In the heart of the trading arena, where precision and intuition intertwine, the concept of price action holds a pivotal place. Like a seasoned mariner navigating treacherous waters, astute traders harness this invaluable tool to decipher market movements, uncover hidden patterns, and make informed decisions in the realm of options trading.

Image: www.tradingfuel.com

Price action, an art form in itself, transcends the limitations of technical indicators and charting tools. It empowers traders to delve directly into the raw, unbiased data of price fluctuations, unearthing valuable insights that often elude traditional analytical frameworks.

Delving into Price Action’s Essence

At its core, price action meticulously examines price movements, identifying patterns and market dynamics that reveal underlying trends and potential reversals. It unveils the story behind price fluctuations, painting a vivid picture of market sentiment, supply and demand imbalances, and the emotions that drive traders’ actions.

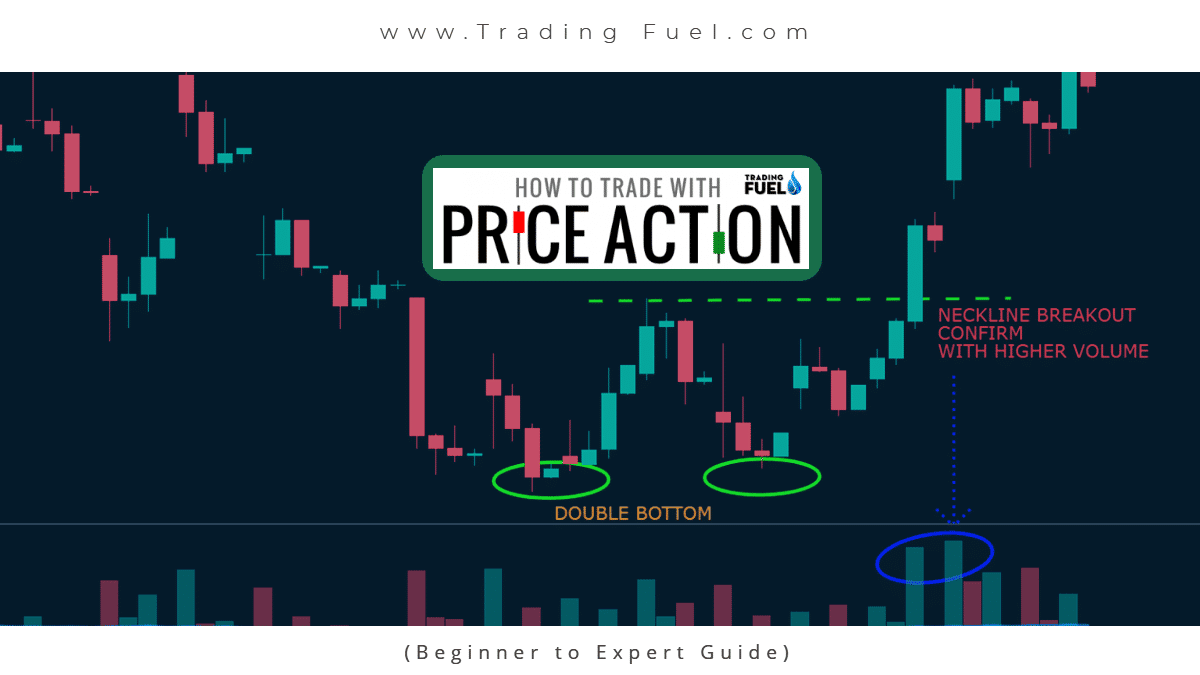

Unlike technical indicators and oscillators, price action eschews mathematical calculations and formulas. Instead, it relies on the human eye to detect and interpret patterns that unfold naturally in the price chart. Candlestick patterns, chart formations, support and resistance levels, and volume analysis form the cornerstone of price action analysis, providing traders with a comprehensive understanding of market behavior.

Unveiling the Power of Price Action in Options

In the dynamic world of options, price action takes on even greater significance. Options, with their unique combination of leverage and risk management capabilities, require a nuanced understanding of market movements to capitalize on opportunities and mitigate potential losses.

Price action allows options traders to:

- Identify market trends and reversals: By closely monitoring price action patterns, traders can anticipate changes in market direction and adjust their option strategies accordingly.

- Determine key support and resistance levels: Price action analysis helps identify pivotal levels where prices tend to bounce or reverse, providing valuable guidance for option entry and exit points.

li>Gauge market sentiment and momentum: Price action reveals market sentiment and momentum, enabling traders to assess the strength and direction of current trends and make informed decisions on option timing and strike price selection.

Embracing Expert Advice: Tips for Effective Price Action Trading

Navigating the intricacies of price action requires a blend of skill, knowledge, and the ability to dispassionately interpret market movements. Seasoned traders offer the following tips to enhance your price action trading prowess:

- Master candlestick patterns: Candlestick patterns, with their unique visual representation of price action, provide invaluable insights into market sentiment, reversals, and trend continuation.

- Analyze chart formations: Chart formations, such as head and shoulders, triangles, and double tops, depict macro price movements and reveal potential trading opportunities.

- Identify support and resistance levels: Historical price data helps identify key support and resistance levels that serve as magnets for price action, offering opportunities for both entry and exit strategies.

- Consider volume analysis: Volume, a crucial indicator of market participation and momentum, complements price action analysis, providing confirmation or divergence of price movements.

Remember, while price action is a powerful tool, it’s an art that requires unwavering discipline, patience, and the ability to avoid emotional decision-making. Each trader’s journey is unique, and consistent practice and the meticulous study of market dynamics are essential for honing your price action skills.

Image: www.paramonasvillas.gr

FAQ: Unraveling the Enigma of Price Action

Q: What are the advantages of price action trading?

A: Price action trading offers several advantages, including:

-

Simplicity and objectivity, as it eliminates the need for complex technical indicators and algorithms, relying primarily on raw price data.

-

Timeliness and responsiveness, as it provides real-time insights into market movements, allowing traders to adapt swiftly to changing conditions.

-

Versatility across multiple markets and instruments, making it a valuable tool for trading stocks, forex, futures, and options.

Q: How do I start learning price action trading?

A: To master price action trading, consider:

-

Studying reputable books, articles, and online resources that provide comprehensive guidance on the subject.

-

Joining trading communities and forums to connect with experienced traders and gain valuable insights.

-

Practicing and applying price action principles on a demo trading account to refine your skills without risking capital.

Q: Is price action trading suitable for all traders?

A: While price action trading can be a potent tool in the hands of experienced traders, it may not be the most accessible approach for beginners due to the required level of technical analysis and market knowledge.

What Is Price Action In Option Trading

Conclusion: Embracing Price Action’s Enduring Legacy

In the ever-evolving landscape of trading, price action remains an indispensable cornerstone, empowering discerning traders to decipher market dynamics, identify profitable opportunities, and manage risk with precision. It’s a discipline that transcends time and trends, a testament to its enduring relevance in the world of finance.

Are you ready to embrace the transformative power of price action in options trading? Unleash the potential of this time-honored technique and embark on a journey of market mastery today!