Introduction

In the ever-evolving financial landscape, where time and knowledge are precious commodities, exploring the realm of options trading can be both intriguing and daunting. E*TRADE, a renowned brokerage firm, offers a comprehensive suite of trading tools and platforms that aim to empower traders of all levels to navigate this dynamic market. In this extensive guide, we delve into the intricacies of trading levels on E*TRADE’s options platform, unraveling the strategies and nuances that can help you harness the potential of options trading.

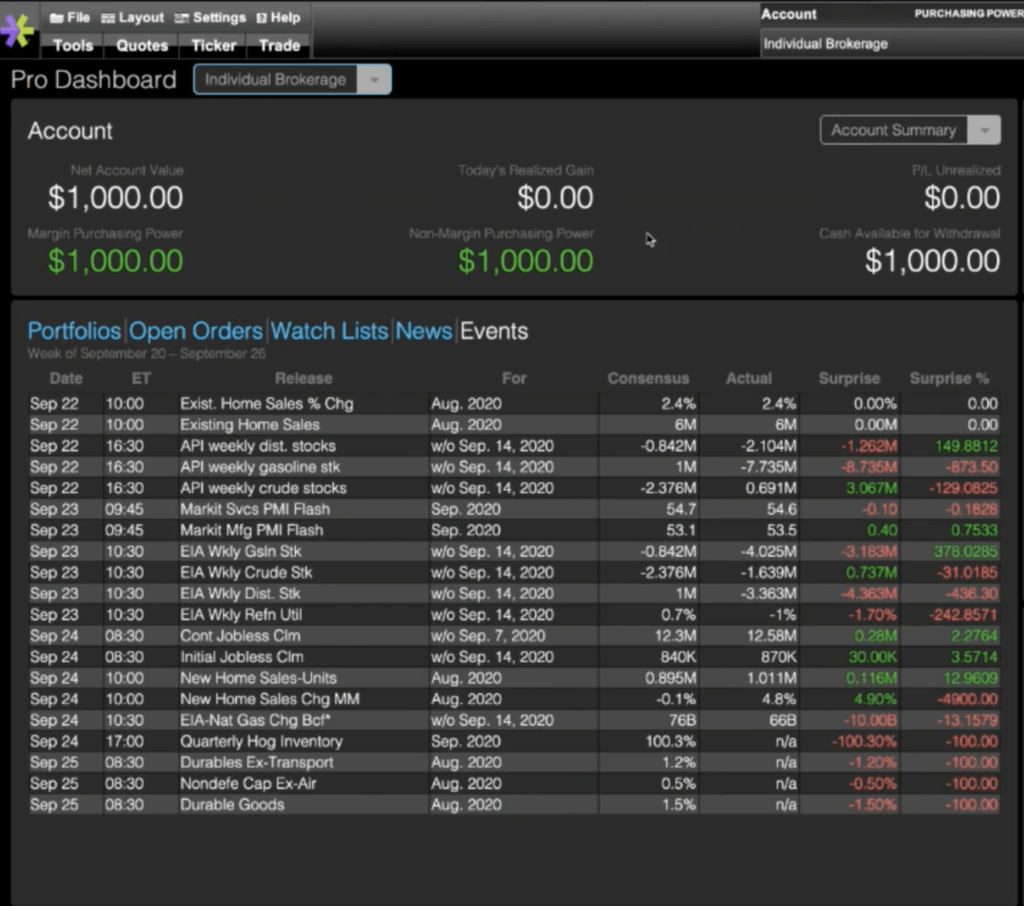

Image: www.youtube.com

Options trading involves the purchase or sale of contracts that convey the right, but not the obligation, to buy or sell an underlying asset, such as a stock or an index, at a predetermined price within a specific time frame. Trading levels serve as a crucial parameter in determining the risk and reward dynamics associated with each trade. By understanding the different levels and their implications, you can tailor your trading strategy to align with your financial goals and risk tolerance.

Trading Levels in E*TRADE Options Platform

E*TRADE’s user-friendly options platform presents three primary trading levels: Level I, Level II, and Level III. Each level offers varying degrees of functionality, catering to the diverse needs and experience levels of traders.

Level I: Entry Point for Novices

Designed for beginners and infrequent traders, Level I provides a simplified trading environment. It offers essential functions such as placing basic orders, viewing real-time quotes, and accessing fundamental company information. This level is suitable for those who are just starting out with options trading and seek a streamlined and accessible interface.

Level II: Intermediate Exploration

Level II caters to more experienced traders who require advanced functionality. It includes all the features of Level I, along with additional capabilities like real-time option chains, complex order types, and charting tools. These features empower traders to conduct in-depth analysis, execute more sophisticated trading strategies, and monitor their positions in real-time.

Image: forexscalpingstrategynoindicators.blogspot.com

Level III: Mastery and Control

Level III is the apex of trading levels, reserved for seasoned professionals and algorithmic traders. It grants access to the full spectrum of E*TRADE’s options trading capabilities. Traders at this level can create and execute complex multi-leg strategies, use advanced charting tools for technical analysis, and monitor their portfolios with customizable alerts and notifications. Level III demands a high level of trading proficiency and a deep understanding of options markets.

Selecting the Right Trading Level

The optimal trading level for you will depend on your trading experience, goals, and risk tolerance. If you are new to options trading or prefer a straightforward approach, Level I is a suitable starting point. As you gain experience and your trading needs evolve, you can consider upgrading to Level II or III to unlock more advanced features and analytical tools.

Strategic Utilization of Trading Levels

Trading levels are not mere access tiers; they represent a spectrum of opportunities. By aligning your trading strategy with the appropriate level, you can optimize your trading outcomes:

-

Level I: Suitable for simple trades with limited risk, such as buying calls or puts to speculate on price movements.

-

Level II: Enables more complex strategies, such as covered calls, cash-secured puts, and spread trading, allowing for greater flexibility and potential reward at the cost of higher risk.

-

Level III: Empowers you to execute advanced multi-leg strategies, such as iron condors or butterfly spreads, which offer sophisticated risk-reward profiles and the potential for significant returns but require a deep understanding of options trading dynamics.

Trading Levels Etrade Options

Image: thebrownreport.com

Conclusion

Understanding and utilizing trading levels effectively is paramount for successful options trading on E*TRADE’s platform. By selecting the appropriate level that aligns with your experience and trading goals, you can unlock a world of opportunities and strategies. Remember, options trading involves