Introduction

In the tumultuous world of finance, where fortunes are forged and shattered with each trading decision, the allure of options trading can be both exhilarating and perilous. Options, financial instruments that derive their value from an underlying asset, offer traders the potential for substantial gains. However, it’s crucial to proceed with caution, as the risk of bankruptcy looms large for those who fail to navigate these complexities wisely.

Image: www.youtube.com

Understanding Options Trading

Options contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). The value of an option contract fluctuates based on factors such as the price of the underlying asset, time to expiration, and market volatility. While options can enhance profit potential, they also carry the potential for significant losses if not managed carefully.

Risks Associated with Options Trading

The primary risk associated with options trading is the potential for unlimited losses. Unlike traditional stock investments, where losses are typically limited to the initial investment, options trading can expose traders to losses exceeding their original capital. This is because options contracts control a larger number of shares than the trader actually owns.

For instance, if an investor purchases a call option on 100 shares of a stock trading at $50 per share with a strike price of $52, they will pay a premium for the right to buy those shares at $52. If the stock price rises above $52, the option contract will gain value, and the investor can potentially make a profit by selling the option or exercising the right to buy the shares. However, if the stock price falls below $52, the option will become worthless, and the investor will lose the entire premium paid.

Strategies for Managing Risk

To mitigate the risks associated with options trading, several strategies can be employed:

- Hedging: Using options to reduce the risk of another investment position.

- Diversification: Spreading investments across a range of options contracts and underlying assets.

- Using Limit Orders: Setting buy or sell orders at specific price levels to limit potential losses.

- Proper Position Sizing: Limiting the size of trades to an amount that aligns with risk tolerance and financial capabilities.

- Sticking to a Trading Plan: Establishing clear guidelines for trade entry and exit, minimizing impulsive and emotional decision-making.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Image: www.plafon.id

Recognizing the Warning Signs

Traders who find themselves on the brink of bankruptcy often exhibit certain warning signs:

- Excessive leverage: Borrowing large sums of money to increase trading capital, magnifying both profits and losses.

- Chasing losses: Attempting to recoup a series of losses by placing increasingly risky trades, often leading to a spiral of escalating losses.

- Ignoring risk management principles: Neglecting key risk mitigation strategies outlined above, such as hedging and proper position sizing.

- Emotional trading: Making decisions based on fear or greed, rather than sound analysis and rational judgment.

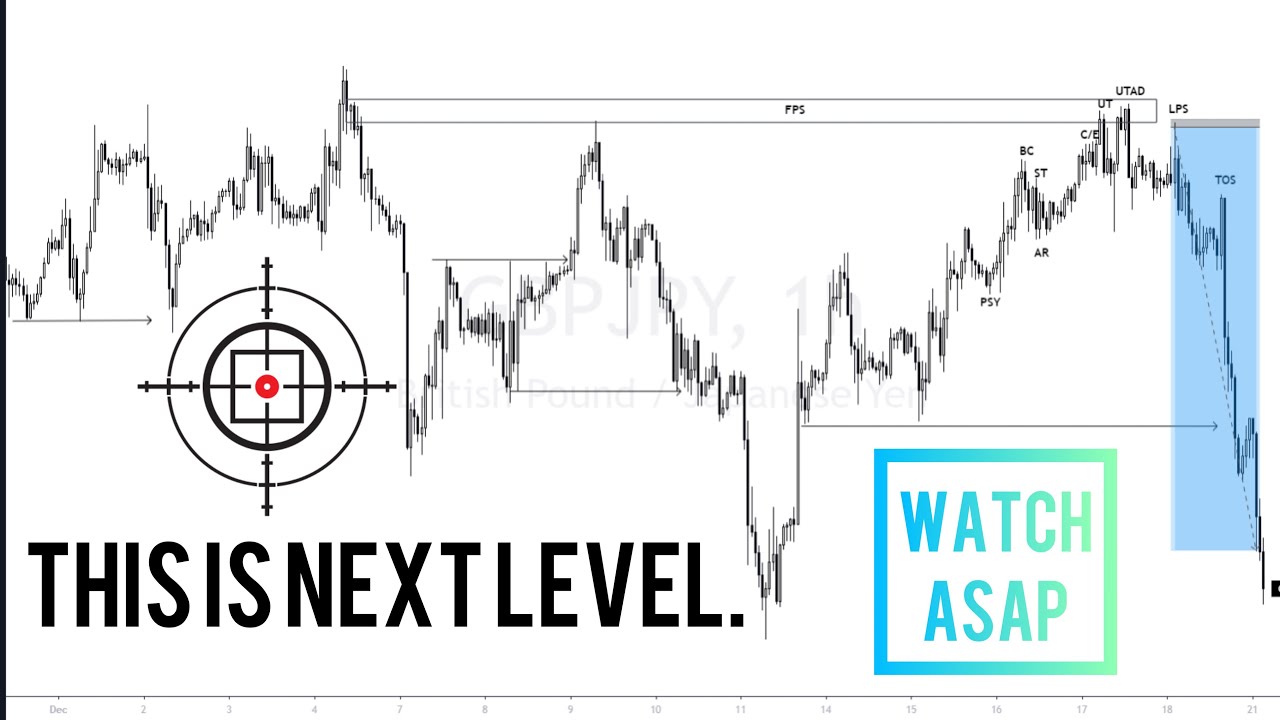

Trading Options Expect Bankrupcy

Image: www.youtube.com

Conclusion

Options trading presents immense opportunities for profit, but it also carries inherent risks that can lead to financial ruin if not managed appropriately. By fully understanding the potential risks and implementing effective risk management strategies, traders can navigate the complexities of options trading with greater confidence and minimize the likelihood of bankruptcy. It’s essential to consult with a qualified financial advisor and thoroughly educate oneself before engaging in options trading. Remember, financial success is a journey, not a destination, and it’s better to strive for consistent returns with manageable risk than to chase unrealistic gains and risk the prospect of bankruptcy.