My passion for trading volatility options flourished when I joined Tastyworks, a brokerage renowned for its user-friendly platform and exceptional educational resources. Embark with me on a journey as we delve into the intricacies of volatility options and explore the strategies that have empowered me in this dynamic market.

Image: www.projectoption.com

Unlocking the Potential of Volatility Options

Volatility options, often known as VIX options, provide a unique instrument for investors seeking to profit from fluctuations in market volatility. These options are derived from the CBOE Volatility Index (VIX), a widely followed measure of expected volatility in the S&P 500 index. By trading volatility options, investors can speculate on the future direction of market volatility, potentially yielding substantial returns.

Unlike traditional stock options, volatility options trade on a standardized contract size of 1000 units of the VIX index. The strike price of a volatility option represents the expected volatility at the time of expiration. If the actual volatility deviates significantly from the strike price, the option can gain or lose value accordingly.

Navigating the Volatility Options Market

Succeeding in volatility options trading requires a thorough understanding of key concepts:

- Volatility Skew: The skewed nature of the volatility curve can influence option pricing and potential returns.

- Implied Volatility: The market’s perception of future volatility, reflected in the option’s price, plays a crucial role in determining its value.

- Options Pricing: Understanding the factors that influence option pricing, such as time to expiration and strike price, is essential for accurate valuation.

Expert Tips for Trading Volatility Options

Mastering volatility options trading requires a combination of knowledge and strategic execution. Here’s some expert advice to enhance your trading:

- Monitor the VIX Index: Stay informed about market volatility by closely tracking the VIX index and its historical fluctuations.

- Research Volatility Patterns: Identify historical patterns in volatility and utilize this knowledge to make informed trading decisions.

- Utilize Technical Analysis: Employ technical analysis tools, such as moving averages and support/resistance levels, to identify potential trading opportunities.

Image: www.projectoption.com

Frequently Asked Questions about Volatility Options

Q: What are the advantages of trading volatility options?

A: Volatility options offer several benefits, including the potential for substantial returns, the ability to hedge against market risk, and the flexibility to speculate on both rising and falling volatility.

Q: Is trading volatility options suitable for all investors?

A: Volatility options trading involves risk and is not suitable for all investors. It requires a high level of understanding and experience in options trading, as well as a tolerance for volatility.

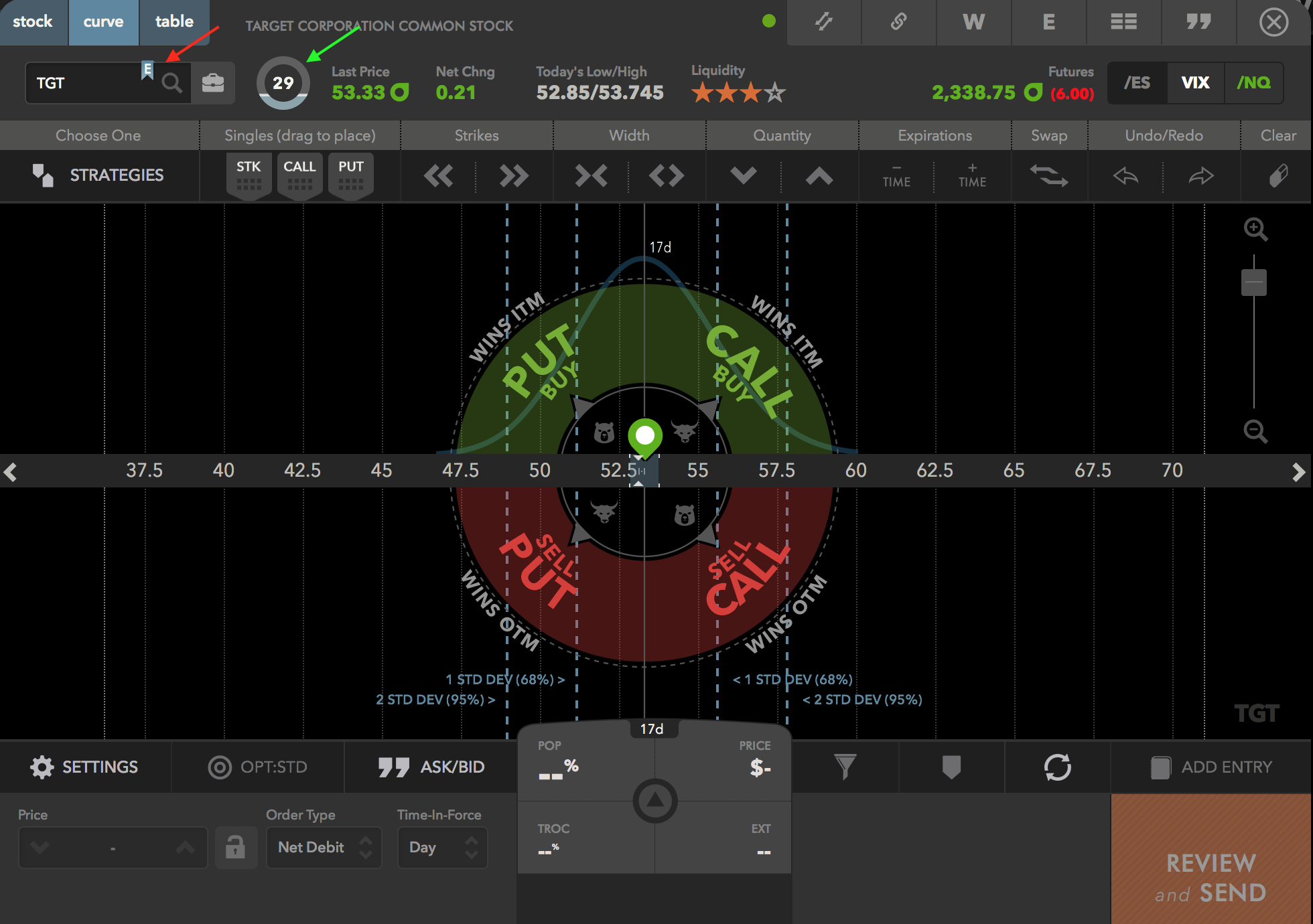

Tastyworks Trading Volatility Options

Image: www.twoinvesting.com

Conclusion: Embrace the Excitement of Volatility Options

Volatility options trading presents a captivating and potentially rewarding opportunity for experienced investors who embrace the inherent risk. By harnessing the power of Tastyworks’ platform and incorporating these proven strategies, you can navigate the volatility options market with confidence and potentially achieve substantial returns. Are you ready to embark on this exciting journey?