Unveiling the Potential of Robinhood’s Options Trading Platform

Robinhood, the renowned stock trading app, has revolutionized the online trading landscape. Its user-friendly interface and commission-free trading options have made it a top choice for investors. Recently, Robinhood expanded its offerings to include options trading, opening up new possibilities for traders of all levels. In this in-depth review, we delve into the intricacies of Robinhood’s options trading platform, exploring its functionalities, advantages, and limitations.

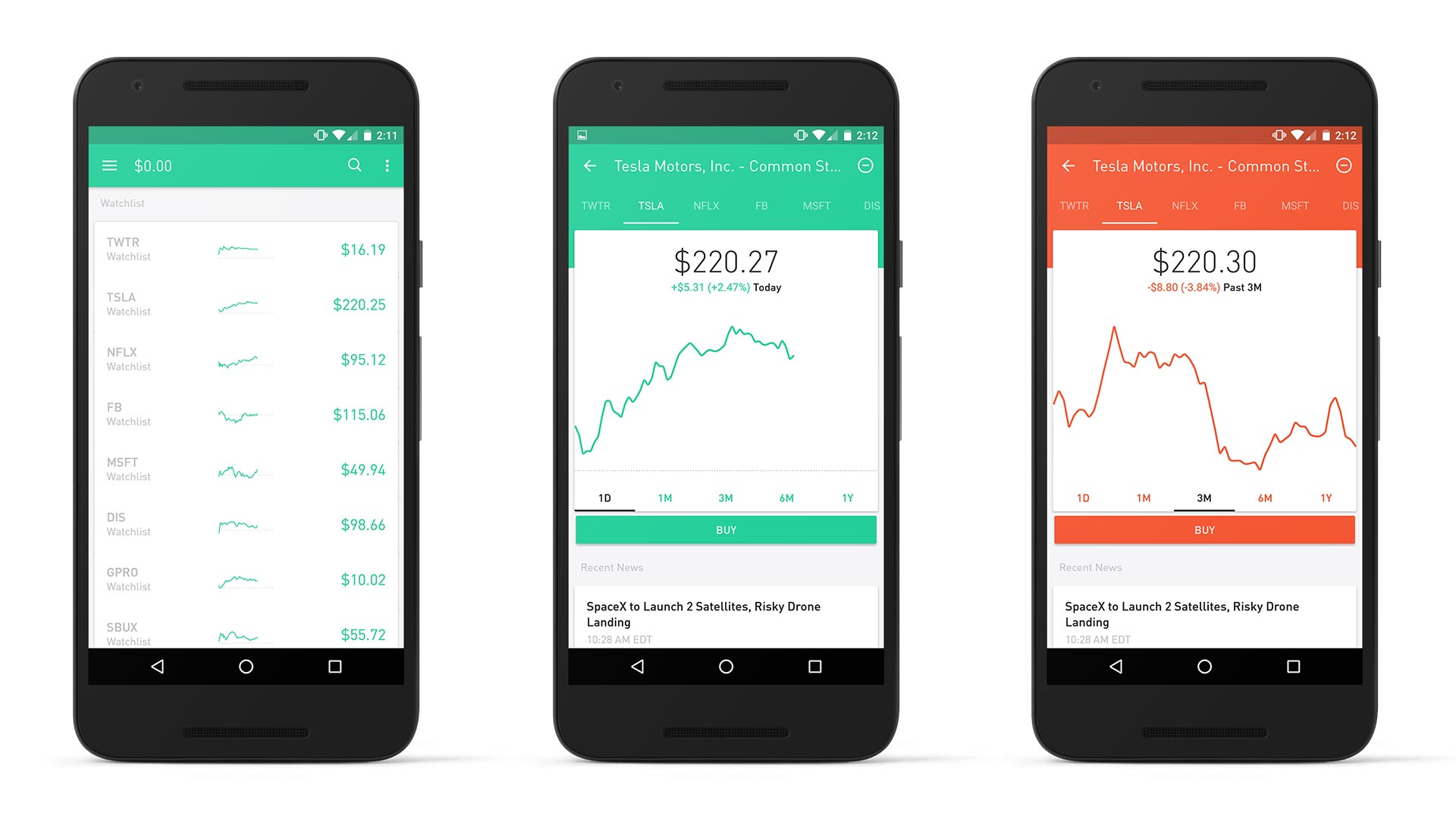

Image: claytrader.com

Robinhood Options: Understanding the Basics

Options trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Robinhood’s options trading platform allows traders to access a wide range of options on stocks, exchange-traded funds (ETFs), and even cryptocurrencies.

Unlike traditional options trading platforms that require a high level of experience, Robinhood’s interface simplifies the process. With clear explanations of options jargon and intuitive navigation, even novice traders can confidently navigate the platform.

Advantages and Benefits of Robinhood’s Options Trading

-

Commission-free Trading: Robinhood’s unwavering commitment to commission-free trading extends to options contracts. This cost-saving advantage allows traders to maximize their potential profits without being burdened by hefty fees.

-

Intuitive Interface: The platform’s user-friendly design and educational resources make options trading accessible to both seasoned pros and aspiring investors. Robinhood’s clean interface and helpful tutorials guide traders through the process, empowering them with knowledge and confidence.

-

Diverse Options Selection: Robinhood offers a comprehensive suite of options contracts across various asset classes. Traders can choose from a vast selection of stocks, ETFs, and cryptocurrencies, allowing them to tailor their portfolios to their specific investment strategies.

Limitations and Drawbacks of Robinhood’s Options Trading

-

Limited Option Strategies: While Robinhood’s options platform offers essential trading capabilities, it lacks support for more advanced option strategies. Traders looking to implement complex strategies may need to consider alternative platforms that cater to their specific needs.

-

Limited Order Types: Robinhood’s options trading platform supports only a limited range of order types. This constraint can limit the flexibility and precision of traders who rely on specialized order types for effective trade execution.

-

Educational Gap: Despite its user-friendly interface, Robinhood’s educational resources for options trading may be insufficient for some investors. Traders new to options or seeking a deeper understanding of the complexities involved may need to supplement their knowledge from external sources.

Image: www.youtube.com

Expert Advice for Successful Options Trading

-

Understand the Risks: Options trading carries inherent risks, and it’s crucial to proceed with caution. Thoroughly familiarize yourself with options terminology, mechanics, and potential risks before diving in.

-

Choose Appropriate Contracts: Carefully consider the underlying asset, strike price, expiration date, and premium when selecting options contracts. Match your choices to your risk tolerance and investment goals.

-

Manage Risk Effectively: Employ prudent risk management strategies. Utilize stop-loss orders to limit potential losses and consider hedging positions to mitigate risk.

Frequently Asked Questions (FAQs)

Q: What are the requirements to trade options on Robinhood?

A: You must be at least 18 years old, have an approved Robinhood account, and have received options trading approval after submitting an application.

Q: What types of options contracts does Robinhood offer?

A: Robinhood offers call and put options on stocks, ETFs, and cryptocurrencies.

Q: What are the associated fees for options trading on Robinhood?

A: Robinhood does not charge any commissions for options trading. However, there is a small fee for each options contract traded.

Robinhood Options Trading Review

https://youtube.com/watch?v=P22zMubpopg

Conclusion

Robinhood’s options trading platform offers both opportunities and limitations for traders. With its accessible interface, commission-free trading, and diverse options selection, Robinhood makes options trading approachable for both beginners and experienced investors. However, the limited range of order types and educational gaps may not cater to the needs of advanced traders. Understanding the risks involved and seeking additional knowledge from external sources are essential for successful options trading. As with any investment decision, it’s crucial to carefully weigh the advantages and disadvantages before embarking on the journey. Are you interested in learning more about Robinhood’s options trading platform?