Introduction

In the realm of options trading, put writers stand as a formidable force, navigating the complexities of the market to reap potential rewards. A put option grants the holder the right, but not the obligation, to sell an underlying asset at a specified price (strike price) before a certain date (expiration date). Put writers, on the other hand, assume the responsibility of fulfilling these sold put options should they be exercised. Embark on this comprehensive guide to master the art of put writing, delving into its multifaceted strategies and empowering you to conquer the financial frontier.

Image: www.youtube.com

Understanding Put Writing

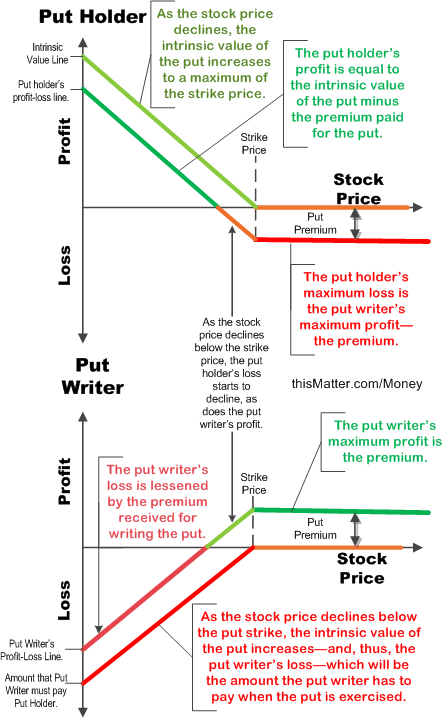

Put writers generate income by selling put options, effectively betting that the underlying asset’s price will remain above the strike price of the option. In return for assuming this obligation, put writers collect an option premium from the buyer. However, this seemingly advantageous position carries potential risks, as put writers are liable for the difference between the strike price and the market price of the underlying asset if the option is exercised. Therefore, a thorough understanding of market dynamics, risk management, and prudent strategy execution is paramount for success in this domain.

Effective Risk Management in Put Writing

Risk management is the cornerstone of successful put writing. Prudent risk management practices include:

-

Thorough research: Conducting in-depth research about the underlying asset, market conditions, and historical patterns is crucial.

-

Understanding Greeks: Mastering the concepts of Delta, Theta, Vega, Gamma, and Rho helps evaluate the sensitivity of an option’s value to changes in underlying asset price and other factors.

-

Calculating potential losses: Accurately gauging the maximum potential loss is essential. This calculation involves determining the difference between the strike price and the asset’s price at the time of exercise.

-

Adequate margin maintenance: Maintaining sufficient margin in your account ensures you can meet potential obligations.

-

Trading in manageable size: Avoid oversizing positions relative to your account size to minimize the impact of adverse market movements.

-

Monitoring market conditions: Constant vigilance of market conditions and asset price movements is imperative for timely adjustments.

-

Hedging strategies: Employing offsetting positions, such as buying call options or selling futures contracts, can mitigate risk.

Strategies for Writing Puts

Seasoned put writers employ various strategies to enhance their profitability, including:

-

Selling naked puts: This strategy involves selling a put option without owning the underlying asset. Higher rewards are accompanied by greater risk.

-

Cash-secured puts: With this strategy, put writers sell puts while holding the equivalent amount of the underlying asset in their portfolio. This reduces risk but may limit potential profits.

-

Married puts: A married put involves selling a put option while simultaneously owning a corresponding long call option with the same strike price and expiration date. This combination provides downside protection while preserving upside potential.

-

Covered puts: Covered puts are created by selling a put option while holding the underlying asset. This strategy limits both potential profits and losses.

-

Collar strategy: A collar strategy combines selling a naked put with buying a protective call option at a higher strike price.

-

Vertical credit spread: Selling a put option at a lower strike price while simultaneously buying a put option at a higher strike price creates a vertical credit spread.

Image: thismatter.com

Options Trading Put Writer

:max_bytes(150000):strip_icc()/BuyingPuts-4c4a647e895a41b8a828761e38465e1a.png)

Image: www.investopedia.com

Conclusion

Venturing into the world of put writing requires a multifaceted approach that combines strategic execution, rigorous risk management, and an unwavering commitment to market comprehension. By mastering the intricacies of this formidable trading strategy, you can unlock the potential for lucrative returns while navigating the inherent risks associated with options trading. Embrace continuous learning, adapt to market dynamics, and never cease your quest for knowledge. Remember, the mastery of put writing lies within the mastery of yourself.