In the realm of financial markets, options trading holds a captivating allure, promising the potential for both high rewards and significant risks. Mastering the intricacies of this complex strategy requires a profound understanding of its underlying concepts, meticulous risk management, and a strategic approach. For aspiring traders seeking to hone their skills without exposing real capital, trading option simulators emerge as a vital tool.

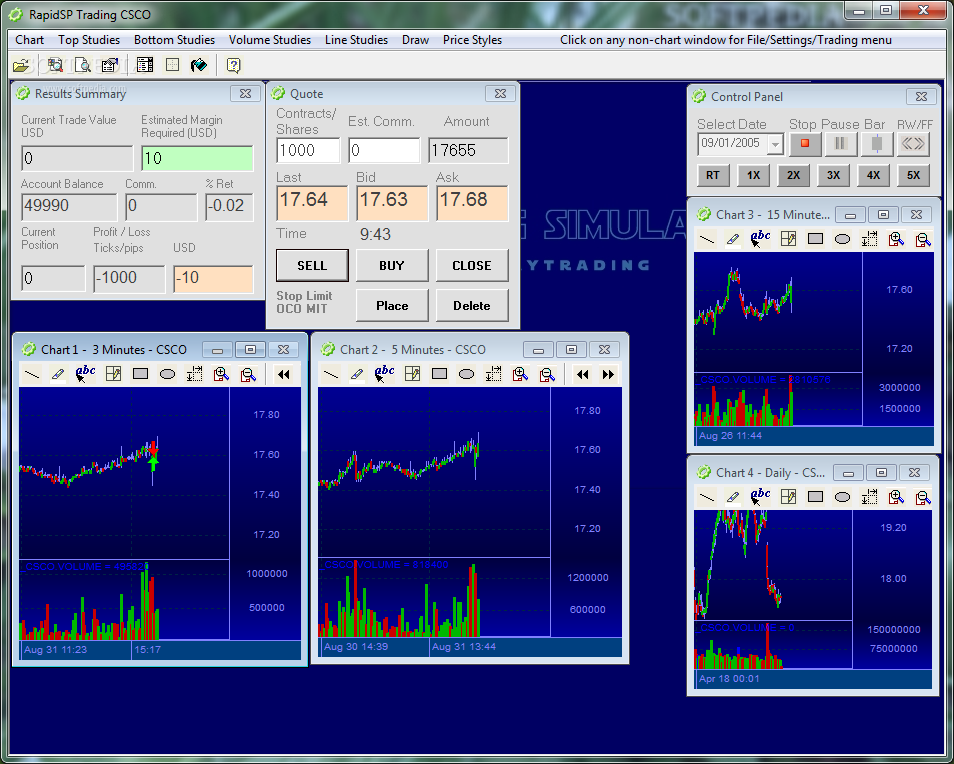

Image: www.eudownloads.com

Trading option simulators mimic the real-world trading environment, providing a risk-free platform where traders can test their strategies, refine their techniques, and gain hands-on experience in navigating the dynamic markets. These simulators replicate market movements, quote systems, and trade executions, simulating the challenges and opportunities encountered in live trading.

Navigating the Landscape of Trading Option Simulators

A plethora of trading option simulators grace the digital landscape, each catering to specific trader needs and preferences. Some simulators emphasize ease of use and intuitive interfaces, making them ideal for beginners seeking a gentle introduction to options trading. Others prioritize advanced features and intricate functionalities, appealing to seasoned traders seeking to refine their strategies.

To choose the right simulator, it’s crucial to evaluate its features, user reviews, and compatibility with your trading goals. Consider factors such as market data accuracy, the breadth of underlying assets, the availability of customizable parameters, and the integration of advanced order types.

Unveiling the Components of Options Trading

Options, versatile financial instruments, bestow upon their holders the right but not the obligation to buy or sell an underlying asset at a predetermined price within a specified timeframe. These contracts are classified into two primary types: calls and puts. Call options grant the holder the right to purchase the underlying asset, while put options confer the right to sell it.

Key concepts in options trading include strike price, expiration date, and premium. The strike price represents the price at which the underlying asset can be bought (in the case of calls) or sold (in the case of puts). The expiration date marks the end of the contract period, after which the option loses its value. The premium, expressed as a percentage of the underlying asset’s price, reflects the price of the option contract.

Mastering the Art of Option Strategies

In the hands of skilled traders, options provide a potent tool for capturing market movements and managing financial risk. A myriad of option strategies exist, each tailored to distinct market conditions and trader objectives. Covered calls, naked calls, cash-secured puts, and protective puts represent a mere fraction of the vast array of strategy choices.

The covered call strategy involves selling (or writing) a call option while simultaneously owning an equivalent number of shares of the underlying asset. This strategy is employed in mildly bullish or sideways markets, allowing traders to generate income from premium collection while limiting their downside risk to the shares they own.

Naked calls, on the other hand, are a more aggressive strategy where traders sell call options without owning the underlying asset. This strategy offers the potential for higher returns but carries substantial risk, as traders may be obligated to buy the underlying asset at the strike price, which can be significantly higher than the current market price.

Cash-secured puts confer a more conservative approach. In this strategy, traders sell put options while holding sufficient cash in their account to cover the purchase price of the underlying asset if the option is exercised. This strategy generates income from premium collection and provides a floor price for the trader’s potential purchase of the asset.

Protective puts act as a hedging mechanism to protect a long position in the underlying asset. By purchasing put options, traders effectively set a floor price for the asset, limiting their potential losses should the market price decline.

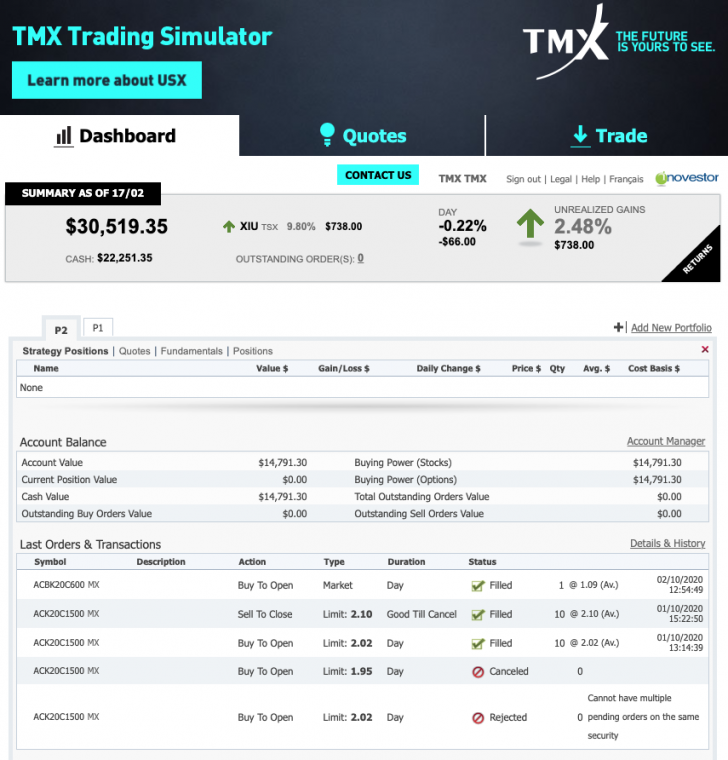

Image: www.optionmatters.ca

Embracing the Power of Trading Option Simulators

Trading option simulators serve as invaluable platforms for traders of all experience levels to enhance their understanding of options trading and test their strategies in a risk-free environment. Through simulated trades, traders can experience the dynamics of the market, optimize their entry and exit points, and learn to manage risk effectively.

Moreover, simulators provide a safe haven to experiment with advanced strategies and techniques, allowing traders to push the boundaries of their trading acumen without fear of financial repercussions. This experimentation fosters a deeper understanding of options trading, ultimately increasing traders’ confidence and competence.

Trading Option Simulator

Image: trading.pikiranwarga.com

Embarking on the Path to Success with Options Trading

To achieve success in options trading, a commitment to continuous learning, diligent practice, and disciplined risk management is paramount. Trading option simulators offer a critical step in this journey, emulating the complexities of the live market and enabling traders to refine their skills without risking real capital.

Embrace the opportunity to delve into the world of trading option simulators. With dedication and perseverance, you can develop the expertise and confidence to navigate the choppy waters of options trading, positioning yourself for greater success in the real-world markets.