Introduction

Options trading has become a popular investment strategy, offering traders the potential for both high rewards and risks. However, with the complexities of options trading comes the need to navigate intricate tax laws and regulations. This comprehensive guide provides an in-depth analysis of the tax implications of options trading, empowering you with the knowledge to maximize tax efficiency and avoid costly pitfalls.

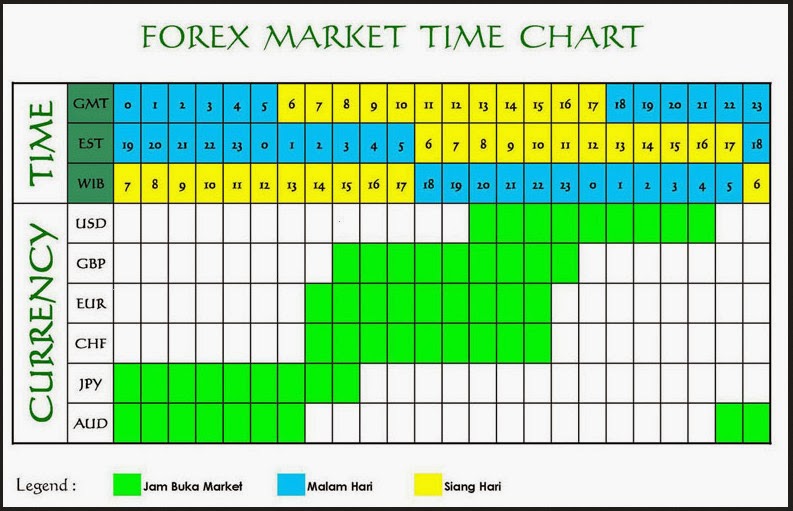

Image: camupay.web.fc2.com

Types of Options and Their Tax Treatment

Options fall into two primary categories: call and put options. A call option grants the holder the right to buy an underlying asset at a specified price on a future date. In contrast, a put option gives the right to sell the asset. The tax treatment of options depends on whether they are exercised or expire worthless.

When an option is exercised, the gain or loss is calculated as the difference between the selling price (for calls) or purchase price (for puts) and the exercise price. This gain or loss is categorized as either short-term or long-term, based on the holding period of the option. Generally, short-term gains are taxed at higher rates than long-term gains.

Tax Strategies for Options Trading

Understanding the tax consequences of options trading allows traders to implement strategies that minimize tax liability. One common approach is to minimize short-term gains by holding options for more than one year. This strategy takes advantage of the preferential tax treatment for long-term capital gains.

Another strategy is to offset losses with gains. Traders can sell losing options or enter into spread trades to create synthetic losses that can be used to offset gains from other options transactions. This technique allows traders to reduce their overall tax liability by netting out losses.

Straddle and Cash-Settled Index Options: Unique Tax Considerations

Straddle options, which involve buying both a call and a put option on the same underlying asset, have specific tax implications. When a straddle is closed, the gain or loss is treated as short-term capital gain or loss, regardless of the holding period.

Cash-settled index options, which are settled in cash rather than in the underlying asset, are also subject to unique tax rules. Gains from cash-settled index options are classified as Section 1256 contracts, which receive unfavorable tax treatment compared to traditional options.

Image: www.msn.com

Reporting Options Transactions for Tax Purposes

Options traders are responsible for accurately reporting their transactions on tax returns. Short-term gains and losses from options trading are reported on Schedule D of Form 1040. Long-term gains and losses are reported on Schedule D and are subject to different tax rates.

It is essential for traders to keep detailed records of their options transactions, including the type of option, the underlying asset, the premium paid or received, the exercise or expiration date, and the gain or loss realized. These records are essential for proper tax reporting and potential audits.

Options Trading Tax Advisor

Image: widetax.com

Conclusion

Understanding the tax implications of options trading is crucial for maximizing profitability and minimizing tax burdens. By implementing tax-efficient strategies and accurately reporting their transactions, traders can navigate the complexities of options taxation and position themselves for success. Consulting with a qualified tax professional is highly recommended to tailor tax advice to specific circumstances and ensure optimal tax outcomes.