Have you ever dreamt of harnessing the power of options to elevate your investment game? It’s a powerful tool, but navigating the complex world of options trading can feel daunting, especially for beginners. The good news? The right options trading software can be your ultimate ally, empowering you with insights and tools to make informed decisions and unlock greater potential. But with so many options on the market, choosing the best software for your needs can be overwhelming. This guide will be your trusted companion, providing a comprehensive overview of the best options trading software available, helping you find the perfect partner on your options trading journey.

Image: www.youtube.com

The world of options trading, often described as a “derivatives market,” involves contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. It’s a powerful tool for investors looking to enhance returns, manage risks, or simply gain more control over their portfolios. Options trading isn’t for the faint of heart, though. It requires a solid understanding of market dynamics, a strategic approach, and the right tools to navigate its complexities. Enter options trading software: your digital arsenal for success.

Unleashing the Power of Options Trading Software:

Think of options trading software as your personalized trading assistant, a dedicated tool offering a plethora of features designed to simplify and enhance your trading experience. From charting tools and analysis capabilities to real-time market data and order execution, these platforms are designed to give you a competitive edge.

Top Contenders: Unveiling the Best Options Trading Software:

Just like any investment decision, selecting the right options trading software requires careful consideration. It’s not just about finding the most popular software, but about evaluating what features resonate most with your specific needs and trading style. Here’s a breakdown of some of the top contenders, highlighting their strengths and unique features:

1. TradeStation: A Powerhouse for Experienced Traders

TradeStation is a favorite amongst experienced traders who crave advanced charting functionalities, real-time market analysis, and an array of customizable tools. It’s known for its impressive backtesting capabilities, allowing you to rigorously evaluate different strategies before committing real capital.

Strengths:

- Robust charting tools: TradeStation offers a wide range of charting indicators, overlays, and analysis tools, making it a dream come true for technical traders.

- Backtesting for strategy refinement: It’s a powerful tool for testing your strategies, allowing you to refine your approach and identify optimal trade entries and exits.

- Extensive research and data: Access to real-time market data, news feeds, and comprehensive market analysis tools.

Drawback:

- Steep learning curve: TradeStation’s advanced features can be intimidating for beginners, demanding some dedication to master its intricacies.

Image: www.techyv.com

2. Thinkorswim: The Intriguing Choice for Beginners and Pros Alike

Thinkorswim, owned by TD Ameritrade, consistently ranks among the best options trading platforms, attracting both novice and experienced traders. It’s a platform celebrated for its user-friendly interface, comprehensive educational resources, and the renowned “PaperTrader” feature. PaperTrader lets you simulate trades in a risk-free environment, building your confidence before entering the real market.

Strengths:

- Intuitive and streamlined interface: Thinkorswim is designed with user-friendliness in mind, making it a great starting point for beginners.

- PaperTrader for risk-free practice: Simulate trades in a virtual environment, allowing you to hone your strategies without putting real capital at risk.

- Powerful charting tools and research: Access to extensive charting features, market analysis tools, and real-time news feeds.

Drawback:

- Limited advanced options features: Though powerful, Thinkorswim’s advanced options features might not match the sophistication of platforms like TradeStation.

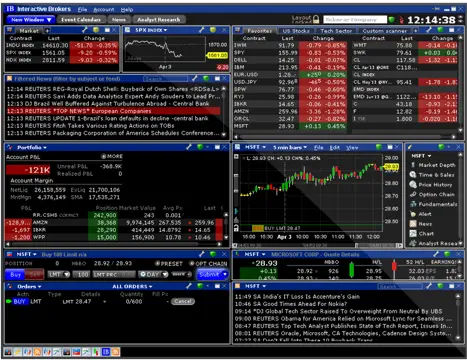

3. Interactive Brokers: A Global Giant for Professional Traders

Interactive Brokers (IBKR) is a global powerhouse, particularly popular among experienced traders, hedge funds, and other high-volume traders. Their platform boasts a wide range of order types, access to global markets, and low trading commissions, making it a preferred choice for professionals.

Strengths:

- Low commissions and fees: IBKR is known for its competitive pricing structure, particularly enticing for high-frequency and professional traders.

- Global market access: Trade assets across a wide range of global markets, including stocks, options, futures, and more.

- Powerful multi-platform trading: Access to their platform through multiple devices, seamlessly managing your trades from your computer, mobile device, or tablet.

Drawback:

- Steep learning curve: IBKR’s advanced features and diverse functionality can require significant time and effort to master.

4. Webull: A Modern Platform for Mobile-First Traders

Webull, a rapidly growing name in the trading platform world, offers a user-centric approach, particularly appealing to younger investors. It prioritizes mobile trading and features a sleek and modern design with easy navigation. Its intuitive interface and focus on key features make it accessible to a wider range of traders.

Strengths:

- Mobile-first design: Designed for seamless trading on your smartphone or tablet, making it a great choice for those on the go.

- Commission-free trades: Webull offers commission-free stock and options trading, making it a truly cost-effective platform.

- Paper and fractional shares: Allows you to “practice” with paper trading and invest in fractional shares of high-value companies, making investing more accessible.

Drawback:

- Limited advanced options features: Webull’s focus on a seamless mobile experience means it might not offer the same level of advanced options features as other platforms.

Expert Insights and Actionable Tips:

From the experts:

“The key to choosing the right options trading software is to find the right balance between simplicity and sophistication. Don’t be daunted by a platform with advanced features, but make sure you have the tools you need to execute your strategies effectively,” advises seasoned options trader Michael F. “Remember, the best software is one that empowers you to understand the market, manage your risks, and achieve your investment goals.”

Actionable advice:

- Define your needs: Before you start your search, think about what you want from options trading software. Are you a beginner looking for a user-friendly interface, or an experienced trader seeking advanced tools?

- Try before you buy: Most platforms offer free trials or demo accounts. Take advantage of these to explore the platform’s features and ensure it aligns with your trading style.

- Consider the costs: Evaluate trading commissions, fees, and data subscription costs for a clear understanding of the overall costs associated with each platform.

- Customer support matters: Look for platforms with responsive customer support, especially if you’re a beginner who might need assistance navigating the platform.

Best Options Trading Software

Conclusion:

Empowering yourself with the best options trading software is crucial to navigating the complex world of options. Your choice should mirror your experience level, trading style, and goals. The right software can be your trusted partner, providing the tools, insights, and resources to enhance your trading journey and unlock your potential. Take the time to explore different platforms, leverage free trials or demo accounts, and choose a software that speaks to your needs. As you embark on this exciting journey, remember: informed decisions and a well-equipped arsenal are the foundation of success in the dynamic realm of options trading.