Introduction: Exploring the World of Fixed Income

In the realm of finance, the U.S. Treasury bond market stands as a cornerstone of stability and liquidity. Treasury bonds, issued by the U.S. government, offer investors a haven during economic uncertainties and are considered one of the safest investments available. However, for savvy investors seeking enhanced returns and effective risk management strategies, trading options on U.S. Treasury bonds presents a compelling opportunity.

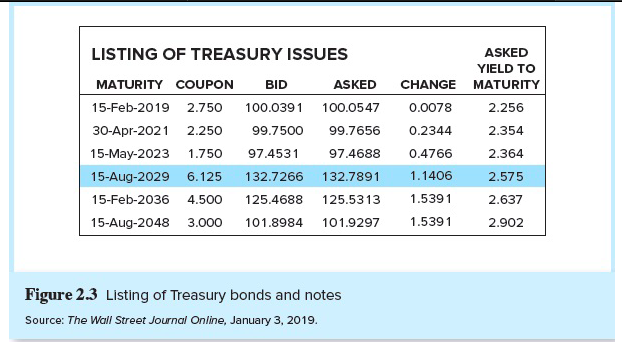

Image: www.chegg.com

Trading Treasury bonds options provides a sophisticated tool for investors to speculate on the future value of interest rates, hedge against interest rate risk, and execute more complex trading strategies. This comprehensive guide will delve into the intricacies of U.S. Treasury bonds options, empowering you with the knowledge and insights necessary to navigate this dynamic market.

Delving into Treasury Bond Options

Treasury bond options are contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specified quantity of U.S. Treasury bonds at a predetermined price (strike price) on a specified date (expiration date). This flexibility allows investors to tailor their strategies to specific market expectations and risk tolerances.

Types of Treasury Bond Options

The U.S. options market offers two primary types of Treasury bond options: Treasury bond futures options and Treasury bond cash-settled options.

- Treasury bond futures options are based on underlying Treasury bond futures contracts, providing leverage and enhanced risk management capabilities.

- Treasury bond cash-settled options result in a cash settlement at expiration, eliminating the need for physical delivery of the underlying bonds.

Key Characteristics of Treasury Bond Options

- Contract Multiplier: Each Treasury bond options contract represents a specified face amount of Treasury bonds, typically $1 million.

- Expiration Cycle: Treasury bond options expire on the third Friday of each month except for March, June, September, and December, which expire on the second Friday.

- Premium: The price of an options contract, referred to as the premium, reflects market expectations of future interest rate movements and the time remaining until expiration.

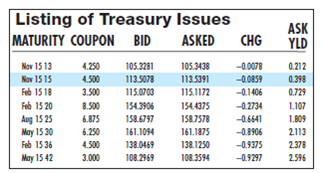

Image: www.wallstreetprep.com

Trading Strategies for Treasury Bond Options

The versatility of Treasury bond options empowers investors with a wide range of trading strategies.

- Hedging: Treasury bond options can be used to hedge against interest rate fluctuations in existing bond portfolios or to offset potential losses in other investments.

- Speculation: Option traders can make speculative bets on the future direction of interest rates by buying or selling options outright.

- Income Generation: By selling (writing) options, investors can generate income and profit from the premium received, although this strategy also carries the risk of unlimited loss.

- Spread Trading: Combining multiple options positions with different strike prices and/or expiration dates creates spread strategies that can target specific market scenarios and limit risk.

Understanding Risk and Managing Volatility

Like all investment instruments, trading Treasury bond options involves inherent risks.

- Interest Rate Risk: The primary risk in Treasury bond options trading stems from fluctuations in interest rates. Unfavorable interest rate movements can result in significant losses.

- Price Volatility: Treasury bond options prices can experience substantial volatility, especially during periods of heightened market uncertainty.

- Time Decay: The value of an options contract diminishes with the passage of time, known as time decay. This factor accelerates as the expiration date approaches.

Managing risk is paramount in Treasury bond options trading. Employing appropriate position sizing, using stop-loss orders, and understanding the Greeks (measures of option sensitivity) can help mitigate potential losses.

Trading Us Treasury Bonds Options Pdf

Image: www.chegg.com

Conclusion: Unveiling Opportunities in the Fixed Income Market

Trading U.S. Treasury bonds options unlocks a powerful tool for investors navigating the dynamic fixed income market. By understanding the intricacies of these contracts, adopting suitable trading strategies, and managing risk effectively, investors can capitalize on opportunities, enhance their returns, and mitigate portfolio volatility.

This comprehensive guide has provided a solid foundation for your exploration of Treasury bond options trading. As you gain experience and delve deeper into this sophisticated market, you will uncover its intricacies and potential rewards.