Introduction

Have you ever wondered about the difference between stock options and trading options? While they may sound similar, these two financial instruments have distinct characteristics and implications.

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Image: www.investopedia.com

Stock options grant the holder the right, but not the obligation, to buy or sell a specified number of shares of a particular stock at a predetermined price within a specific period. Trading options, on the other hand, involve the buying and selling of standardized contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a specific price and on a specific date. Understanding the nuances between these two instruments is crucial for savvy investors.

Definitions and Key Differences

Stock Options

Stock options are a type of employee compensation that allows employees to purchase shares of the company’s stock at a discounted or fixed price. They come in two main forms: incentive stock options (ISOs) and non-qualified stock options (NSOs). ISOs offer tax advantages, while NSOs are subject to capital gains tax upon exercise.

Trading Options

Trading options are financial contracts traded on exchanges like stocks. They are standardized agreements that give the holder the right to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on a specific date (expiration date). Trading options can be used for speculation, hedging, and income generation.

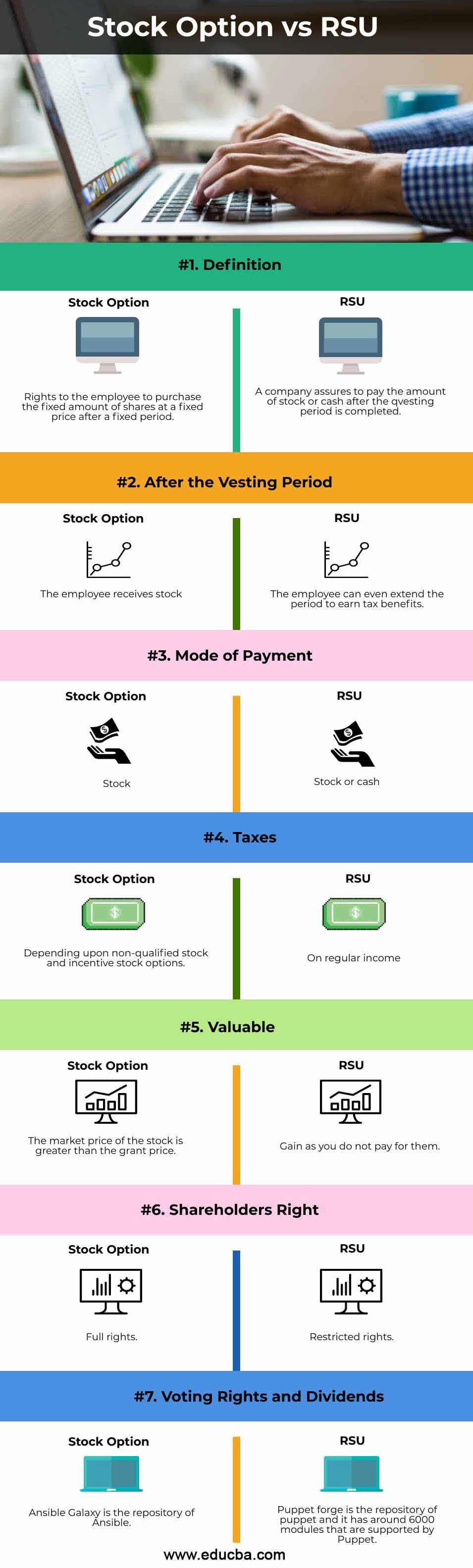

Image: www.educba.com

Key Differences

- Purpose: Stock options are primarily used for employee compensation, while trading options are used for trading and speculation in the financial markets.

- Exercise: Stock options must be exercised to acquire the underlying shares, while trading options can be exercised or sold before expiration.

- Taxation: Stock options may be taxed differently than trading options, with ISOs offering potential tax advantages for employees.

- Liquidity: Stock options are typically less liquid than trading options, as they are not traded on exchanges.

Understanding Trading Options

Call Options

Call options give the holder the right to buy an underlying asset at a specified price until a specified date. They are often used when investors expect the underlying asset price to increase, as they provide the opportunity to profit from this expected appreciation.

Put Options

Put options give the holder the right to sell an underlying asset at a specified price until a specified date. They are frequently employed when investors anticipate a decline in the underlying asset price, offering them the chance to profit from this expected depreciation.

Option Greeks

Option Greeks are metrics that provide insights into option pricing and risk. These include delta, gamma, theta, and vega, which measure the sensitivity of the option price to changes in various factors, such as the underlying asset price and time to expiration.

Expert Advice

Tips for Stock Option Recipients

- Consider the potential value of the options and the company’s performance.

- Understand the tax implications of exercising stock options.

- Consult with a financial advisor to determine the best strategy for exercising or selling options.

Tips for Trading Options

- Choose appropriate options strategies based on the underlying asset and market outlook.

- Manage risk by understanding option Greeks and using stop-loss orders.

- Monitor the performance of options positions regularly and adjust trades as needed.

FAQ

Q: What is the difference between intrinsic and extrinsic value in options?

A: Intrinsic value is the difference between the strike price and the underlying asset price, while extrinsic value represents the premium paid for factors such as time to expiration and volatility.

Q: When should I exercise or sell a stock option?

A: Consider factors such as the stock price, your investment goals, and tax implications to determine the optimal time to exercise or sell a stock option.

Q: What is the risk involved in trading options?

A: Trading options involves potential losses, including the loss of the entire investment amount.

Stock Option Vs Trading Option

Image: www.pinterest.com

Conclusion

Understanding the distinction between stock options and trading options is essential for investors seeking to leverage these financial instruments. Stock options provide employees with a potential ownership stake in the company, while trading options offer opportunities for speculation and hedging in the financial markets. By carefully evaluating the risks and rewards, investors can make informed decisions and potentially enhance their financial well-being.

Are you interested in delving deeper into the world of stock options or trading options? We encourage you to explore reputable sources, consult with financial professionals, and stay updated on the latest trends in these markets.