Are you looking to maximize your trading potential with SPX weekly options? Understanding the unique trading hours associated with these contracts is crucial for successful navigation of the markets. In this in-depth guide, we will delve into the intricacies of SPX weekly options trading hours, empowering you with the knowledge to make informed decisions.

Image: stockreversals.com

Defining SPX Weekly Options

SPX weekly options are contracts that provide the right, but not the obligation, to buy (call options) or sell (put options) the S&P 500 index (SPX) at a predetermined price on a specific expiration date. Unlike traditional options that expire monthly, SPX weekly options have a shorter lifespan, expiring every Friday. This unique feature allows for greater flexibility and precise trading strategies.

Trading Hours for SPX Weekly Options

SPX weekly options are traded on the Cboe Options Exchange (CBOE) during the following business days:

- Monday through Friday: 9:30 AM – 4:15 PM ET

- Trading Halts: 9:30 AM – 10:00 AM ET and 3:00 PM – 4:00 PM ET

It’s important to note that SPX weekly options are not traded on Saturdays, Sundays, or market holidays.

Understanding Pre-Market and After-Hours Trading

Pre-market trading for SPX weekly options begins at 8:00 AM ET each trading day, allowing traders to place orders before the regular market opens. Pre-market trading hours provide an opportunity to respond to overnight news and market events.

After-hours trading for SPX weekly options is available from 4:30 PM to 8:00 PM ET, extending the trading window beyond the regular market hours. This allows traders additional time to adjust positions or enter new trades based on post-market information.

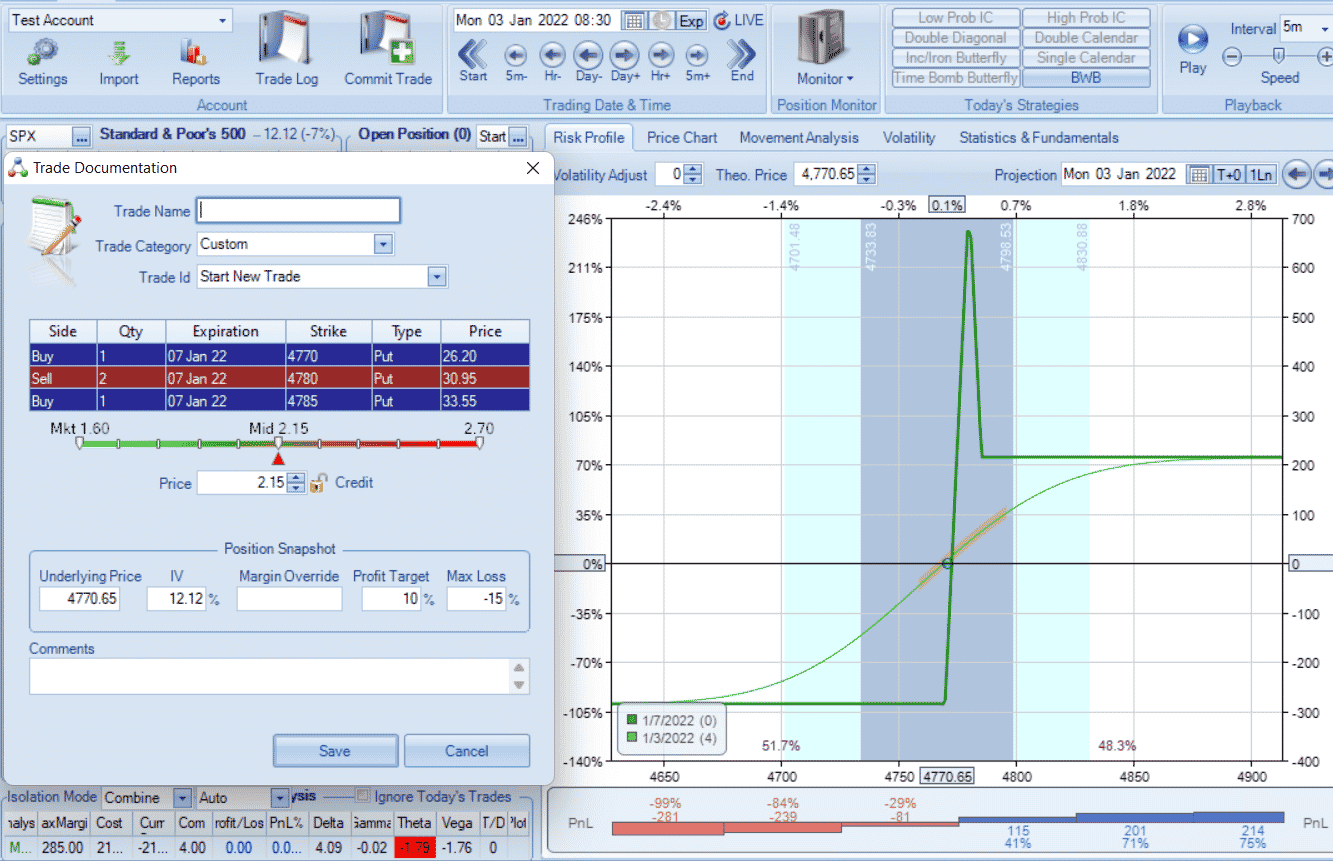

Image: www.focusedtrades.com

Order Entry and Execution

SPX weekly options orders can be placed during trading hours through CBOE’s trading platform or through a broker that provides access to the CBOE. Traders can choose from various order types, including market orders, limit orders, and stop orders, to suit their trading strategies.

Once an order is entered, it will be executed during the trading hours, subject to market conditions. Execution prices are determined by the supply and demand for the specific option contract at that particular time.

Additional Considerations for SPX Weekly Options Trading

- Volatility: SPX weekly options typically have higher volatility than monthly options due to their shorter time to expiration. Traders should be aware of the potential for rapid price movements and adjust their strategies accordingly.

- Liquidity: SPX weekly options are generally more liquid than other types of equity options, ensuring easy order execution and timely trade settlements.

- Expiration Trading: The Friday expiration of SPX weekly options presents unique challenges and opportunities for traders. As options approach expiration, their value decreases rapidly due to time decay. This can lead to significant losses if not managed appropriately.

Spx Weekly Options Trading Hours

Image: optionstradingiq.com

Conclusion

Understanding SPX weekly options trading hours is paramount for successful trading in these contracts. By leveraging the flexibility and increased precision offered by the shorter expiration cycles, traders can optimize their strategies and maximize their potential returns. Remember to stay informed of market conditions, manage risk effectively, and make informed decisions to navigate the dynamics of SPX weekly options trading successfully. With the guidance provided in this article, you are well-equipped to embark on this exciting and potentially lucrative market segment.