For those seeking to navigate the dynamic world of options trading, a well-curated library of books can serve as an invaluable asset. This comprehensive guide presents a curated selection of the best options trading books available, empowering traders of all experience levels to unlock the full potential of this versatile financial instrument.

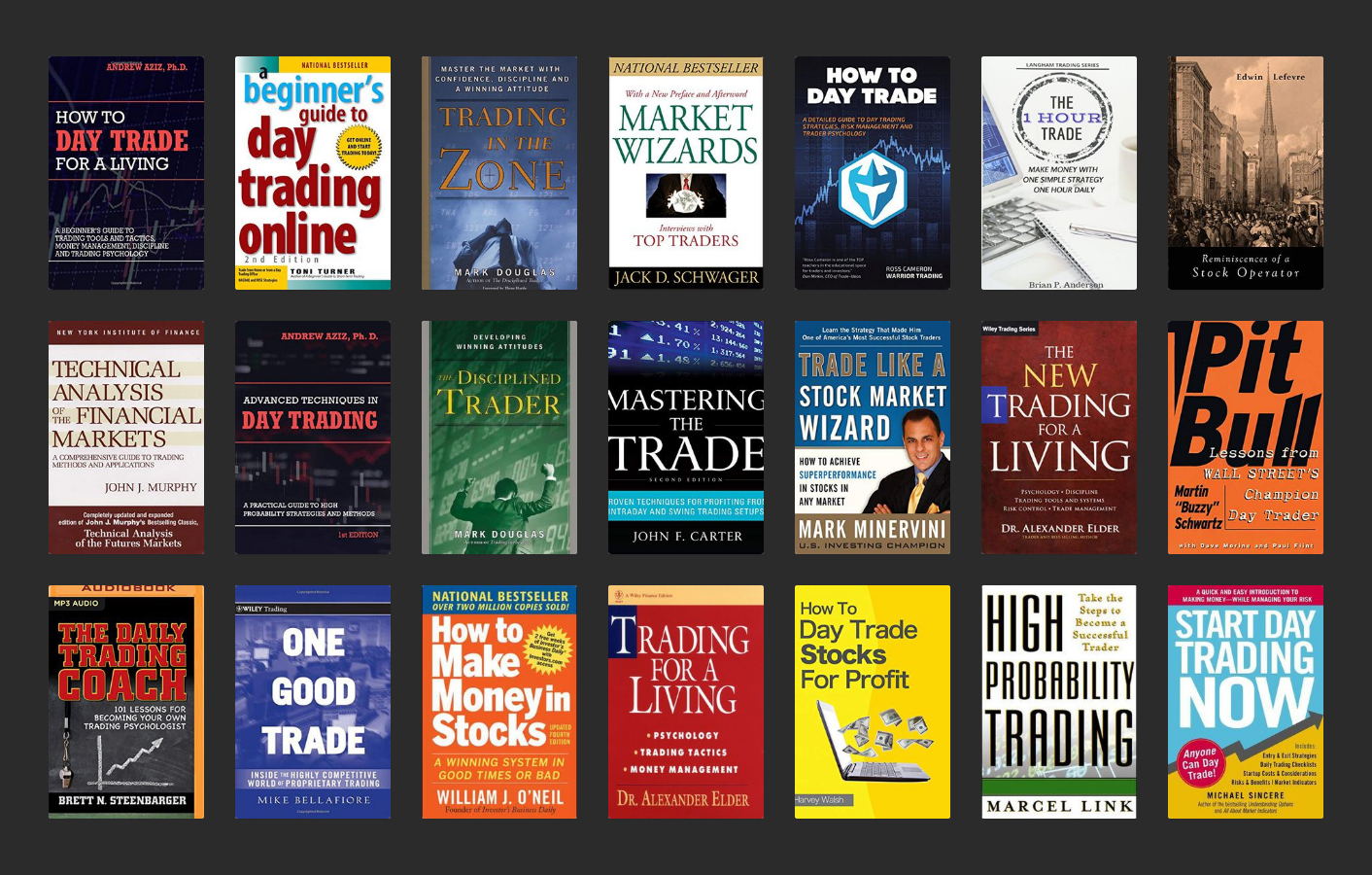

Image: tradingtools.net

Understanding Options Trading

Options trading involves contracts that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. The flexibility and leverage offered by options make them a powerful tool for both hedging and speculative trading.

Choosing the Right Options Trading Books

Navigating the plethora of options trading books can be daunting. Consider your experience level, trading objectives, and preferred learning style to identify the books that align best with your needs. Essential factors to consider include:

- Clarity and Comprehensiveness: Look for books that present complex concepts in a clear and easy-to-follow manner, ensuring a deep understanding of the subject matter.

- Expert Insights: Seek books authored by experienced options traders or financial professionals, leveraging their industry knowledge and practical experience.

- Practical Applications: Focus on books that provide practical examples and case studies, enabling you to connect theoretical knowledge with real-world trading scenarios.

- Up-to-Date Information: Choose books that reflect the latest developments and trends in options trading, ensuring your strategies are aligned with current market dynamics.

The Ultimate Guide to Options Trading

Image: www.readthistwice.com

1. “Options Trading: A Guide to Trading the Financial Markets,” by Brian Overby

Cited as the bible of options trading, this widely acclaimed book offers a comprehensive overview of options strategies and trading principles. It delves into the intricacies of options contracts, pricing models, and risk management, catering to both beginners and seasoned traders.

2. “Option Volatility & Pricing: Advanced Trading Strategies and Techniques,” by Sheldon Natenberg

Recognized as the industry standard for volatility trading, this book provides a thorough understanding of options volatility, pricing models, and advanced trading techniques. Natenberg’s in-depth analysis empowers traders to exploit market volatility and generate superior returns.

3. “Option Pricing and Volatility: A Practitioner’s Guide,” by Euan Sinclair

This highly respected book bridges the gap between theory and practice, presenting a practical framework for pricing and trading options. Sinclair’s expertise in financial modeling and derivatives trading provides invaluable insights into the complexities of options pricing and risk management.

4. “Options, Futures, and Derivatives,” by John C. Hull

Serving as a comprehensive reference for derivatives trading, this classic textbook offers a rigorous treatment of options, futures, and other derivative contracts. Hull’s academic background and consulting experience enable him to present complex concepts with clarity and precision.

5. “Option Trading for Dummies,” by Joe Duarte

This accessible guide demystifies options trading for those new to the field. Duarte’s user-friendly approach simplifies complex concepts, providing a solid foundation for understanding options contracts and trading strategies.

The Best Options Trading Books

Expanding Your Options Trading Knowledge

In addition to the top five books listed above, our guide recommends delving into a wider range of options trading literature to deepen your understanding of this dynamic market:

- Advanced Trading Techniques: “The Volatility Surface: A Practitioner’s Guide,” by Christian Laux, and “The Handbook of Option Trading Strategies,” by Jeff Augen.

- Risk Management and Hedging: “Options as a Strategic Investment,” by Lawrence G. McMillan, and “Risk Management and Options Trading,” by Tavakkol Siavash.

- Volatility Trading: “Volatility Trading: Strategies for Profiting from Market Swings,” by Euan Sinclair, and “The VIX: An Insider’s Guide to the CBOE Volatility Index,” by Seth E. Golub.

- Technical Analysis: “Technical Analysis of the Financial Markets,” by John J. Murphy, and “Trading Options Using Technical Analysis,” by Jay Kaeppel, Kam Ahon, and Ashley Kao.

By incorporating these renowned options trading books into your learning journey, you will equip yourself with the knowledge and strategies necessary to navigate the market with confidence and maximize your trading potential.