A Personal Journey into the World of Palantir Options

Greetings, fellow traders! My foray into the enigmatic realm of Palantir option trading was a fortuitous one. It all began with a captivating interview with a Palantir executive, where I gained invaluable insights into the company’s groundbreaking technology and ambitious vision. Intrigued, I embarked on a meticulous exploration of Palantir options, determined to unravel their intricacies and maximize my trading potential. Join me as I share my hard-earned knowledge, guiding you through the labyrinthine landscape of Palantir options.

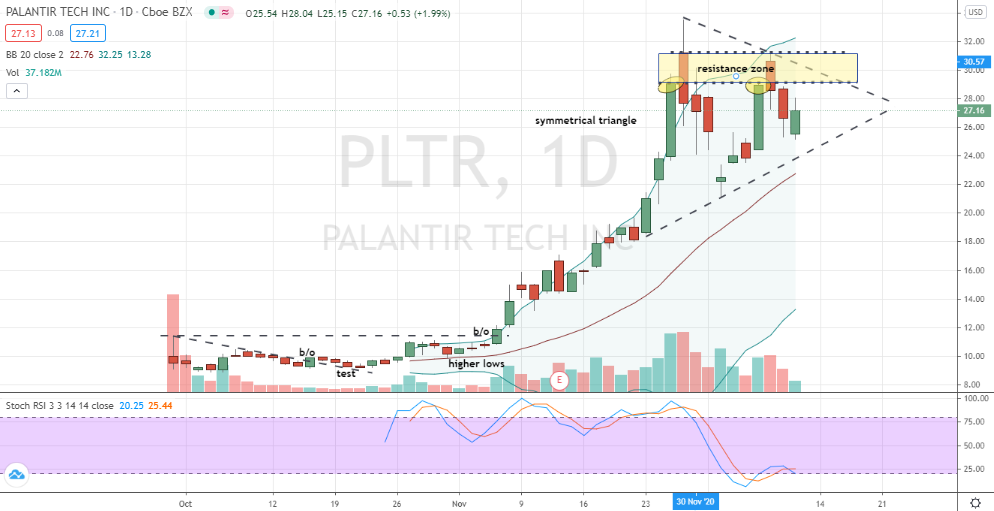

Image: www.tradingview.com

Palantir: A Technological Powerhouse

Palantir Technologies, a global leader in software development, has captivated the tech industry with its unparalleled data analytics and integration solutions. The company’s flagship software suite, Palantir Gotham, is a force multiplier for intelligence agencies, law enforcement, and defense organizations around the globe. Palantir Foundry, tailored for the commercial sector, empowers businesses to harness their data and derive actionable insights. As Palantir’s dominance in this rapidly evolving field continues to grow, so too do the opportunities for astute option traders.

Understanding Palantir Options: A Fundamental Overview

An option is a derivative contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specified date (expiration date). In the context of Palantir option trading, the underlying asset is Palantir’s common stock (PLTR). By leveraging options, traders can speculate on the future price of PLTR and position themselves to profit from potential price movements.

Unlocking the Nuances of Palantir Option Trading

To navigate the complexities of Palantir option trading, a deep understanding of option pricing and hedging strategies is paramount.

Image: investorplace.com

Pricing Factors

The price of an option is influenced by several key factors, including the current price of PLTR, the strike price, the time to expiration, and implied volatility. Implied volatility, in particular, plays a crucial role in determining option premiums. Traders must carefully consider these variables when assessing potential trades.

Hedging Strategies

Hedging is a risk management technique employed to mitigate portfolio losses. A common approach in Palantir option trading involves selling out-of-the-money (OTM) calls against shares held in a long position. This strategy generates premium income while capping upside potential. Conversely, selling OTM puts can protect against downside risk.

Insights and Expert Advice: Mastering Palantir Options Trading

Navigating the volatile waters of Palantir option trading requires a combination of technical prowess and a collaborative mindset. Here are some insightful tips from industry experts to enhance your trading performance:

Follow the News and Industry Updates

Staying abreast of the latest news and developments surrounding Palantir is crucial. Monitor press releases, company statements, earnings reports, and industry forums to gather timely information that could impact PLTR’s performance.

Utilize Options Analysis Tools

A plethora of online tools and platforms offer comprehensive option analysis capabilities. These tools provide invaluable insights into historical data, volatility charts, and option pricing models. Leverage these resources to make informed trading decisions.

Frequently Asked Questions (FAQs) on Palantir Option Trading

Q: How do I start trading Palantir options?

A: To trade Palantir options, you will need an account with a brokerage firm that offers options trading services.

Q: What is a premium in the context of options trading?

A: A premium is the price paid by the option buyer to the option seller for the right to buy or sell the underlying asset.

Q: How long do Palantir options contracts last?

A: Palantir options typically expire on the third Friday of the month.

Palantir Option Trading

Conclusion: Embracing the Power of Palantir Options

Palantir option trading presents a unique opportunity to harness the power of Palantir’s transformative technology and potentially profit from market fluctuations. By delving into the intricacies of option pricing, hedging strategies, and market insights, traders can navigate this dynamic landscape with confidence.

I encourage you to continue exploring the intriguing world of Palantir option trading. The knowledge and experience you acquire will empower you to make informed trading decisions and unlock the full potential of this exciting market. Are you ready to embark on this trading journey? Join the ranks of successful Palantir options traders by embracing the insights and strategies outlined in this comprehensive guide.