Unveiling the Key to Calculated Risks

The realm of options trading presents a plethora of opportunities for both experienced and novice traders alike. However, understanding the intricacies of this complex market is paramount to achieving long-term success. Among the fundamental concepts that every trader must master is position sizing – a critical skill that determines the amount of capital allocated to each trade. In this comprehensive guide, we will delve into the depths of position sizing, exploring its importance, techniques, and potential impact on your trading endeavors.

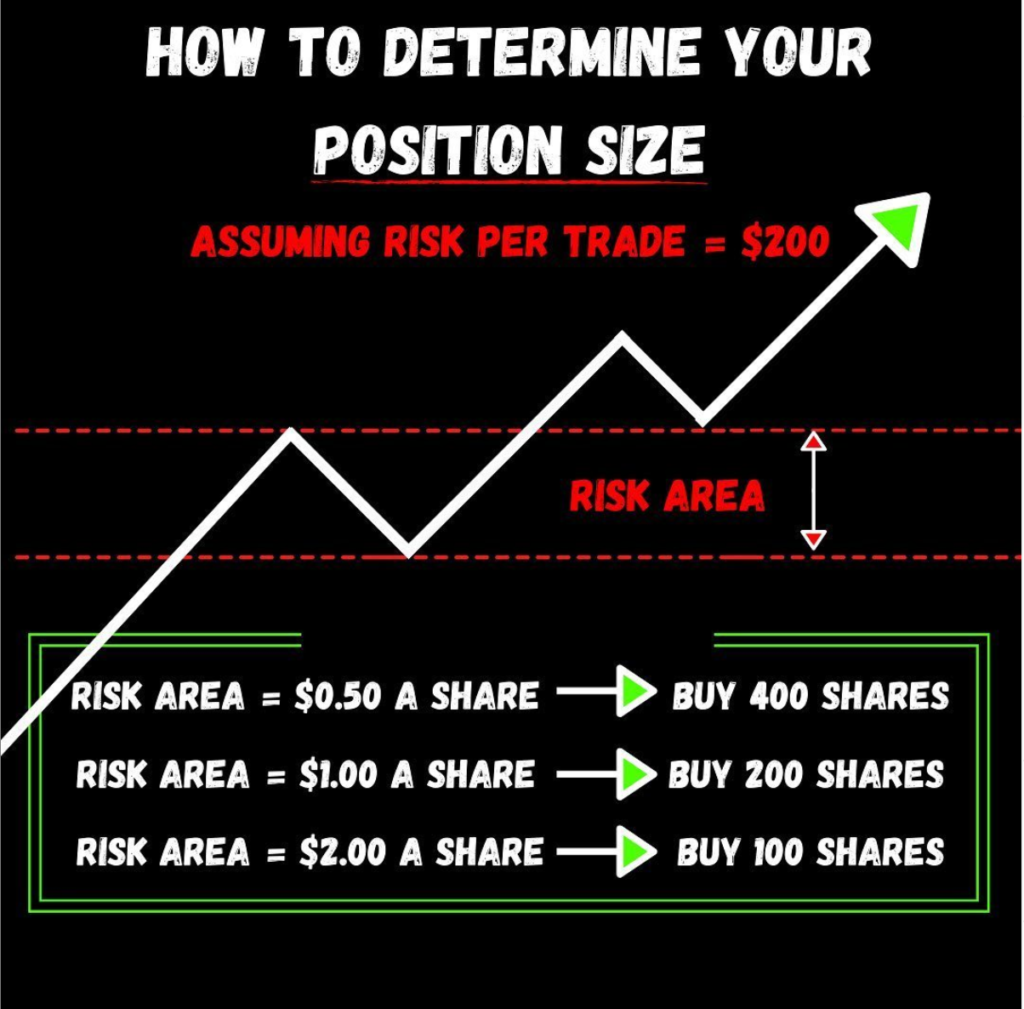

Image: bullsonwallstreet.com

Defining Position Sizing

Position sizing refers to the strategic determination of the size of each trade, expressed as the number of contracts or shares purchased or sold. It plays a pivotal role in managing risk and maximizing profit potential. By carefully assessing factors such as market volatility, account size, and risk tolerance, traders can optimize their position sizes to enhance their probability of success.

Significance of Position Sizing

Understanding position sizing is not merely an academic exercise; it is an essential skill that can profoundly influence your trading outcomes. Improper sizing can lead to excessive risk exposure, while overly conservative sizing can limit profit potential. Striking the right balance between risk and reward is crucial for consistent profitability.

Risk Management Strategies

Position sizing is a primary tool for effective risk management in options trading. By allocating a prudent proportion of your account to each trade, you can limit potential losses and preserve your trading capital. Conversely, oversizing your positions can lead to catastrophic losses, even during favorable market conditions.

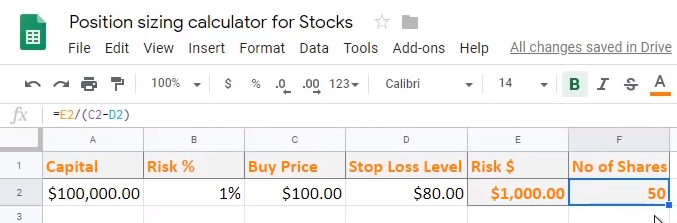

Image: www.shootingstocks.com

Techniques for Determining Position Size

There are various techniques for determining the optimal position size. One common method is the percentage of account rule, where you allocate a specific percentage of your account balance to each trade. Another approach is the fixed dollar risk method, waarbij you determine the maximum dollar amount you are willing to lose on any given trade.

Diversification and Position Sizing

Diversification is a fundamental risk management strategy that involves spreading your capital across multiple positions. By diversifying your portfolio, you reduce the impact of adverse price movements in any single underlying asset or market sector. Position sizing plays a vital role in diversification, as it ensures that you do not overweight any one position.

Emotional Control in Position Sizing

Trading in options can be an emotionally charged endeavor, and it is imperative to maintain emotional control when determining position sizes. Avoid succumbing to fear or greed, which can lead to impulsive and ill-informed decisions. Stick to your predefined risk management plan and adjust your positions rationally based on market conditions.

What Is Position Sizing In Options Trading

Image: warriortradingnews.com

Conclusion

Position sizing is an indispensable aspect of options trading that demands careful consideration and meticulous execution. By mastering the art of position sizing, traders can effectively manage risk, enhance profit potential, and achieve long-term trading success. Remember, the key to successful trading lies not in taking excessive risks but in making calculated decisions based on sound principles of risk management and position sizing.