In the bustling metropolis of modern finance, where market volatility dances like an untamed tempest, the allure of options trading beckons to the intrepid and discerning. Amidst this financial labyrinth, Uber Options Trading emerges as a potent strategy, offering savvy investors the potential to navigate market currents and seize lucrative returns.

Image: fourweekmba.com

Uber Options Trading: A Prelude

Options, sophisticated financial instruments, empower traders to speculate on future asset price movements without incurring immediate ownership. In the Uber Options Trading realm, traders can wager on the price trajectory of Uber stock, a bellwether of the ever-evolving ride-hailing industry.

Unveiling the Fluid Nature of Uber Options Trading

The beauty of Uber Options Trading lies in its adaptability to diverse market conditions. Whether markets soar like triumphant eagles or plummet like hapless larks, options provide traders with the flexibility to craft tailored strategies that align with their risk tolerance and financial ambitions.

Bullish Strategies for Ascending Markets

When optimism reigns supreme and markets embark on an upward trajectory, traders can deploy bullish options strategies. By purchasing call options, investors effectively bet on Uber’s ascent, anticipating that its stock price will continue to rise. The potential profits in such scenarios can be substantial, offering lucrative rewards to those who correctly gauge market sentiment.

Image: www.thestreet.com

Bearish Strategies for Market Downturns

In the face of market adversity, when economic headwinds howl and asset prices threaten to plunge, bearish options strategies come into play. Traders can deploy put options, which grant them the right (but not the obligation) to sell Uber stock at a predetermined price. If market forecasts prove accurate, these options can yield significant profits as the underlying stock price depreciates.

Navigating the Uber Options Trading Landscape

Mastering Uber Options Trading demands a deep understanding of market dynamics, options pricing, and risk management techniques. Vigilant market monitoring, coupled with sound investment strategies, is paramount for success in this challenging yet potentially rewarding arena.

Deciphering Options Pricing

Options pricing, influenced by a complex interplay of factors including stock price, strike price, time to expiration, and volatility, requires careful analysis. Traders must comprehend the intricate relationship between these variables to make informed trading decisions.

Embracing Risk Management Principles

Risk management is the bedrock of successful Uber Options Trading. Prudent traders employ various techniques, such as stop-loss orders and position sizing, to mitigate potential losses and protect their hard-earned capital. A disciplined approach to risk management is essential to avoid catastrophic losses and safeguard financial well-being.

Expert Advice for Uber Options Trading Success

To elevate your Uber Options Trading game, consider the following insights culled from seasoned professionals:

- Embrace a comprehensive understanding of market dynamics: Delve into economic indicators, industry trends, and geopolitical events that can influence Uber’s stock price.

- Master the art of options pricing: Gain a thorough comprehension of the factors that determine options premiums and how they impact potential returns.

- Employ a disciplined risk management strategy: Establish clear risk tolerance levels and adhere to them diligently to safeguard your capital and maximize your chances of long-term success.

- Practice technical analysis techniques: Study historical price charts and identify patterns that can assist in predicting future price movements, providing a valuable edge in Uber Options Trading.

FAQs on Uber Options Trading

Q: What are the risks associated with Uber Options Trading?

A: Uber Options Trading involves the potential for significant financial loss, especially for inexperienced traders. Market volatility, improper risk management, and a lack of market knowledge can exacerbate these risks.

Q: What is the minimum capital required to start Uber Options Trading?

A: The minimum capital requirement varies depending on the broker you choose and the strategies you employ. However, it is generally advisable to start with a substantial amount of capital to mitigate potential losses.

Q: How much profit can I make from Uber Options Trading?

A: Potential profits from Uber Options Trading can vary significantly depending on market conditions, trading strategies, and risk tolerance. There is no guarantee of profitability, and both profits and losses are possible.

Uber Options Trading

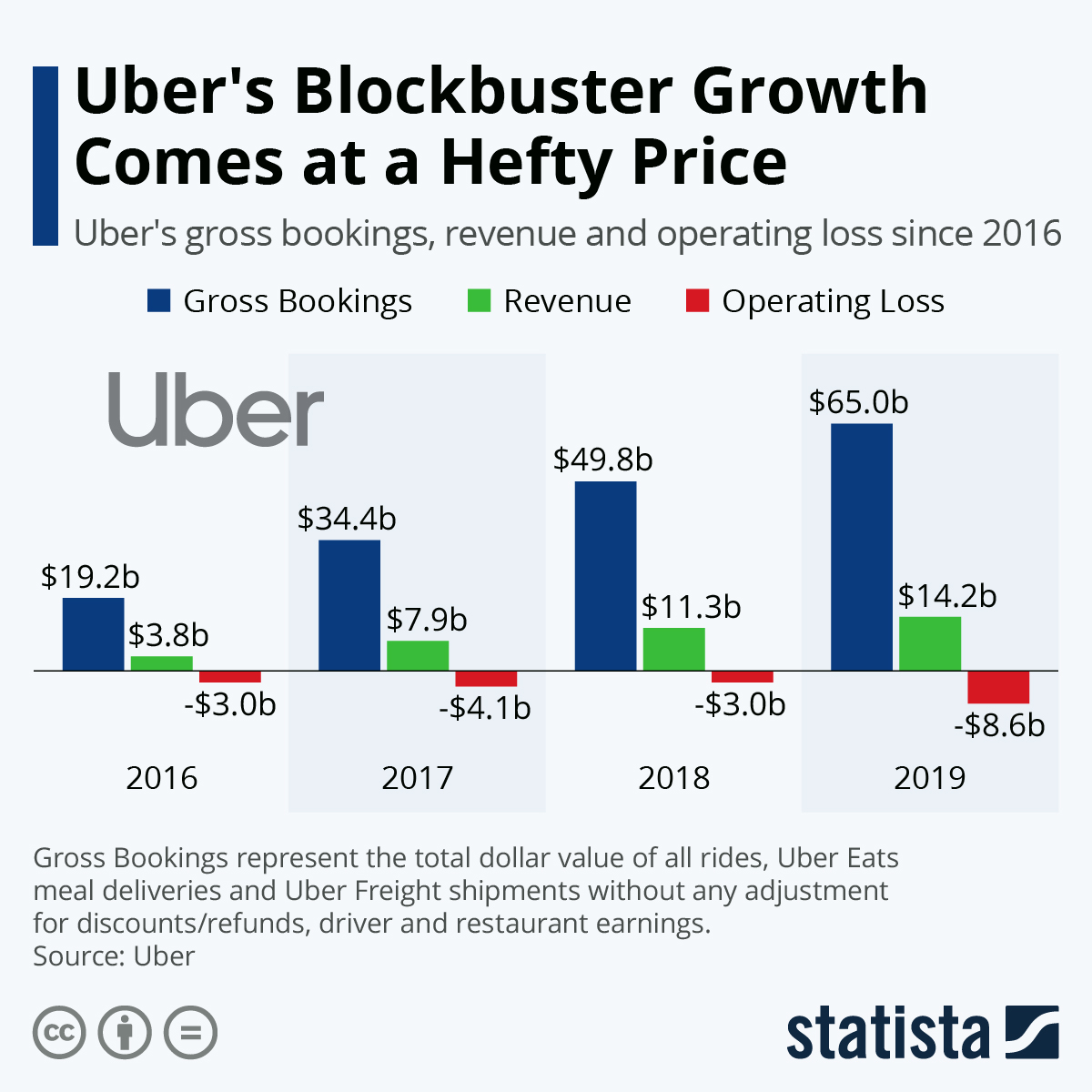

Image: www.statista.com

Conclusion

Uber Options Trading, a potent financial instrument, unlocks myriad opportunities for savvy investors to harness market movements and generate substantial returns. By embracing sound strategies, comprehending options pricing, and implementing robust risk management practices, traders can navigate the evolving landscape of Uber stock and reap the rewards that this dynamic market offers.

Are you intrigued by the allure of Uber Options Trading? Embark on a journey of discovery and exploration, and unlock the potential that awaits you in this exciting realm of financial adventure.