A Personal Journey into the World of Options

I vividly recall my initial forays into the world of options trading, a complex and exhilarating financial landscape. The allure of potentially exponential returns was both intoxicating and daunting. However, I soon discovered that navigating the intricacies of options markets requires meticulous research, astute decision-making, and a healthy dose of risk tolerance.

Image: mimevagebasoh.web.fc2.com

Through countless hours of studying market dynamics, poring over charts, and engaging with seasoned traders, I gradually gained a deeper understanding of options strategies and their applications. I embraced the thrill of calculated risk, recognizing its potential to magnify both gains and losses. The world of options trading became an obsession, a continuous pursuit of knowledge and self-improvement.

Unveiling the Nuances of Option Trading

Definition and History: Option trading involves contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predefined period. This unique financial instrument has a rich history dating back centuries, tracing its origins to the 17th century.

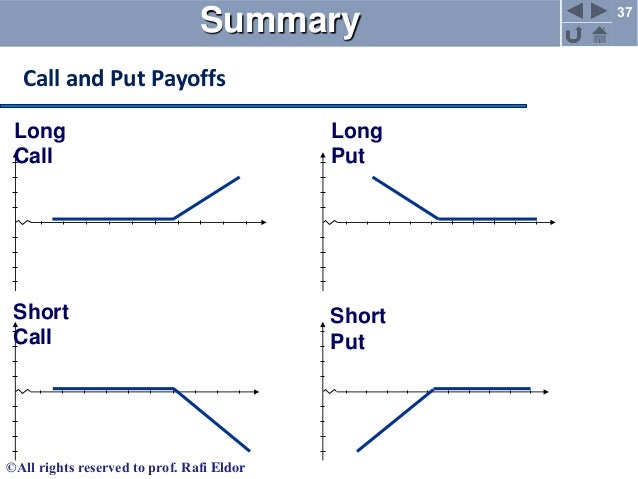

Understanding Terminology: Options jargon can be overwhelming for beginners. “Call” options give the buyer the right to buy, while “Put” options confer the right to sell. “Premiums” represent the cost of purchasing an option contract. Options with earlier expiration dates command higher premiums due to their time-sensitive nature.

Mechanisms and Strategies

Covered Calls: A covered call involves selling a call option while simultaneously owning the underlying asset. This strategy generates premium income but limits potential upside gains.

Protective Puts: Protective puts provide downside protection for existing stock positions. Purchasing a put option at a strike price below the stock’s current value allows the holder to sell at that fixed price if the stock declines.

Iron Condors: This more complex strategy involves simultaneously selling one call and one put option at different strike prices and buying one call and one put option at even further strike prices. The goal is to profit from price movement within a specific range.

Navigating Market Trends and Innovations

Blockchain and Options: Blockchain technology is emerging as a game-changer in the options market. The decentralized nature of blockchain offers new possibilities for transparent and secure option trading.

Artificial Intelligence in Options Analysis: AI is revolutionizing how traders analyze options data. Algorithmic models can now identify trading opportunities, predict price movements, and automate execution strategies.

Image: bfsi.eletsonline.com

Expert Tips and Strategic Insights

1. Risk Management: Exercise unwavering discipline in risk management. Determine your risk tolerance and adhere to a comprehensive trading plan that aligns with your capabilities.

2. Education and Continuous Learning: Embrace a lifelong pursuit of knowledge about options and financial markets. Stay abreast of industry updates and seek guidance from experienced traders.

3. Trading Discipline: Emotional decision-making can be detrimental to your financial success. Formulate a trading strategy and strictly follow its parameters, diligently managing your trades.

FAQs on Option Trading

Q: Is option trading suitable for everyone?

A: Option trading requires a high level of financial knowledge, risk tolerance, and emotional discipline. It is not recommended for inexperienced or risk-averse individuals.

Q: Can I make a quick profit with option trading?

A: While options offer the potential for significant returns, it is crucial to remember that trading carries inherent risks. Consistent profitability requires a comprehensive strategy, patience, and a deep understanding of the market.

Q: How do I choose the right options strategy?

A: The choice depends on your risk tolerance, investment goals, and market outlook. Consult with experienced traders or financial advisors to identify the most appropriate strategy for your situation.

Option Trading Org

Conclusion

The world of option trading is an ever-evolving realm where excitement and risk coexist. Whether you are a seasoned trader or just starting to navigate its complexities, it is essential to approach this realm with a clear understanding of its mechanisms, strategies, and potential pitfalls. By embracing calculated risk, adhering to sound trading practices, and continuously seeking knowledge, you can unlock the potential of options trading and enhance your financial acumen.

Are you ready to embark on a journey into the captivating world of option trading? Share your thoughts and questions in the comments below!