Introduction

Are you eager to unlock the potential of options trading and capitalize on market fluctuations? Reddit, the vibrant online community, has become an invaluable resource for aspiring traders looking to navigate the complexities of options. Whether you’re a seasoned investor or just starting your financial journey, this comprehensive guide will empower you with the knowledge and strategies to start trading options with confidence. Get ready to enhance your trading horizon and discover the world of options.

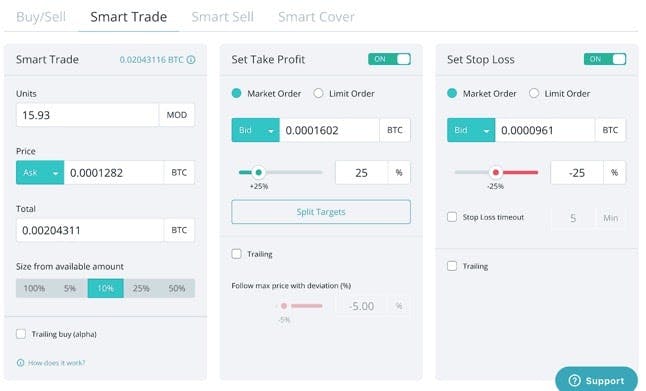

Image: 3commas.io

What are Options?

Options contracts, often referred to as the “Pandora’s Box” of financial instruments, grant you the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This versatility sets options apart from traditional stocks and bonds, making them powerful tools for mitigating risk, generating income, and bolstering investment strategies.

Types of Options

The options market offers a spectrum of choices to cater to diverse trading goals. Call options bestow upon you the power to purchase an asset at a specified price, while put options provide the flexibility to sell. American options grant the privilege of exercising the contract at any point until expiration, whereas European options can only be exercised on a specific date. Naked options represent uncovered positions, leaving you vulnerable to potentially significant losses, while covered options involve owning the underlying asset or holding an opposite position. Understanding these distinctions is paramount before embarking on options trading.

Benefits of Options Trading

Integrating options into your trading arsenal unlocks a treasure trove of benefits that can empower your investment strategies. Options provide the dexterity to:

- Mitigate risk: Options act as financial shields, protecting your portfolio from unfavorable market movements.

- Generate income: Options present lucrative opportunities to generate income through premiums and option strategies.

- Enhance portfolio performance: Options offer a potent avenue to amplify gains, hedge against losses, and enhance overall portfolio performance.

Image: unbrick.id

Before You Start:

Before delving into the exhilarating world of options trading, equip yourself with a solid foundation. Familiarize yourself with the basics, including option terminology, risk management principles, and fundamental trading strategies. Remember, knowledge is the bedrock of success in this dynamic arena.

Getting Started

-

Choose a Broker: The first step towards options trading is selecting a reputable broker. Research different brokers, compare their offerings, fees, and platforms. Opt for a broker that aligns with your trading style and provides educational resources.

-

Open an Account: Once you have chosen a broker, it’s time to establish your trading account. Be prepared to furnish personal information, undergo an identity verification process, and fund your account.

-

Educate Yourself: Never underestimate the power of knowledge. Take advantage of online courses, workshops, webinars, and books to deepen your understanding of options trading. Knowledge is your ally in navigating the complexities of options.

-

Start with Paper Trading: Before risking real capital, hone your trading skills with paper trading. This simulated environment provides a safe haven to test strategies, understand market dynamics, and perfect your techniques without financial repercussions.

Risk Management: The Bedrock of Success

In the realm of options trading, risk management is not merely a buzzword but an indispensable pillar. Ignoring this aspect could lead to devastating financial consequences. Embrace the following strategies to safeguard your capital and navigate the risks inherent in options trading:

- Understand the Greeks: The Greeks, a family of metrics, quantify the sensitivity of options to changes in underlying asset price, time decay, volatility, and interest rates. Familiarize yourself with their significance in managing risk.

- Set Stop-Loss Orders: Stop-loss orders act as automated safeguards, protecting you from excessive losses. Determine an acceptable loss threshold and instruct your broker to execute a sale if the option’s price breaches that predefined level.

- Diversify Your Portfolio: Diversification is the prudent practice of spreading your investments across a variety of options contracts. This strategy reduces the impact of any single adverse market move.

Start Trading Options Reddit

Image: tradingoptionsforbeginners.medium.com

Conclusion

The allure of options trading lies in its potential to amplify gains and mitigate risks, revolutionizing the way investors approach the markets. Reddit, with its vibrant community and wealth of shared knowledge, serves as a guiding light for aspiring traders navigating the intricacies of options. By diligently applying the strategies outlined in this guide, you can embark on your options trading journey with confidence, maximizing its potential and mitigating risks. Remember, financial success isn’t a sprint but a marathon, demanding patience, learning, and a resolute embrace of risk management principles. Embrace the challenge, delve into the world of options trading, and witness your financial horizons expand.