As an avid investor, I’ve always been drawn to the potential returns that options trading offers. When I stumbled upon TD Ameritrade’s commercial options trading platform, I was immediately intrigued by their advanced tools and unparalleled support.

Image: tickertape.tdameritrade.com

What sets TD Ameritrade apart is their commitment to empowering traders with the knowledge and tools necessary to succeed in this complex market. In this comprehensive guide, we’ll dive into the world of commercial options trading with TD Ameritrade, covering everything from definitions and strategies to expert tips and the latest industry trends.

Unveiling Commercial Options Trading: A Glimpse into the Basics

Commercial options trading involves using options contracts to hedge against risk or speculate on the future price movements of an underlying asset. Options provide traders with the flexibility to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

Traders utilize these contracts to manage risk, generate income, or protect their investments. Understanding the intricacies of options trading is crucial for maximizing your potential returns and minimizing losses.

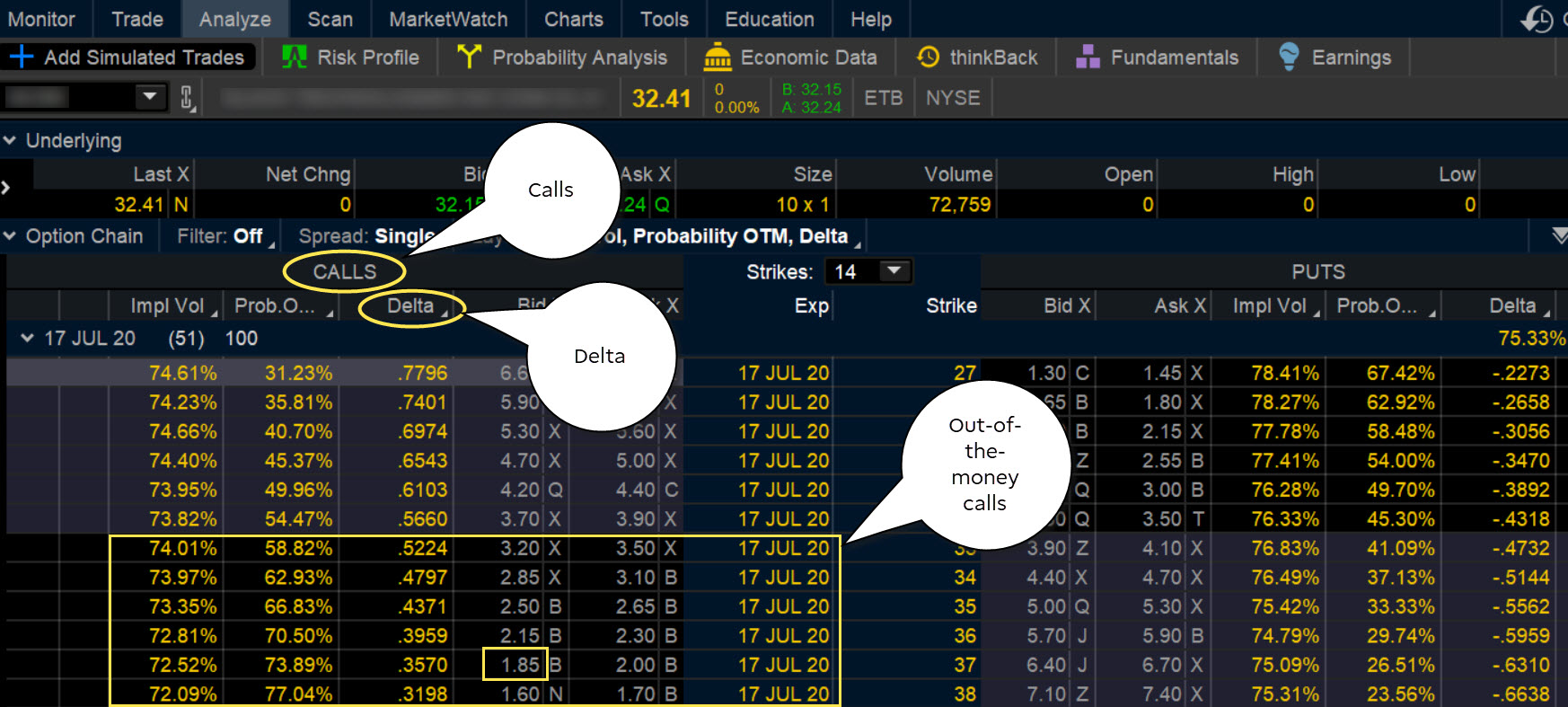

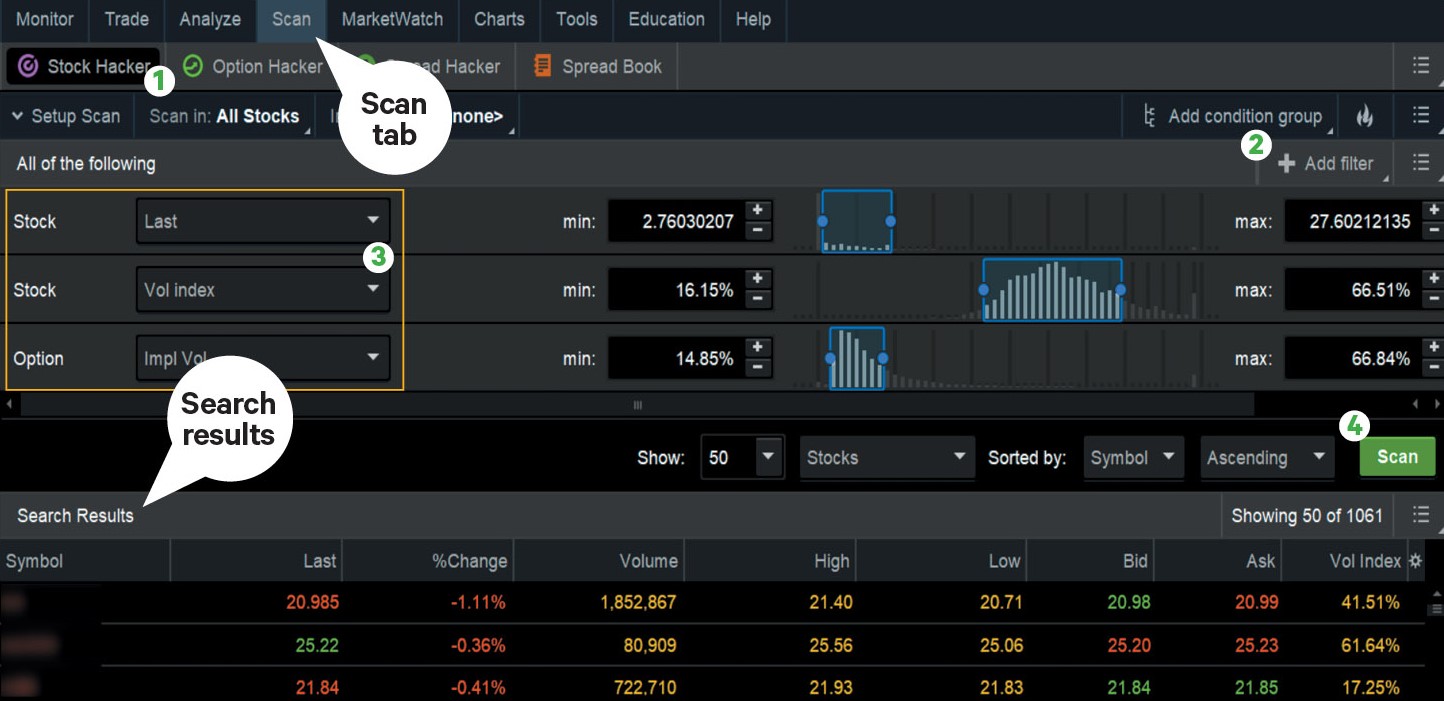

Navigating the TD Ameritrade Commercial Options Trading Platform

TD Ameritrade’s commercial options trading platform is designed to empower traders of all levels. Their intuitive interface provides real-time market data, advanced trading tools, and comprehensive educational resources.

The platform offers various order types, including market, limit, and stop orders, providing traders with the flexibility to execute their trades according to their strategies. TD Ameritrade also provides robust order management features, allowing traders to monitor and adjust their positions effortlessly.

Mastering Options Trading Strategies: A Path to Success

To master options trading, it’s imperative to understand the different strategies available. TD Ameritrade offers a wealth of resources to help traders develop and refine their strategies. Covered call writing, for instance, involves selling covered call options against existing shares to generate additional income.

Other strategies include protective puts and debit spreads. Protective puts help reduce losses on long positions, while debit spreads involve buying and selling options at different strike prices to limit risk and enhance profit potential. TD Ameritrade’s educational platform provides detailed explanations, examples, and case studies to help traders grasp these strategies effectively.

Image: thewaverlyfl.com

Staying Ahead of the Curve: Exploring Latest Trends and Developments

The options trading landscape is constantly evolving, with new trends and developments emerging regularly. TD Ameritrade’s Insights & Education section offers valuable market commentary, expert analysis, and webinars led by industry professionals.

By keeping abreast of these trends, traders can stay informed about changing market dynamics and adapt their strategies accordingly. Social media platforms and online forums also provide traders with a space to engage with peers, exchange ideas, and learn from experienced traders.

Embracing Expert Advice: Unlocking Your Trading Potential

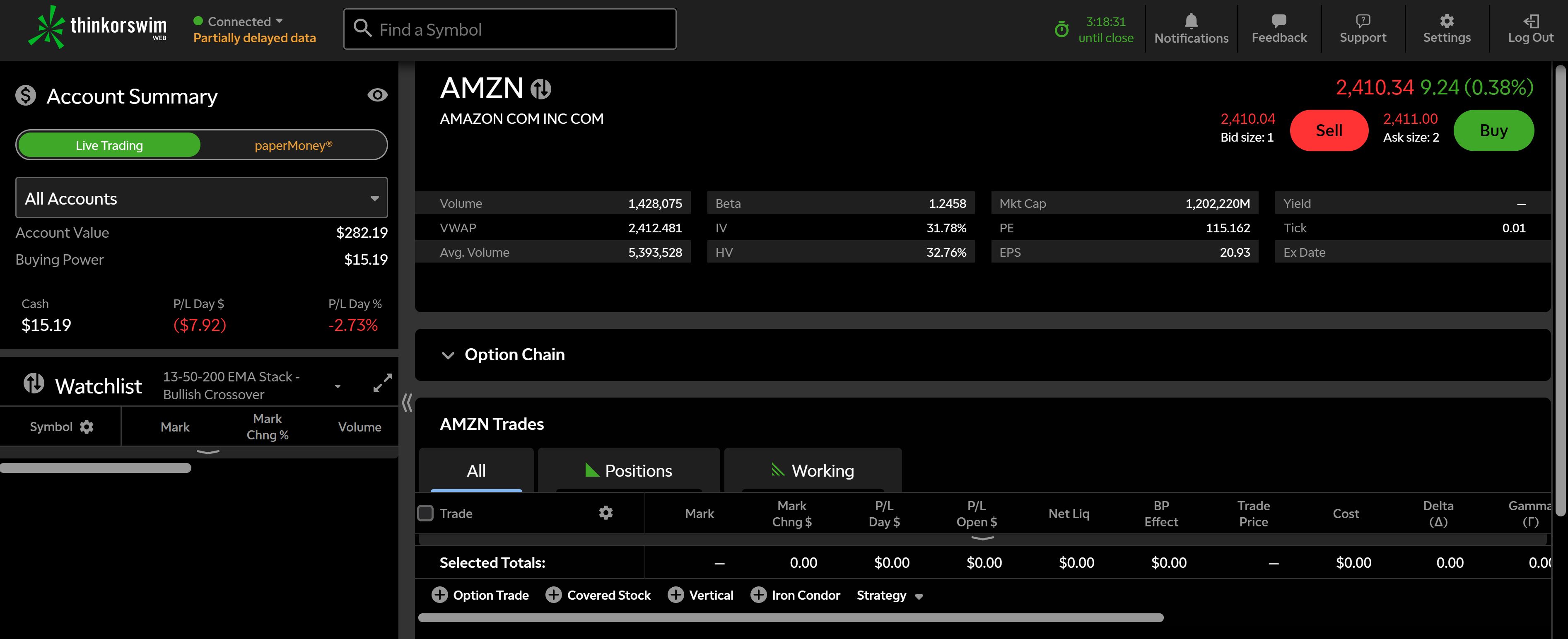

Seeking expert advice can significantly enhance your options trading endeavors. TD Ameritrade offers the ThinkorSwim platform, which provides advanced charting tools and trading strategies developed by expert traders.

Partnering with a broker who provides educational resources, research tools, and personalized support can accelerate your learning curve and empower you to make informed trading decisions. Utilize the wealth of resources available to you and strive to continuously expand your knowledge.

Frequently Asked Questions: Unraveling Common Queries

Q: What is the advantage of using TD Ameritrade for commercial options trading?

A: TD Ameritrade offers a comprehensive platform with advanced tools, educational resources, and personalized support to empower traders of all levels.

Q: How can I get started with commercial options trading?

A: TD Ameritrade provides educational materials, trading simulations, and webinars to guide new traders through the learning process.

Q: What strategies should I consider for commercial options trading?

A: Explore strategies such as covered call writing, protective puts, and debit spreads to enhance your profit potential and manage risk effectively.

Td Ameritrade Commercial Options Trading

Image: b3mmqc.blogspot.com

Conclusion: Embark on the Journey of Options Trading Mastery

Delving into the world of commercial options trading with TD Ameritrade equips you with the tools, knowledge, and support necessary to navigate this complex market. By mastering trading strategies, staying informed about industry trends, and embracing expert advice, you can unlock your full potential as an options trader.

Whether you’re a seasoned pro or a novice eager to explore the possibilities, TD Ameritrade’s platform provides an unparalleled foundation for success. Seize this opportunity to deepen your understanding of options trading and embark on a rewarding journey towards financial empowerment.

Let me know in the comments below if you’d like to delve deeper into any aspect of commercial options trading. Your feedback and questions will help me enhance this guide and provide even more value to aspiring options traders.