Introduction

In the fast-paced and ever-evolving world of financial markets, options trading has emerged as a powerful tool for investors seeking to enhance their portfolio returns and manage risk. Among the plethora of available options, the Invesco QQQ Trust (QQQ) offers a unique opportunity to gain exposure to the high-growth tech sector. This comprehensive guide will delve into the intricate world of trading QQQ options, empowering you with the knowledge and strategies to navigate this dynamic market.

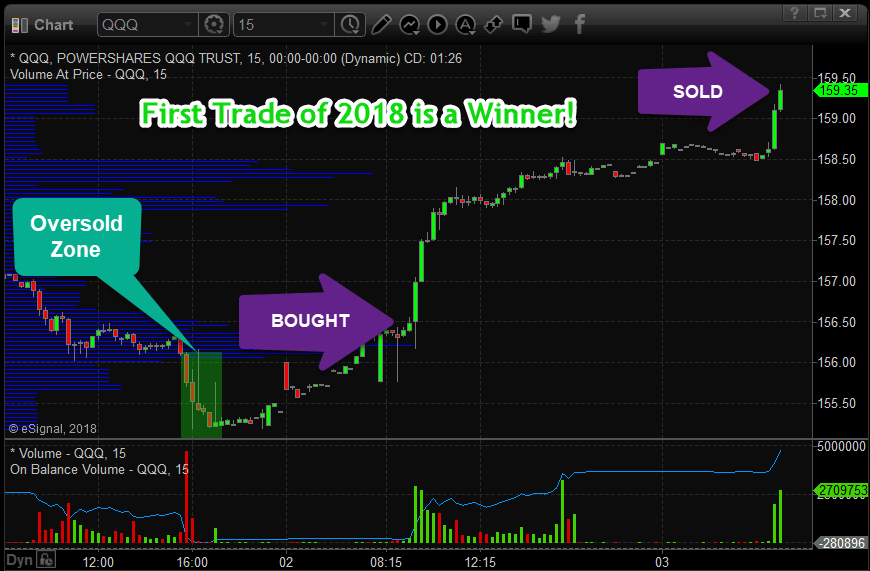

Image: thetechnicaltraders.com

QQQ Options: An Overview

QQQ, or the Nasdaq 100 Index Tracking Stock, is an exchange-traded fund (ETF) that mirrors the performance of the Nasdaq-100 Index. This index comprises the 100 largest non-financial companies listed on the Nasdaq stock exchange. As a result, QQQ provides investors with a single investment vehicle to gain exposure to a diversified portfolio of leading technology and internet giants.

Options contracts give traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). Trading QQQ options allows investors to capitalize on price movements in the Nasdaq-100 Index without the capital outlay required for purchasing the underlying stocks directly.

Understanding the Basics of QQQ Options

Before venturing into the world of QQQ options trading, it’s crucial to grasp the fundamental concepts involved. Here’s a breakdown of the essential terms:

- Option Premium: The price paid to acquire an option contract.

- Underlying Asset: In the case of QQQ options, it is the Nasdaq-100 Index.

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The last day the option contract can be exercised.

- Call Option: Gives the holder the right to buy the underlying asset.

- Put Option: Gives the holder the right to sell the underlying asset.

It’s worth noting that options contracts come in various types, each catering to specific trading strategies. For instance, call options can be purchased for speculative upside potential, while put options can be employed for hedging downside risk.

QQQ Options Trading Strategies

Options trading offers a multitude of strategies tailored to different risk appetites and investment horizons. Here are some popular QQQ options trading strategies to consider:

- Bull Call Spread: A strategy involving buying a lower-strike call option and selling a higher-strike call option, creating a potentially profitable spread if the underlying asset price rises.

- Bear Put Spread: Similar to a bull call spread, but involves selling a lower-strike put option and buying a higher-strike put option, profiting from a decline in the underlying asset price.

- Covered Call: A conservative strategy where an investor holding QQQ shares sells call options against them, generating additional income while limiting potential upside gains.

- Protective Put: An option strategy used to hedge against potential losses in an existing QQQ position. The investor buys a put option with a strike price below the current QQQ price, providing downside protection.

Image: tradingforexguide.com

Expert Insights and Actionable Tips

Seasoned options traders emphasize the importance of due diligence and risk management. Here are some expert insights and actionable tips to enhance your QQQ options trading experience:

- Thoroughly research: Educate yourself on the Nasdaq-100 Index and the factors that drive its movement. Understand the risks and rewards associated with options trading.

- Define your objectives: Determine your trading goals and choose strategies that align with your risk tolerance and investment horizon.

- Manage risk wisely: Use options in conjunction with other risk management techniques. Monitor your positions regularly and adjust them as needed.

- Seek expert guidance: Consult with experienced options traders or financial professionals for personalized advice and guidance.

- Stay informed: Keep abreast of market news, economic events, and company announcements that may impact QQQ prices.

Trading Qqq Options

Conclusion

Trading QQQ options can be a lucrative and rewarding endeavor when approached with knowledge and prudence. By comprehending the fundamentals of options trading, implementing sound strategies, and adhering to risk management principles, you can navigate the QQQ options market effectively. This guide has provided you with the building blocks to embark on your options trading journey with confidence. Remember to continuously educate yourself, seek expert advice when necessary, and stay disciplined in your approach to maximize your chances of success.