Introduction

In the realm of financial trading, options contracts grant traders the right, but not the obligation, to buy or sell an underlying asset at a specified strike price on or before a set expiration date. These contracts are categorized into two distinct types based on their relationship to the underlying asset’s current market price: in the money and out of the money options. Understanding the differences between these two types is crucial for savvy options traders.

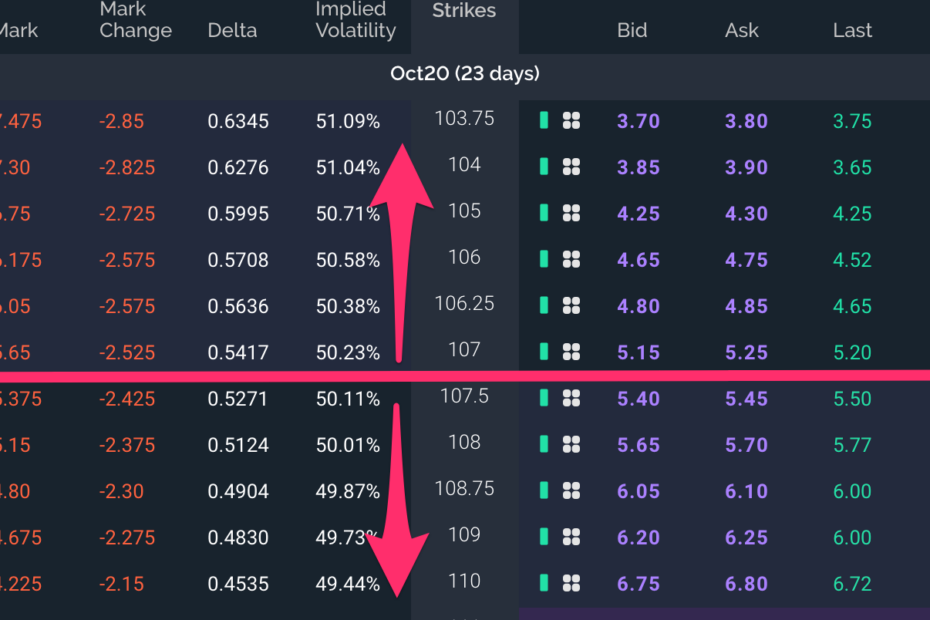

Image: www.imperialfin.com

In the Money Options

In the money (ITM) options represent contracts where the strike price is below (for call options) or above (for put options) the underlying asset’s current market price. This means that the option holder has the potential to profit immediately if they exercise the option to buy or sell the asset. ITM options are generally more expensive than their out of the money counterparts due to their inherent value.

Example: ITM Call Option

Assume a stock is trading at $100. A trader purchases an ITM call option with a strike price of $95, giving them the right to buy the stock at $95 anytime before expiration. As the stock is currently trading at $100, the trader has an immediate profit of $5 per share.

Out of the Money Options

Out of the money (OTM) options, on the other hand, are contracts where the strike price is higher (for call options) or lower (for put options) than the prevailing market price. OTM options have no intrinsic value at the time of purchase, meaning they carry no immediate profit potential. However, they offer the possibility of speculative gains if the underlying asset’s price moves in a favorable direction.

Image: stock-investing-guide.com

Example: OTM Put Option

Consider a stock trading at $100. A trader buys an OTM put option with a strike price of $105, giving them the right to sell the stock at $105 before expiration. Since the stock is at $100, the trader has no current profit. However, if the stock price falls below $105, the trader can still profit by exercising the put option to sell the stock at a higher price.

Key Differences between ITM and OTM Options

Beyond the immediate profit potential, ITM and OTM options differ in several other key aspects:

- Premium: ITM options command a higher premium than OTM options due to their built-in value.

- Likelihood of Profit: ITM options have a higher probability of being profitable immediately, while OTM options require a larger price movement in the desired direction to yield profit.

- Break-even Point: For ITM options, the break-even point (where the trader earns zero profit) is usually close to the current market price. For OTM options, the break-even point is further away, requiring a substantial price movement.

- Risk and Reward: ITM options offer lower risk and lower reward potential compared to OTM options. OTM options come with higher risk but offer the possibility of higher returns if executed successfully.

Factors to Consider

When deciding between ITM and OTM options, traders should consider factors such as:

- Time to Expiration: ITM options are more suitable for short-term trading, while OTM options can be beneficial for longer-term speculative strategies.

- Underlying Asset Volatility: ITM options are less sensitive to volatility than OTM options. Traders should evaluate the expected volatility of the underlying asset.

- Personal Risk Tolerance: ITM options align with lower risk tolerance, whereas OTM options appeal to traders willing to take on more risk in pursuit of higher potential rewards.

Options Trading In The Money Vs Out Of The Money

Image: www.hdfcsec.com

Conclusion

Understanding the distinctions between in the money (ITM) and out of the money (OTM) options is critical for options traders. ITM options provide immediate profit potential but cost more, while OTM options offer speculative opportunities with lower initial cost. By carefully considering the factors outlined in this article, traders can make informed decisions about the most appropriate options strategies for their individual trading objectives and risk tolerance. Whether you are an experienced trader or a novice venturing into the world of options, this guide has equipped you with a solid foundation for success. Remember, the financial markets are dynamic, and knowledge is paramount for effective and profitable trading.