world of options trading and explore the opportunities that await?