Options and futures trading, often carried out by seasoned investors seeking greater returns and willing to embrace higher risks, provide a diverse set of opportunities in the financial markets. When it comes to selecting a broker for these intricate instruments, understanding their fee structure is paramount. In this comprehensive guide, we delve into the world of Schwab futures and options trading fees, offering a detailed breakdown, breaking down the various charges associated with these trades.

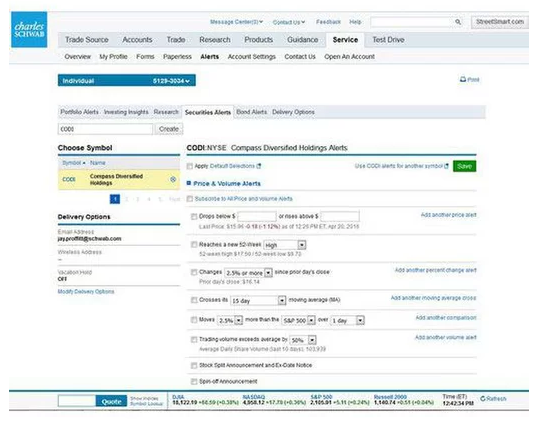

Image: www.schwab.com

Navigating the Landscape of Schwab Futures Trading Fees

Schwab, a prominent name in the brokerage industry, offers a platform for futures trading with competitive fee structures. These fees vary depending on the type of futures contract traded and the exchange on which it is executed. For instance, trading a single E-mini S&P 500 futures contract incurs a fee of $1.50 per side, making it a budget-friendly gateway for exploring futures trading.

For those engaging in more active trading, Schwab’s tiered pricing structure provides additional cost efficiency. Higher trading volume within a calendar month qualifies for lower per-contract fees. Traders executing over 500 contracts in a given month, for example, enjoy a reduced rate of $0.80 per side – a substantial discount compared to the standard $1.50 fee.

Demystifying Schwab Options Trading Fees

Options trading, another popular strategy among advanced investors, involves a distinct fee structure at Schwab. The commission charged for each options trade encompasses two components – a base commission and a per-contract fee. The base commission varies according to the type of options contract and its expiration date. Trading a standard equity option, for instance, incurs a base commission of $0.65 per contract, with an added fee of $0.05 per contract.

Just as in futures trading, Schwab’s tiered pricing structure offers cost advantages for options traders with higher trading volume. Traders executing over 30 options contracts in a calendar month qualify for reduced commissions, starting from $0.50 per contract plus $0.05 per contract. Moreover, active traders surpassing 1000 contracts monthly unlock even lower rates, further minimizing their trading costs.

Additional Considerations and Cost Implications

Beyond the direct trading fees, there are other potential costs associated with futures and options trading at Schwab. These include exchange fees, regulatory fees, and clearing fees. Exchange fees vary depending on the specific exchange where the trade is executed, while regulatory fees are imposed by government agencies to oversee and maintain market integrity. Clearing fees, typically charged by a clearinghouse, cover the risk management and settlement process. Understanding these additional charges is essential for a comprehensive assessment of the overall trading costs.

Image: www.bestreviewguide.com

Schwab Futures And Options Trading Fees

Image: www.schwab.com

Conclusion

Schwab’s fee structure for futures and options trading offers a balanced blend of competitiveness and flexibility. The tiered pricing model caters to both occasional traders and those with higher trading volume, incentivizing active participation. By carefully considering the various fees and charges associated with these trades, investors can make informed decisions that align with their trading strategies and financial goals. This in-depth guide serves as an invaluable resource for those seeking a comprehensive understanding of Schwab’s trading fee landscape.