Imagine the thrill of transforming small investments into substantial gains, harnessing the power of market movements. Options trading provides this exhilarating opportunity, allowing you to magnify your potential returns while managing risks. Zerodha Kite, India’s leading online trading platform, makes options trading accessible to everyone, empowering you to unlock market opportunities and navigate financial complexities.

Image: www.chittorgarh.com

Fundamentals of Options Trading

Options contracts are financial instruments that grant buyers the right (but not the obligation) to buy or sell an underlying asset at a specified price on a predetermined date. Call options give buyers the right to purchase, while put options grant the right to sell. The underlying asset can encompass stocks, indices, commodities, and more. By understanding the nuances of options contracts, their various types, and their intrinsic value, you lay the foundation for successful trading decisions.

Benefits of Trading Options with Zerodha Kite

Zerodha Kite offers a plethora of advantages for options traders. Its intuitive user interface simplifies navigation, enabling seamless order placement, even for beginners. Real-time data and advanced charting tools empower traders with instant access to market information and technical analysis capabilities. Zerodha’s competitive brokerage fees ensure that you maximize your profits and minimize transaction costs. Plus, the platform’s extensive educational resources provide valuable guidance to enhance your trading prowess.

Trading Strategies for Beginners

Start your options trading journey with strategies designed for beginners. Covered calls involve selling call options against stocks you own, generating additional income while maintaining ownership. Cash-secured puts offer a conservative approach, wherein you sell put options while holding the cash required to purchase the underlying if the option is exercised. For income generation, consider a buy-write strategy where you simultaneously purchase shares and sell call options against them. These strategies offer a measured entry point into the world of options trading.

Image: tradingtuitions.com

Advanced Strategies for Seasoned Traders

As your experience grows, explore more sophisticated options trading strategies. Spreads involve combining multiple options contracts to create tailored risk and reward profiles. Butterflies and condors are popular spread strategies that provide directional bets with defined risk parameters. For experienced traders with a strong understanding of market dynamics, naked options strategies, such as selling uncovered calls or puts, offer the potential for higher profit margins but carry greater risk.

Risk Management in Options Trading

Options trading involves inherent risks that need to be carefully managed. Always determine your risk tolerance and trade within those limits. Employ stop-loss orders to mitigate potential losses, and continuously monitor market movements to adjust your positions accordingly. Diversification across multiple underlying assets and strategies helps spread risk and protect your portfolio from market volatility. Prudent risk management practices enable you to trade with confidence while minimizing potential setbacks.

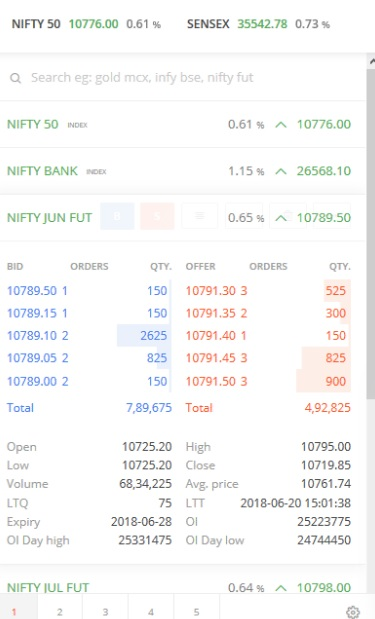

Options Trading In Zerodha Kite

Image: zerodha.com

Conclusion

Options trading with Zerodha Kite can be a transformative avenue for financial growth and market navigation. Embrace the opportunity to unlock market potential, generate income, and hedge against risks. By mastering the fundamentals, leveraging the platform’s advantages, and employing appropriate strategies, you gain the power to make informed trading decisions. Whether you’re a beginner or an experienced trader, the world of options awaits, offering the excitement and rewards of maximizing your financial endeavors.