Are you ready to enter the exciting world of options trading? With the potential for high returns comes the need for a reliable and powerful broker that can handle your trades with precision and efficiency. Navigating the vast landscape of brokerages can feel overwhelming, especially for beginners. But fear not! This comprehensive guide will walk you through the key considerations when choosing the best brokerage for your options trading journey.

Image: www.hustlermoneyblog.com

Options trading, a complex financial instrument, offers unique advantages like leverage and flexibility. However, choosing the right brokerage platform becomes crucial to maximize profits and manage risks effectively. This guide will decipher the intricacies of options trading and explore what makes a brokerage truly stand out, empowering you to make an informed decision.

Understanding the World of Options Trading

The financial world offers a wide range of trading instruments, but options stand out for their ability to amplify potential returns and manage risk. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset (like a stock) at a specific price, known as the strike price, on or before a specific date (expiration date).

Here’s a simple breakdown:

Types of Options

- Calls: Give the buyer the right to buy the underlying asset at the strike price. They benefit when the price of the underlying asset goes up.

- Puts: Give the buyer the right to sell the underlying asset at the strike price. They benefit when the price of the underlying asset goes down.

Key Advantages of Options Trading

Options trading offers several benefits over traditional stock trading:

- Leverage: Options offer a way to control a large amount of stock with a much smaller investment. A single contract can represent 100 shares of stock, allowing for significant profits with a small capital outlay.

- Flexibility: Options provide a wide range of strategies to suit different risk appetites and market outlooks. You can profit from both rising and falling markets, making them a versatile tool.

- Risk Management: Options can be used to hedge existing positions, limit potential losses, and define the maximum risk you are willing to take.

Image: www.interactivebrokers.com

Navigating the Challenges of Options Trading

While options trading offers tremendous potential, it also comes with inherent risks:

- Complexity: Options contracts have numerous variables, like strike price, expiration date, and underlying asset value, making them more complex to understand and trade than stocks.

- Time Decay: Options lose value as their expiration date approaches, known as “time decay.” This phenomenon needs careful consideration when choosing an option strategy.

- Potential for Loss: While offering the possibility of high returns, options trading can also result in substantial losses, especially for novice traders. A deep understanding of the risks involved is crucial.

Choosing the Right Brokerage for Options Trading

With its unique complexities, choosing the right brokerage for options trading is essential. Consider the following factors:

1. Platform and Tools

- User-Friendly Interface: Look for a platform that’s intuitive, easy to navigate, and offers a streamlined trading experience. Avoid platforms that are cluttered or too complex, especially if you are a beginner.

- Advanced Tools: Experienced traders benefit from sophisticated tools like real-time quotes, charting capabilities, backtesting tools, and order types, such as limit orders and stop-loss orders, to manage risk.

- Mobile App: A robust mobile app ensures you can monitor your trades and make adjustments on the go, providing flexibility and convenience.

2. Account Types and Fees

- Options Trading Accounts: Ensure the brokerage offers specific accounts designed for options trading. These accounts often come with advanced tools, research resources, and educational materials.

- Commissions and Fees: Compare commission structures, like per-contract fees or flat-fee options, and identify whether there are any hidden fees or monthly account maintenance charges.

- Minimum Account Balance: Some brokerages require a minimum account balance to open an options trading account. Compare these requirements to ensure they align with your financial capacity.

3. Research and Education

- Real-Time Data and News: Access to real-time market data, financial news, and expert analysis is vital for making informed trading decisions. Look for brokerages that provide in-depth research resources.

- Educational Resources: Check if the brokerage offers comprehensive educational materials, like webinars, tutorials, and articles, to help you understand the complexities of options trading and build your skills.

- Customer Support: Reliable customer support is essential, especially for beginners. Seek a brokerage with responsive customer support channels, including phone, email, and live chat, to address any questions or concerns you may have.

4. Security and Reliability

- Regulation and Security: Choose a brokerage regulated by reputable authorities like the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). This ensures your funds are protected and the brokerage operates ethically.

- Encryption and Security Measures: Verify the brokerage implements robust security measures like encryption, multi-factor authentication, and fraud detection systems to safeguard your information and assets.

- Reputation and Reviews: Review the brokerage’s reputation and customer reviews online. Websites like Trustpilot, BrokerChooser, and Investopedia provide insights from other traders about their experiences.

Examples of Top Brokerages for Options Trading

To give you a head start, here are some of the top-rated brokerages that excel in options trading:

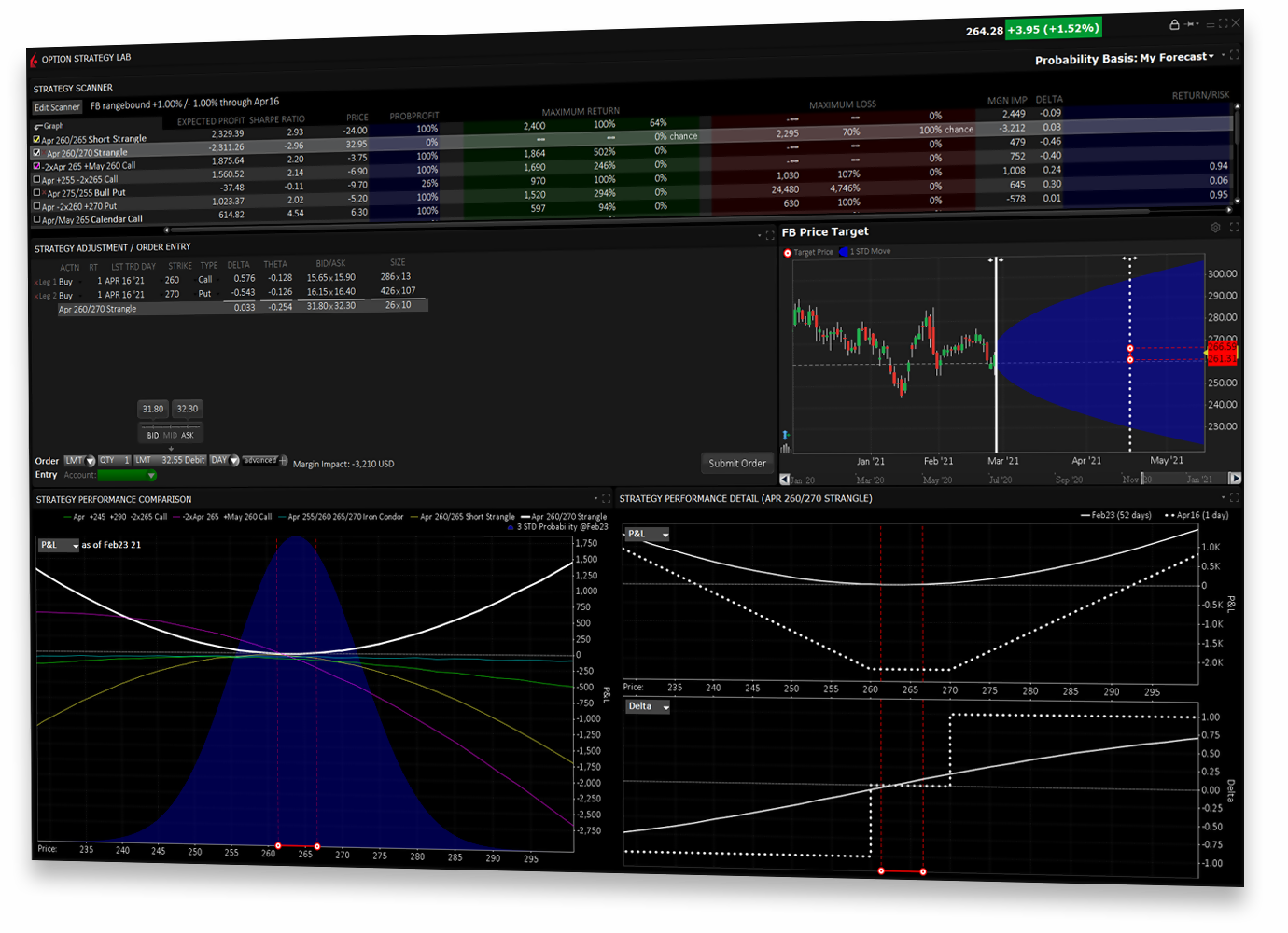

- TD Ameritrade: Popular for its robust platform, Thinkorswim, with advanced trading tools, real-time data, and educational resources. It offers commission-free trades for stocks and ETFs, making it an attractive option for active traders.

- Interactive Brokers: Known for its deep liquidity, low commission fees, and advanced trading platform. It caters to seasoned traders and institutions with a wide range of order types and sophisticated analytical tools.

- Fidelity: Renowned for its user-friendly platform and extensive research resources. It provides commission-free trades for stocks and ETFs and boasts a solid reputation for reliable customer support.

- E*TRADE: Offers a straightforward trading platform with comprehensive educational materials and a user-friendly mobile app. It’s a good choice for beginners looking for an intuitive and accessible platform.

- Robinhood: Gained popularity for its commission-free trades, simple platform, and mobile-first approach. While suitable for stock trading, it’s worth noting that its options trading tools may not be as comprehensive as other brokerages on this list.

- Webull: Similar to Robinhood, Webull offers commission-free stock and ETF trades with a user-friendly interface and fractional shares. It’s a suitable choice for beginners with a small investment capital.

Tips for Success in Options Trading

Once you’ve chosen a reputable brokerage, here are some tips to enhance your success in options trading:

- Start with Education: Before diving into options trading, invest time in learning the basics. Educational resources from your chosen brokerage, online courses, books, and reputable websites can provide a strong foundation.

- Practice with a Demo Account: Most brokerages offer demo accounts that simulate real-time trading environments. Use this valuable tool to experiment with different strategies and understand how options contracts behave without risking real money.

- Start Small: Begin with a small investment amount and gradually increase your exposure as you gain experience and confidence. This helps manage risk and minimize potential losses.

- Define Your Risk Tolerance: Understand your capacity for risk and set clear guidelines for how much you are willing to lose. Utilize risk management strategies like stop-loss orders to limit potential losses.

- Develop a Trading Plan: Having a well-defined plan is crucial. Decide on your trading objectives, risk management strategy, and entry and exit points for each trade. Stick to your plan to avoid impulsive decisions and emotional trading.

- Monitor Your Trades Regularly: Keep track of your trades, analyze their outcomes, and learn from both successes and failures. This helps you refine your strategies and adapt to changing market conditions.

Best Brokerage For Trading Options

Conclusion

Choosing the right brokerage is a critical step in your options trading journey. By considering factors like platform features, account types, fees, research resources, and security, you can find a broker that empowers you to trade with confidence and achieve your financial goals. Remember to prioritize your education, practice with a demo account, start small, define your risk tolerance, and develop a trading plan to maximize your chances of success in this dynamic and potentially lucrative financial market.