Options trading, a captivating domain of financial markets, often evokes dreams of lightning-fast profits and resounding success stories. However, beyond the allure lies a complex reality that demands a deep understanding and a cautious approach. In this comprehensive guide, we’ll venture into the intricacies of options, demystifying their nature, exploring their uses, and revealing the truths that can propel you towards informed decisions and prudent investments.

Image: www.tradethetechnicals.com

Beyond the Veil: Exploring the Essence of Options

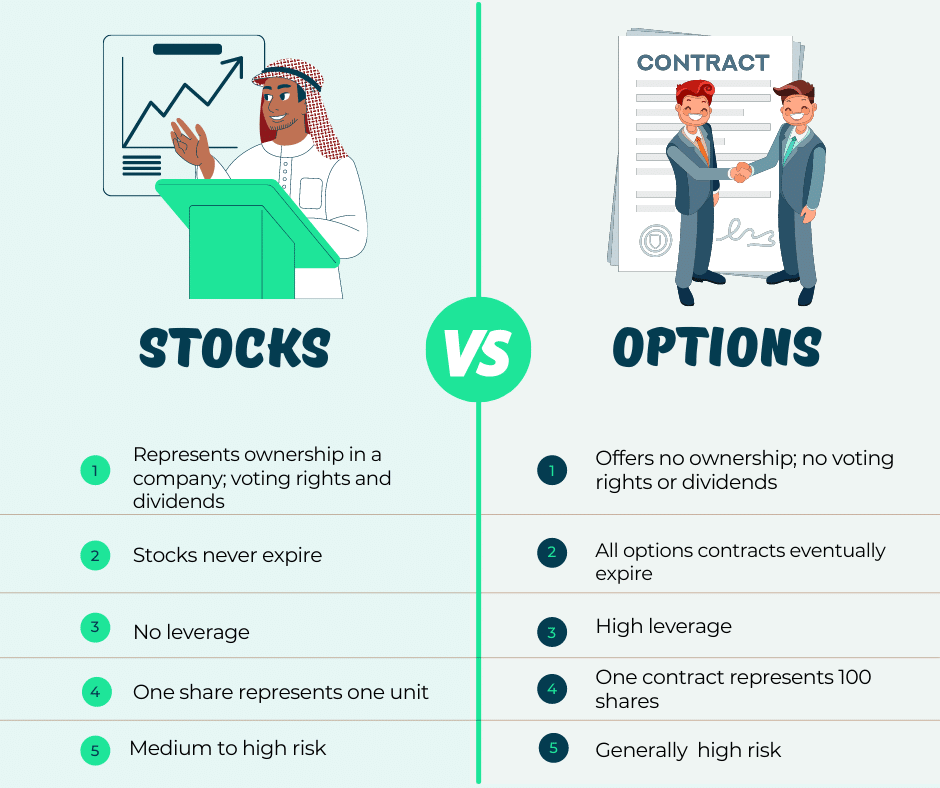

Options, financial instruments rooted in the underlying assets they represent, hold the unique ability to confer upon their holders the rights, not obligations, to buy (call options) or sell (put options) the underlying assets at a predetermined price (strike price) on or before a specified date (expiration date). This inherent flexibility endows options with a remarkable duality: the potential for substantial returns balanced by the risk of complete loss.

Prospering in the Options Arena: Unveiling the Truths

To navigate the labyrinthine landscape of options trading effectively, a steadfast adherence to truths becomes imperative:

-

Options Trading Amplifies Both Profits and Losses: Harnessing the potent leverage inherent in options can magnify both potential gains and losses. Embrace this power with a conservative mindset, ensuring that your risk tolerance aligns with the inherent volatility of options.

-

Effective Options Trading Requires Strategic Time Management: The relentless march of time exerts a profound influence on options. Time decay perpetually erodes the value of options, necessitating timely execution of strategies. Comprehend the time-sensitive dynamics of options to exploit them effectively.

-

Options Premiums Reflect Intrinsic and Extrinsic Value: The premiums paid for options encapsulate both intrinsic value, based on the immediate potential for exercising the option, and extrinsic value, derived from factors like time to expiration and market volatility. Comprehend this duality to make informed pricing decisions.

-

Options Trading Encompasses a Spectrum of Strategies: Options trading offers a vast canvas for devising multifaceted strategies. From simple to complex, these strategies harness the unique characteristics of options to pursue specific objectives. Carefully consider the suitability of each strategy to your risk profile and investment goals.

-

Volatility and Options Trading Dance in Partnership: Volatility, the measure of an asset’s price fluctuations, wields immense influence over options. High volatility environments enhance the potential for both profits and losses, necessitating a thorough understanding of volatility’s impact.

Image: www.youtube.com

The Truth About Options Trading

Image: www.projectfinance.com

Conclusion: Embracing Options Trading with Wisdom

Unveiling the truths of options trading dispels the mystique, empowering investors to make informed decisions. By embracing these truths, you can harness the potential of options while mitigating the risks. Remember, options trading is not a path to instant riches but rather a potent tool that, wielded with prudence and knowledge, can enhance your investment strategies. Venture forth with a thirst for continuous learning and a pragmatic approach, and you’ll navigate the options landscape with greater confidence and potential success.