Introduction

The world of financial markets is vast and complex, with options trading presenting a unique opportunity for investors seeking to maximize their returns. Options, as derivative financial instruments, allow traders to speculate on the future price movements of an underlying asset without actually owning it. By understanding the intricacies of options trading and implementing effective strategies, traders can potentially increase their chances of profitability.

Image: www.myxxgirl.com

Strategies for Options Trading

At the heart of successful options trading lies a well-structured strategy that aligns with the trader’s risk appetite and financial goals. Numerous options trading strategies exist, each catering to specific market conditions and the trader’s preferred approach. Let’s delve into the three most common strategies:

Covered Calls

This strategy is ideal for traders who own an underlying asset and want to generate additional income. Covered calls involve selling a call option on the underlying asset while maintaining ownership of the asset. This strategy generates income through the option premium and provides limited protection against a potential decline in asset price. However, any upside potential beyond the strike price is capped.

Cash-Secured Puts

Similar to covered calls, cash-secured puts empower traders who do not own the underlying asset. By selling a put option and holding cash equal to the strike price, the trader gains income from the option premium. This strategy benefits from a potential increase in the asset’s price until the strike price is hit. However, the trader may be obligated to purchase the asset at the strike price if its value falls below it.

Image: www.tradingreviewers.com

Iron Condors

Iron condors are designed for experienced traders seeking a neutral market outlook. This strategy involves selling an out-of-the-money call option and an out-of-the-money put option at the same strike price. Additionally, the trader purchases a further out-of-the-money call option and a further out-of-the-money put option. The profit potential lies in the theta decay of these options over time.

Trends and Developments in Options Trading

The options trading landscape is constantly evolving, influenced by economic factors, market volatility, and technological advancements. Here are some of the most recent trends to keep an eye on:

- Increased Regulation: Global regulatory bodies continue to enhance oversight of options trading, including increased transparency and risk management measures.

- Growth of Exchange-Listed Options: Exchanges are expanding their options offerings, making it more accessible for retail investors to participate.

- Advanced Trading Platforms: Technological advancements have led to the development of sophisticated trading platforms that provide real-time data and analytical capabilities.

Tips and Expert Advice for Enhanced Trading

Successfully navigating the world of options trading requires a combination of skill, experience, and sound advice. Here are some crucial tips to consider:

- Stay Informed: Keep yourself updated with the latest market news, economic indicators, and industry trends.

- Manage Risk: First, determine your risk tolerance and stick to strategies within those boundaries.

- Understand Options Greeks: Options have different characteristics known as Greeks. Study them to understand how they affect option prices.

- Analyze Market Sentiments: Evaluate market sentiments and volatility to make informed decisions.

- Seek Professional Guidance: Consult with experienced financial advisors or brokers for personalized guidance and insights.

General FAQ on Options Trading

Q: What is the difference between a call and a put option?

A: A call option gives the buyer the right to buy an asset at a specific price on or before a certain date, while a put option allows the buyer the right to sell.

Q: How do I determine which options trading strategy is best for me?

A: Consider your risk tolerance, financial goals, and market outlook when selecting an options trading strategy.

Q: Can options trading be profitable for beginners?

A: While it’s possible, beginners should start with small trades and thoroughly understand the risks involved.

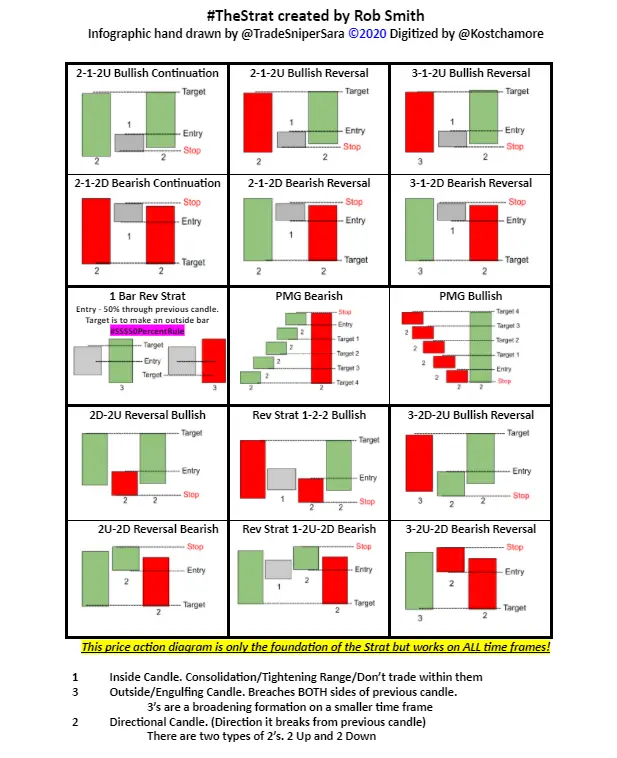

Options Trading Strat

Image: www.youtube.com

Conclusion

Options trading offers a unique opportunity for investors to enhance their financial returns. By adopting a carefully crafted strategy, staying informed about market trends, and utilizing expert advice, traders can increase their chances of success. Whether you’re a seasoned investor or just starting out, the world of options trading awaits your exploration. Embark on your trading journey with knowledge, confidence, and a thirst for success. Are you ready to conquer the options trading realm?