Introduction: The Art of Tailored Trading

In the ever-evolving world of options trading, understanding intenerick and extenseric strategies is not just a competitive advantage – it’s a necessity. These two approaches cater to opposing market beliefs, enabling astute investors to capitalize on the tides of financial uncertainty. Let’s delve into a comprehensive exploration of intenerick and extenseric options, unraveling their intricate dynamics and unlocking their potential in maximizing investment returns.

Image: www.youtube.com

Intenerick: Betting on a Stable Course

Intenerick options find their strength in the prediction of a relatively stable market environment. Investors deploying this strategy anticipate minimal fluctuations in the underlying asset’s price, believing that volatility will stay within a modest range. By venturing into the realm of near-the-money options with short timeframes, intenerick traders seek to extract value from time decay and maintain a steady level of return.

As the expiration date draws near, the time premium associated with options begins to erode. Intenerick traders capitalize on this time decay, carefully selecting options with a limited time to expiry. The intention is to maximize value while minimizing exposure to unpredictable movements that could erode potential gains.

Extenseric: Embracing Volatility’s Embrace

In contrast to intenerick’s affinity for stability, extenseric options welcome the turbulent currents of a volatile market. These traders embrace the inherent risk, betting that the underlying asset’s price will experience significant swings. They typically opt for deep-in-the-money or deep-out-of-the-money options with extended maturities.

Extenseric strategies are designed to capitalize on extreme price movements that can lead to substantial returns. The extended timeframe allows for a higher potential for the predicted volatility to materialize. However, this adventurous approach comes with a heightened level of risk, as the market’s unpredictable nature can lead to substantial losses as well.

The Intenerick Game Plan: Balancing Risk and Reward

Intenerick trading revolves around precision and risk management. By opting for near-the-money options, traders limit their potential profit margin but simultaneously minimize the risk of significant losses. Additionally, the short time frame associated with intenerick options reduces the impact of adverse market events, further safeguarding traders from substantial drawdowns.

The intenerick approach is particularly adept at capitalizing on theta decay, which is the erosion of an option’s time premium as it nears expiration. This enables traders to generate a steady stream of small profits over time, without exposing themselves to excessive risk.

Image: www.pinterest.com

The Extenseric Formula: Embracing Volatility’s Rewards

Extenseric trading is built on the belief that volatility is an inherent characteristic of financial markets and can be harnessed to generate outsized returns. By venturing into the realms of deep-in-the-money or deep-out-of-the-money options, traders have the potential to capitalize on extreme price swings.

However, the allure of potentially lucrative returns comes intertwined with a higher level of risk. Extenseric options are susceptible to the whims of a volatile market, and substantial losses can be incurred if the predicted price movements do not materialize. Therefore, a robust risk management strategy is pivotal in navigating the volatile waters of extenseric trading.

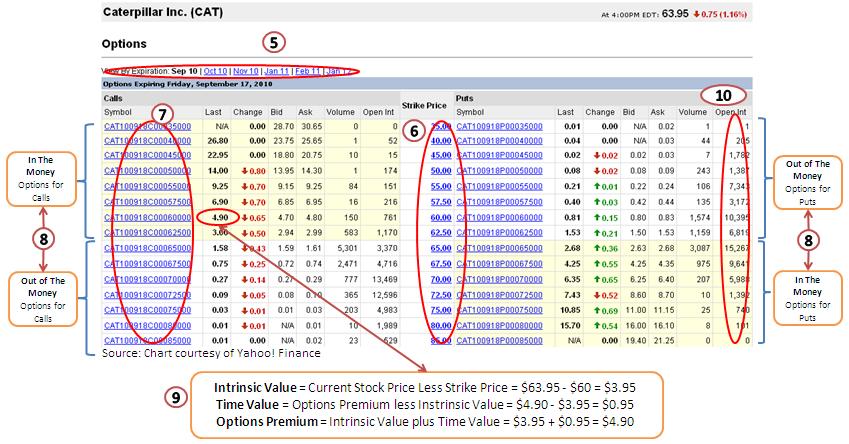

Understanding Intenerick And Extenseric In Trading Options

Image: yzypohu.web.fc2.com

Choosing the Optimal Strategy: Aligning with Market Conditions

The choice between intenerick and extenseric strategies hinges on the prevailing market conditions and the investor’s risk tolerance. Intenerick options are typically employed when the underlying asset’s price is expected to remain relatively stable, with minimal volatility anticipated. This approach is favored by risk-averse traders seeking to generate consistent returns with a lower risk profile.

On the other hand, extenseric options become a more attractive proposition when the market is anticip