Introduction

Options trading offers investors an opportunity to enhance their portfolio’s earning potential and manage risk. Webull, a popular online broker, provides access to various options trading strategies, making it an attractive platform for both novice and experienced traders. However, it’s essential to understand the options trading requirements on Webull before delving into this exhilarating financial arena. This in-depth guide will shed light on the eligibility criteria, account types, and knowledge assessments necessary to trade options on Webull.

Image: www.webull.com

Eligibility Criteria for Options Trading

-

Age: Individuals must be at least 18 years of age to apply for options trading.

-

Experience and Knowledge: Applicants must demonstrate a fundamental understanding of options trading concepts, including options pricing, different option strategies, and risk management principles.

-

Investment Objectives: Traders must clearly outline their investment objectives and how options trading aligns with their financial goals.

-

Risk Tolerance: Options trading involves inherent risks, and applicants must acknowledge and understand their risk tolerance level.

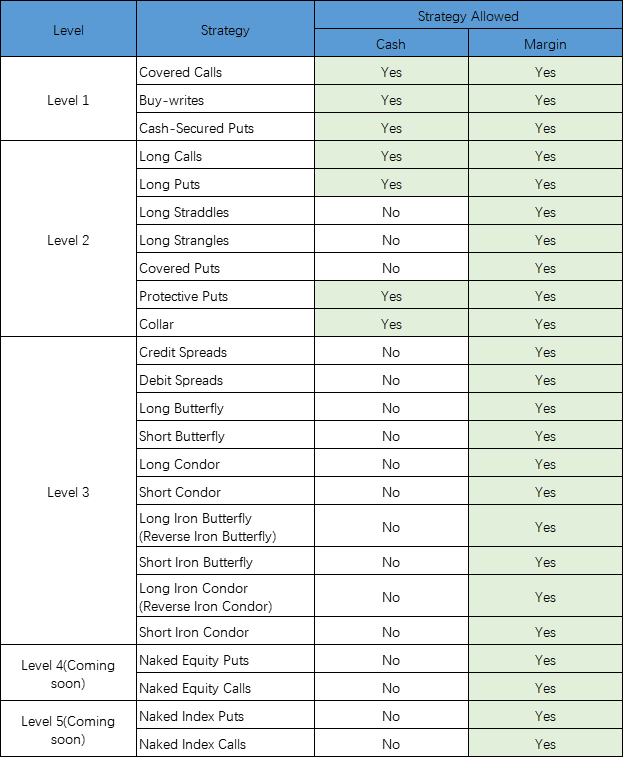

Account Types

-

Cash Account: A standard brokerage account funded with cash, allowing traders to purchase and sell options based on their account balance.

-

Margin Account: A more advanced type that allows traders to borrow capital from the broker to increase their purchasing power. However, margin trading comes with additional risks and responsibilities.

Image: shortthestrike.com

Options Trading Requirements Webull

Image: derivbinary.com

Knowledge Assessment

To ensure traders are adequately prepared to navigate the complexities of options trading, Webull requires them to complete a knowledge assessment. The assessment evaluates their understanding of options terminology, pricing models, and trading strategies.

Option Types: Webull supports various option types, including calls, puts, bull calls, bear puts, and more. Understanding the distinctions between these options is crucial for formulating effective trading strategies.

Option Positions: Traders can hold different positions in options, such as long calls, short calls, long puts, or short puts. Understanding these positions and their implications is essential for managing risk and maximizing returns.

Option Greeks: Options are priced based on several factors known as Greeks. Key Greeks include Delta, Gamma, Theta, Vega, and Rho, each measuring a different aspect of an option’s value. Traders must comprehend these Greeks to make informed trading decisions.

Strategy Selection: Webull offers a diverse range of options trading strategies, catering to both conservative and aggressive traders. Common strategies include covered calls, cash-secured puts, iron condors, and butterfly spreads. Choosing the appropriate strategy aligns with risk tolerance and investment objectives.

Risk Management: Options trading carries inherent risks, and effective risk management is paramount. Common risk management techniques include position sizing, stop-loss orders, and hedging strategies. Traders must develop a risk management plan to mitigate potential losses.

Conclusion

Options trading on Webull provides investors with a powerful tool to enhance their portfolio’s potential and manage risk. By meeting the eligibility criteria, choosing an appropriate account type, and successfully completing the knowledge assessment, traders can unlock the realm of options trading. It’s imperative to approach options trading with a clear understanding of the concepts involved, prudent risk management practices, and a well-defined investment strategy. Remember, knowledge and preparedness are the cornerstones of successful options trading endeavors.